A loan maturity date is the date on which the final loan payment is due. In other words, the maturity date is when the loan is expected to be fully paid back.

When you borrow money, it’s important to be clear about your financial plans, including the maturity date on your loan.

This is true whether you get a loan to pay for a house, a car, a vacation, a wedding, or some other purchase. If you use an installment loan, or any kind of closed-end loan, you will want to know when you can expect to have your loan paid back. Credit cards do not have loan maturity dates because they are revolving credit.

Keep reading to learn why a loan maturity date matters, how it works, and ways it can help you plan for your financial future.

Table of contents

- Why is a loan maturity date important?

- How does a loan maturity date work?

- How can you plan with a loan maturity date in mind?

- 4 tips for paying off your loan on time

- Can you pay off a loan before its maturity date?

- What is amortization?

- What is an amortization schedule?

- What are the next steps in your budget journey?

Why is a loan maturity date important?

A loan maturity date tells you the number of months you’ll be making payments, helping you set a reliable budget. In this way, the maturity date gives you an understanding of how the loan affects both your immediate and long-term financial planning.

Before you apply for a loan, it’s important to understand how a maturity date may affect your monthly payments. A shorter repayment term typically increases the amount you pay each month, while a longer repayment term may lower the amount. The maturity date may also affect the interest rate you are charged. Longer loans may have higher interest rates.

Choosing the right repayment term is vital as you plan your budget. For example, if you’re applying for a Discover® personal loan, you can use our personal loan calculator to estimate how much you’ll pay each month based on the repayment terms you choose.

How does a loan maturity date work?

When you take out an installment loan, the maturity date is part of your loan agreement. For example, if you took out a loan in March 2021 with a 48-month repayment term, your final payment would be in March 2025. At that time, your loan would be fully paid off.

Throughout the repayment term of an installment loan, you typically pay a fixed monthly amount to your lender. In addition to paying back the principal, the original amount that was borrowed, these payments will include interest and any fees that were charged by the lender.

If your loan is not fully paid back by the maturity date, you may face additional interest charges, late fees, or negative comments in your credit report. It’s important to contact your lender before the maturity date if you need to discuss other repayment options or alternative solutions.

How can you plan with a loan maturity date in mind?

Once you know your loan maturity date, you will know when payments are due, so you’ll be able to plan for the future. You may even be able to automate payments so that you can always pay on time. This could help you avoid potential late fees.

For additional inspiration, you might highlight certain financial milestones on your calendar and include your loan maturity date—the final date you will make a payment. Seeing your small steps towards a larger goal may help you keep up your momentum as you reach the finish line.

4 tips for paying off your loan on time

By knowing the amount of your monthly payments, when they are due, and the loan’s maturity date, you can more easily plan ahead.

1. Keep track of the dates

Mark the date on your calendar each month when your loan payment is due. Even if you automate payments, this can help remind you before the payment day arrives.

2. Set alerts on your phone

Set monthly reminder alerts on your smartphone for your payment due date or for a few days before.

3. Automate payments

Set up monthly automatic payments from your bank account for additional convenience.

4. Mark your calendar for success

Be sure to note the day your maturity date is due to be reached. You might even jot down the halfway mark or even smaller milestones on your way to paying off the loan.

Can you pay off a loan before its maturity date?

Depending on the loan and the lender, you may be able to pay off installment loans earlier than the maturity date.

Before you pay off a loan early, be sure you understand your loan agreement and any fees or prepayment penalties you may be charged. At Discover Personal Loans, there are no fees of any kind.

What is amortization?

Amortization is the process of reducing or paying off a loan over a set period of time.

What is an amortization schedule?

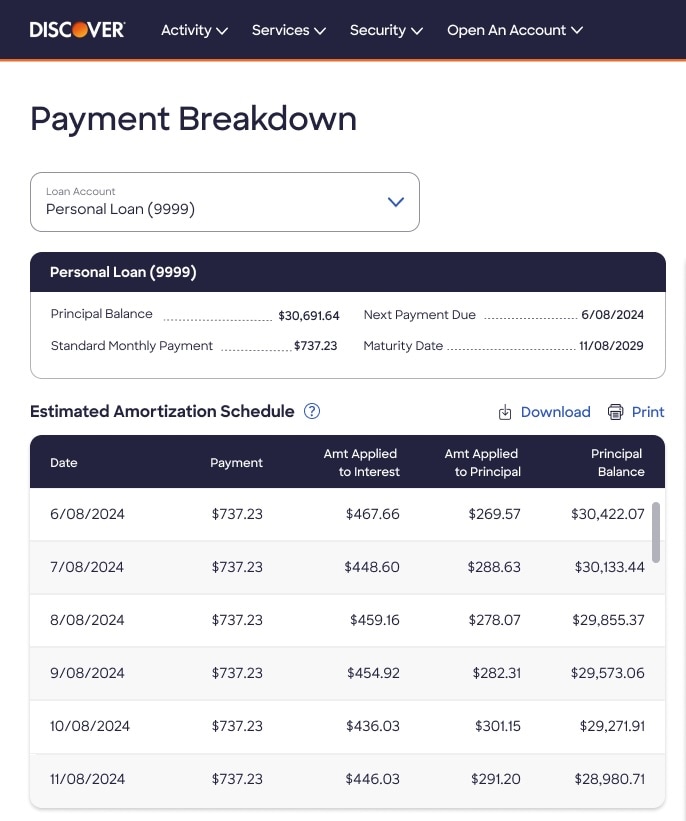

An amortization schedule shows the amount you pay on your loan each month and how much of that payment goes to pay principal and how much to interest.

The calculation is based on the amount you borrow, the interest rate, and the repayment term. This allows you to see the progress you are making on a monthly basis and when the final payment is scheduled.

In this sample personal loan amortization schedule, you can see how the amount of money applied to the interest and the principal changes with each monthly payment.

What are the next steps in your budget journey?

Once you know the maturity date of your loan and understand its importance, you are one step closer to building a healthy financial future.

With an installment loan that is right for you, you should be able to create a budget that includes loan payments and know well in advance when your loan is due to be paid off.

At Discover Personal Loans, you can design your loan around you. You can pick the amount you need and the repayment term from options offered to fit your budget. For example, if you get approved for a $15,000 loan at 11.99% APR for a term of 72 months, you'll pay just $293 per month.

You can use our personal loan calculator to estimate your monthly payments based on a loan amount, your credit score, and a repayment term that you choose.

Frequently Asked Questions

-

Generally, payments will be first applied to any accrued and unpaid interest, then toward the principal balance. If you have a balance of late fees, part of your payment may be applied to that after you have satisfied your New Amount Due and any Amount Past Due.

-

Interest due is calculated on your outstanding principal balance, so as your balance goes down, the amount of your payment that is applied to interest will also go down.

-

If your loan is current and no other fees or past items are due, you can save money on your loan by paying more than the monthly minimum payment. When you makelarger, payments, the additional amount will be applied to the principal balance. As the principal decreases, the amount of interest you pay on the principal will also decrease.

-

The maturity date cannot be changed after you agree to the original repayment term for your loan. However, if you make extra payments, you may be able to pay off your loan early. Be sure to know if the lender charges any prepayment penalties.

-

An amortization schedule shows how your payments apply to principal and interest over the life of your loan. The payments assume a constant due date and payment amount.

-

You cannot change your amortization schedule after receiving a loan because it is based on the original interest rate and repayment term. If you make additional payments, though, those extra payments will be applied to the principal balance provided no past-due amounts or fees are owed. As a result, the principal balance will decrease, which could reduce the amortization period of your loan.

-

If a loan is not paid in full by its maturity date, any remaining balance may still be owed. Your lender may take steps to collect the amount that is past due. Depending on the terms of your loan agreement, the impact could include additional interest charges, late fees, or negative effects to your credit score.

If you are unable to pay off your loan by the maturity date, it’s important to contact your lender assoon as possible. They may be able to provide repayment options or alternative solutions to help you avoid default.

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.