Green loans can provide funding for a variety of eco-friendly projects. But some green loans have strict rules about how you can use them. Personal loans used for green projects, on the other hand, can offer flexibility to use the funds for almost any purpose.

For homeowners, borrowing money can help you make environmentally friendly home updates that might reduce your carbon footprint. You might also benefit from lower electric, gas, and water bills, which could reduce your costs in the long run.

If you‘re planning to start a green home remodeling project, you may consider paying for it with a green loan. This article explains the potential benefits of going green with home improvement projects and the different ways to pay for them

What is a green loan?

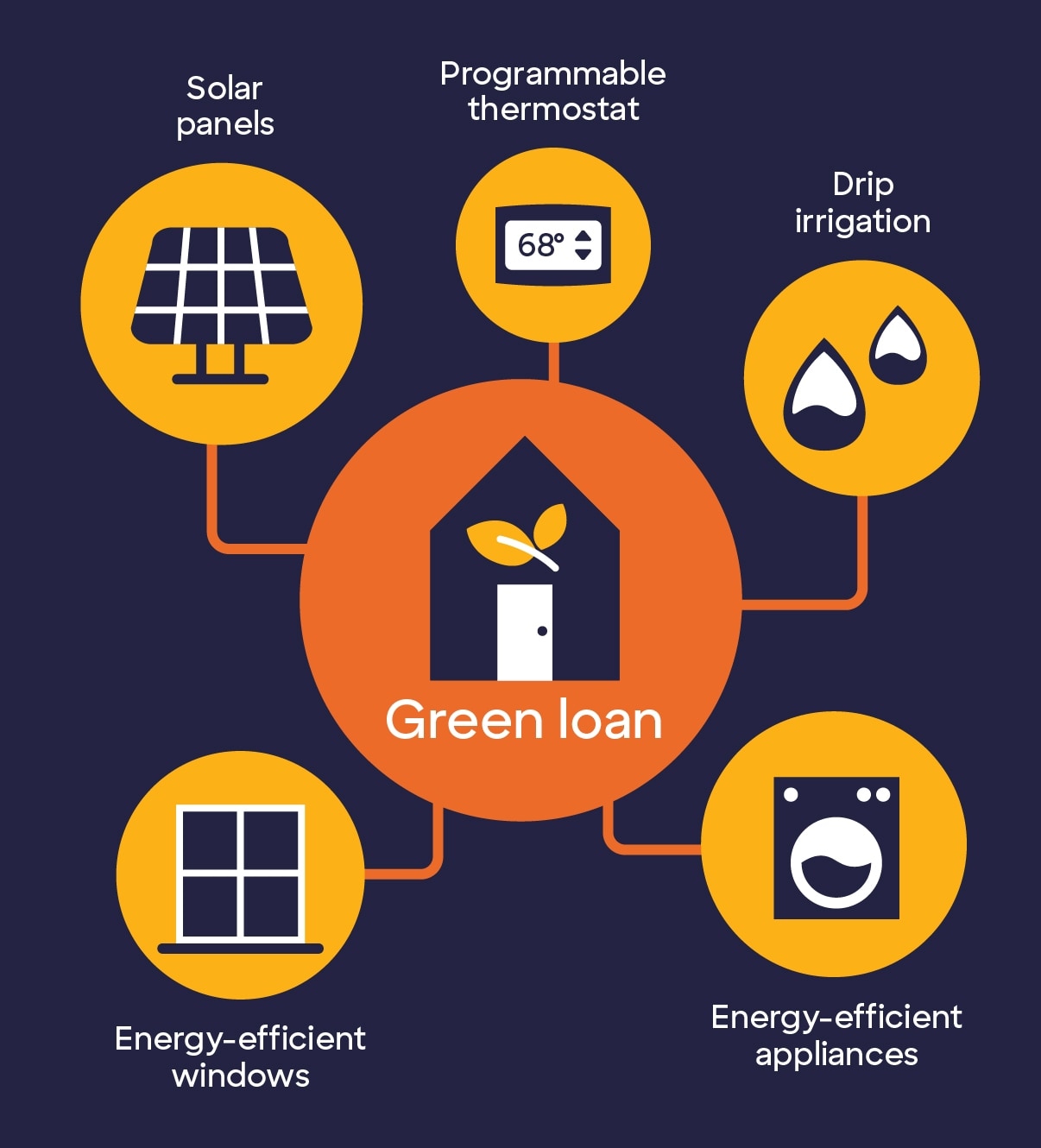

A green loan is a type of loan used to pay for equipment or projects that help the environment by lowering carbon emissions, cutting down on waste, or saving natural resources.

Green loans from the government or financial institution may require that funds adhere to specific principles and guidelines. Green loan lenders may also have lists of eligible products.

While you may not need a green loan to buy energy-saving light bulbs or a bicycle, you might consider one for energy-efficient home improvements. These projects might include the installation of solar panels, geothermal heat pumps, or energy-saving windows, doors, or appliances.

A green loan may be secured or unsecured, meaning that you may or may not need to offer collateral to qualify. A personal loan for environmentally friendly projects is typically unsecured.

What are the benefits of green improvement projects?

A green home improvement project might help you conserve energy and save money. There are several potential benefits of green projects.

Cut energy costs

Depending on location, the average U.S. homeowner will save around $52,000 over 25 years after installing solar panels.1 The average American household spends around $583 per month on electricity, water, gas, sewer, and other essential utilities.2 Updating your home with WaterSense-labeled fixtures and ENERGY STAR®–certified appliances can lower your water bill as much as $380 a year. Simply replacing your toilets with WaterSense-labeled models could save you up to $130 each year.3 Buying a heat pump could reduce your electricity use for heating by up to 75%, leading to even more savings.4

Reduce your carbon footprint

By making your home more energy efficient, you’re doing your part to help the environment. Just like biking to work instead of driving a gas-consuming car, making eco-friendly updates to your home can help the planet.

Increase the appeal of your home

If you’re considering making improvements before selling your home, you might install eco-friendly appliances or make other green upgrades. Several studies over the years have shown that upgrading a home to be more energy efficient could increase its value by 2% up to 8%.5

Qualify for federal and state tax credits

Solar panels and solar water heaters, heating and cooling systems, and other products might qualify for state and federal tax credits. Taking advantage of these tax credits, as well as any rebates, can reduce the cost of your green home project. Be sure to consult with a tax professional to know what, if any, potential benefits exist in your state.

What are examples of green home improvements?

Green home improvements include projects that reduce your environmental impact by lowering your carbon footprint, reducing waste, or saving natural resources. There are many kinds of green projects you might consider.

Major renewable energy projects

- Solar panels installed on your roof

- Geothermal heat pumps, which use ground temperature to heat and/or cool your home

- Energy-efficient windows, storm windows, and window coverings

- Kitchen and bathroom renovations using energy-efficient appliances or fixtures

- New insulation in attic or walls

Water-saving projects

- Drip irrigation systems, which may conserve water

- Repairs to leaking faucets and pipes to save water and prevent damage

- Energy-efficient landscaping to make the most of your home’s sun and shade

- Low-flow showers and toilets to control water waste

How can you pay for green home improvement projects?

Green loans may be available for specific types of home improvements from government agencies or lenders.6 There may be restrictions regarding the projects they fund and how the money is used.

To explore whether your project might qualify for a green loan, you will want to determine if your improvement is only about environmentally friendly upgrades or if you are adding green elements to a larger project. Then check with federal and state agencies or financial institutions to find out what assistance might be available.

If you’re just starting to plan, you might want to consider how to pay for your home improvement project. You could start by comparing a green loan to more versatile lending products, like a personal loan.

What are the benefits of green loans ?

In addition to supporting eco-friendly projects and possibly increasing the value of your home, green loans may be helpful in other ways.

- Higher loan amounts: If your project is extensive, you may need to borrow a large amount. By pledging an asset you own as collateral, you may be able to borrow the extra money needed with a secured loan.

- Longer repayment terms: Green loans issued by a government entity or lender may offer you extended repayment options.

- Lower interest rates: Secured green loans may offer lower interest rates because the funds are backed by the value of an asset.

- Tax benefits: Green loans that meet specific requirements may offer certain tax incentives. You’ll want to check with a tax professional to know if they are available for your project.

What are the disadvantages of green loans ?

Green loans may require additional steps for approval and carry certain restrictions. You should understand the possible downsides to pursuing a green loan from government agencies or other lenders before you apply.

- Limited availability: Green loans might not be easily available for your project. Some government programs are also aimed at specific income levels.

- Product limitations: A green loan may require that improvements include certain types of products or approved materials.

- Proof of environmental impact: You may need to demonstrate the positive environmental benefits that your project would achieve.

- Due diligence: The lender might require a review of the proposal and the type and location of the improvement before approving the loan.

Can you use a personal loan for green home improvements?

Yes. A personal loan can be used for home improvement projects, including energy-efficient upgrades. These might include buying energy-efficient appliances or adding eco-friendly features to a larger project, such as adding solar panels when you replace your roof.

While a green loan from a government agency or bank may have restrictions, a personal loan can be used to pay for almost any type of home improvement. A kitchen remodel, for example, may include new countertops or cabinets in addition to new eco-friendly appliances. You can use the funds from a personal loan to pay for any of that.

A personal loan can also offer flexible repayment terms. With a Discover® personal loan, for example, you might borrow between $2,500 and $40,000. Plus you can choose a repayment term of 36, 48, 60, 72 or 84 months so you can make payments over a time frame that best fits your needs.

While Discover Personal Loans doesn’t offer green loans, if you’re looking to finance your green home improvement project, a personal loan might help. You can use our personal loan calculator to estimate payments to help you build your budget.

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.

The information provided herein is for informational purposes only and is not intended to be construed as professional advice. Nothing contained in this article shall give rise to, or be construed to give rise to, any obligation or liability whatsoever on the part of Discover, a division of Capital One, N.A., or its affiliates.