Lots of people face major, unplanned expenses that could lead to financial turmoil at some point in their lives. What are unexpected expenses? An urgent home repair, major car repair, medical bill, emergency veterinary bill, family member relocation—each of these is a common unexpected expense that could cost thousands of dollars.

In 2024, 37% of adults in the U.S. reported they wouldn’t be able to cover an unexpected expense of $400 or more with cash, savings, or a credit card, according to a recent report from the Federal Reserve. What’s the best way to pay for unexpected expenses or cover a financial emergency when you don’t have the cash reserve available?

1. Pay over time with a payment plan

Ask the company or creditor if you can work out a payment plan to repay the debt over time, rather than struggling to pay your bill all at once. Some creditors may be willing to extend the due date for your bill or spread payments out over time until you’re paid in full.

Hospitals and other healthcare providers are often willing to handle medical bills this way.

And, while it isn’t common, businesses that provide major home repairs, such as a new roof or HVAC (heating ventilation air conditioning) system replacement, may offer payment plans so you can get the work done even if you can’t pay the entire bill up front. This could help you budget payments to work with your financial situation.

2. Borrow from a family member

A trusted family member or close friend may be willing to help you pay for a major unexpected expense, if they have the financial resources. Before you ask, think about how your relationship with this person might change if you borrow money from them. If you ask for assistance and they agree, treat the financial support like any third-party loan: Write up an agreement with clear loan terms, including any interest charges and the amount of time you’ll need to repay the loan, and any penalties if you don’t pay it back on time.

3. Explore credit card options

If you already have a credit card with enough available credit to cover it, you could charge your unexpected expense. Remember, a credit card may not be the best solution if it has a high interest rate and you don’t think you can pay the balance in full or in a few payments.

If you’d prefer to apply for a new credit card with a enough of a credit limit to pay for your expense, look for a card with a 0% or low-interest rate offer or a balance transfer offer, and make sure it’s reasonable for you to pay off the balance during the introductory offer period.

If you choose to use a credit card to fund an unexpected expense, try to research all options to find the one that best fits your financial situation. Using the right card responsibly can reduce your debt but using one with a high interest rate may be counterproductive.

4. Apply for a personal loan

A personal loan is an unsecured fixed-rate loan, so you don’t need to put up collateral to get one. With a Discover® personal loan, you can borrow from $2,500 to $40,000. When you need quick access to funds, a personal loan could offer an advantage. With some lenders, such as Discover Personal Loans, money can be sent as soon as the next business day once you’re approved and accept the loan. And a personal loan, like a Discover personal loan, offers flexibility: You choose where the money goes. You can send money straight to many creditors or to your bank account.

Another benefit of a personal loan with a fixed rate is that the interest rate and your monthly payment never change. There’s typically a set payoff date, and you know the total amount owed from the beginning of the loan. Your interest rate on a personal loan could also be lower than what you’d pay with a higher-interest credit card, making it a potentially better option to pay for emergency expenses.

Additionally, it might be helpful to use some of the funds you get from a personal loan to consolidate higher-rate debt you already carry. This means you would borrow the amount that covers both the emergency expenses and any outstanding bills and balances that have a higher interest rate. A personal loan can help you pay off debt sooner and save on interest when consolidating higher-rate debt.

If you go the personal loan route, consider key factors before choosing a lender. Make sure you understand the total cost of the loan, including all fees. Your best option is to find a lender that doesn’t charge application fees, origination fees, or prepayment penalties. Discover Personal Loans, for example, charges no fees of any kind.

5. Sell high-value items and cut expenses

When you look around your home, do you see things you can live without? Clothing, jewelry, handbags, antiques, electronics, or even unused gift cards can all be sold to generate cash quickly. Look for reputable online marketplaces or roll up your sleeves and have an old-fashioned garage sale.

What about your car? If walking, ride sharing, or public transit are options where you live, consider whether selling your car would save—or make—you money. It may seem like a big move, but this short-term sacrifice could cut down your ongoing costs or bring a check that’s big enough to pay for that major expense. (If you can eliminate a car, you'll also avoid paying for gas, repairs, and insurance premiums.)

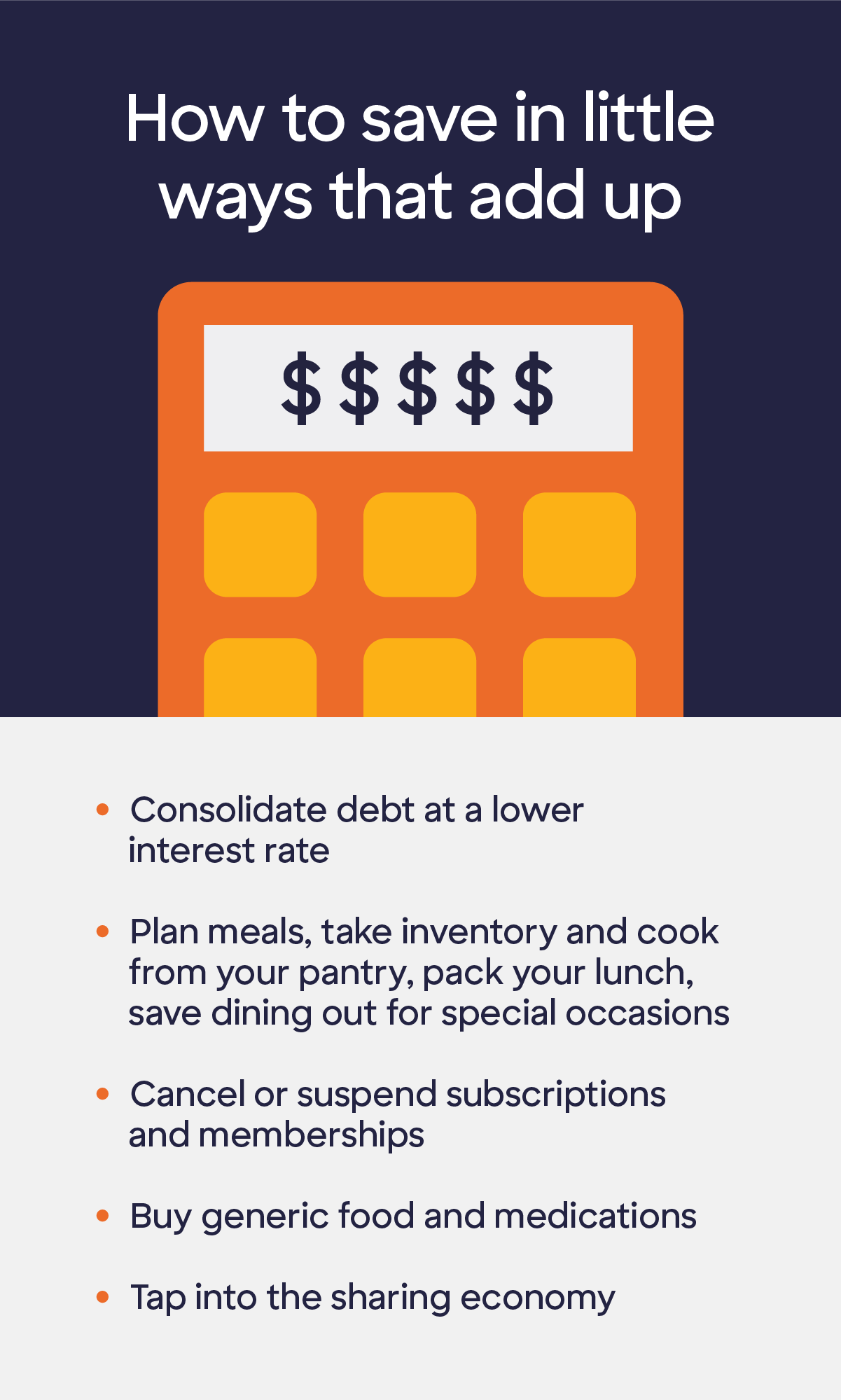

Examine your monthly spending habits: Start by prioritizing non-negotiable bills, such as utilities and groceries, and then review your other costs to identify where you can trim your budget. Consider suspending gym memberships, streaming services, or other subscriptions that you don’t use often. And think about cooking and eating at home until your unexpected expense is paid off.

6. Increase your income

When confronted with a serious gap in your finances, it may be time to get resourceful. If possible, pick up extra hours at work or look for a second job that creates an opportunity to earn more each month.

For example, seasonal work over the holidays or during a busy tourist season doesn’t require advanced qualifications, and employers often don’t expect a long-term commitment. While working two jobs can be demanding, it’s an effective way to get your unplanned expense paid off faster.

Another option could be to start a side hustle from home. Maybe you have talents to offer outside of your day job, like photography, art, or other creative pursuits, and you could sell your creations online or at local events.

Other popular opportunities for additional income include driving for a ride-share company or becoming a vacation rental host. Or keep it simple: Cut grass, walk dogs, or take care of pets and homes for people when they’re out of town.

7. Take advantage of employee benefits

Some employers offer employee benefits to help you pay for emergency expenses. For example, you may be able to take a salary advance, which allows you to repay the borrowed amount through payroll deductions from future paychecks. You might also be able to borrow from a permanent life insurance policy or 401(k) account. Check with a benefits counselor to ensure you have a clear understanding of the terms and conditions, including penalties, interest, or fees, if you choose this route.

8. Build an emergency fund

The best way to pay for unplanned expenses is to plan for the unexpected. If you have the benefit of time and no financial emergency, you can start taking steps to be better prepared if one does arise in the next month, year, or unforeseeable future. And if you’re recovering from a financial emergency that blindsided you, building an emergency fund could help you relieve stress by taking concrete steps to control your finances. All of this could help ensure that an emergency expense is a temporary setback and not a full-blown financial crisis.

Most financial experts recommend having roughly 3 to 6 months of living expenses in savings to ride out a financial emergency, but you can start with a smaller goal: Even $1,000 can make a difference when you need it.

Next, create a budget that factors in your emergency fund, as well as periodic, expected maintenance for your car and home. List annual bills, like property taxes, and other known expenses, such as car insurance or an upcoming home repair. Use a budgeting strategy that fits your personal circumstances. One that’s helpful to many people is the 50-30-20 rule: Divide up your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings.

And finally, continue to live within a budget, even if your income increases. This sets the groundwork to pad your savings account and prepares you for a financial emergency.

The bottom line

We all hope we’ll be able to tackle an unexpected expense immediately. The first step is to take a deep breath. Then assess your financial picture and figure out the best payment solution for your financial situation.

Once you’ve determined how to pay the bill, come up with an action plan to identify the expenses preventing you from saving more money. It takes work and discipline, but you’ll gain peace of mind and confidence that you can handle the unexpected moving forward.

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.

The information provided herein is for informational purposes only and is not intended to be construed as professional advice. Nothing contained in this article shall give rise to, or be construed to give rise to, any obligation or liability whatsoever on the part of Discover, a division of Capital One, N.A., or its affiliates.