How much can I save with a renewable energy project?

How much you’ll save with a green project depends on how energy efficient your home is right now, the size of your home, and how many upgrades you make, among other factors. In addition to the savings mentioned above, a few studies suggest even more ways to save.

For example, the average American household spends around $328 per month (or about $3,936 per year) on electricity, water, gas, sewer and other essential utilities, according to Move.org.4 As energy prices keep climbing, that number will, too. Energy-efficient upgrades may help offset that cost.

How can I pay for a green home improvement project?

There are a variety of ways to finance your green project. First you must determine if your project is only about environmentally friendly upgrades, or if you are adding green elements to a larger project. Then size your project--scope how much work you’re doing and what your ballpark budget could be.

Once you have a plan and budget, you’re ready to think about how to pay for your home remodeling project. You could start by comparing a green loan to more versatile lending products, like a personal loan.

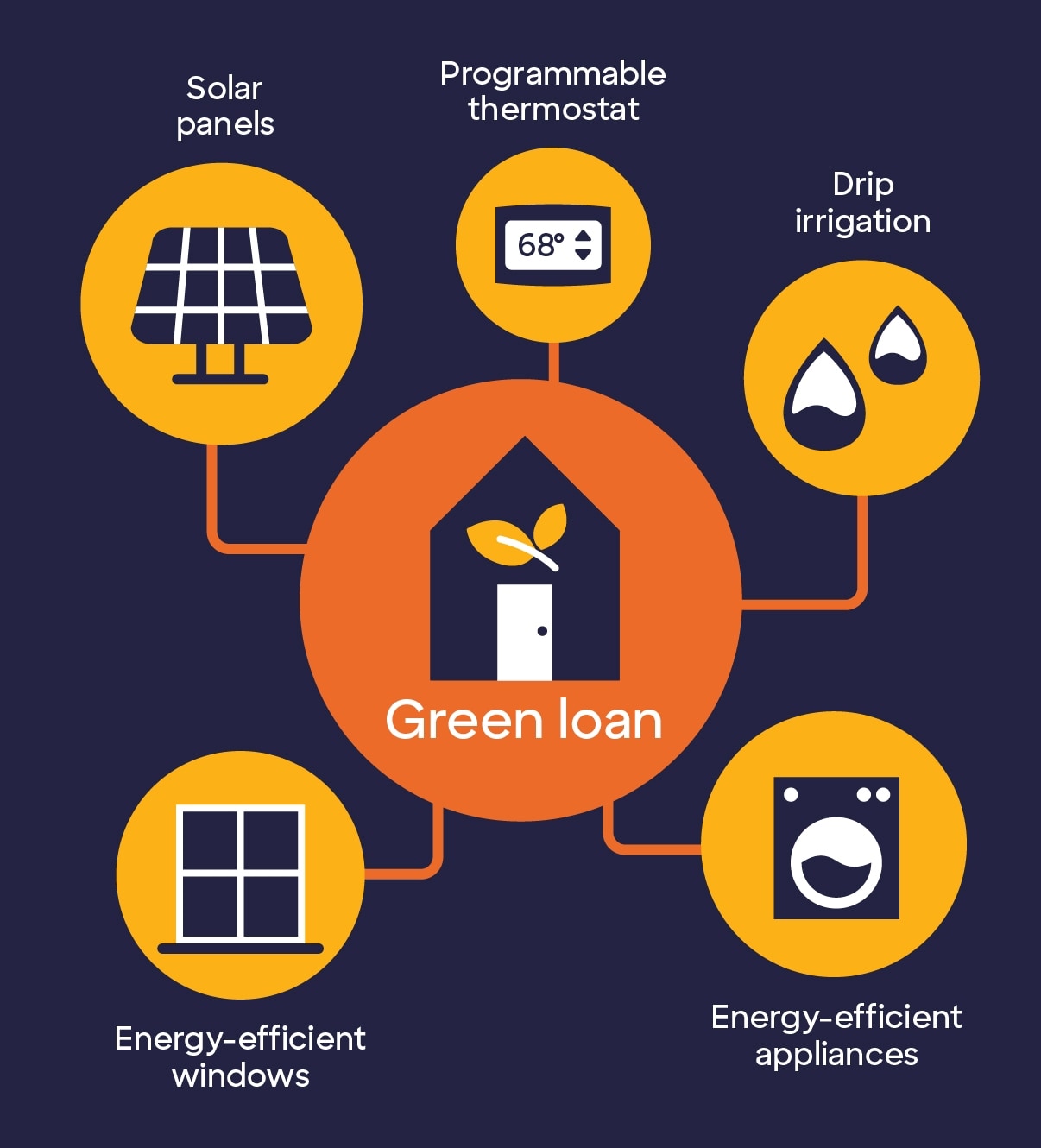

What are green loans?

"Green loan" is understood as requiring all funds be used for environmentally beneficial home improvements. You may not need a green loan to buy LED (light-emitting diode) light bulbs or a clothesline, but you might seek a loan for more expensive upgrades, like installing solar panels or geothermal heat pumps.

Green loans have become popular as homeowners look for ways to make their homes more energy efficient. They may offer repayment terms and interest rates similar to other personal loans. The main difference is that a green loan must be used for “green” home improvements, such as a smart electrical system or ENERGY STAR® windows, doors, and/or appliances. Most green loan lenders have specific lists of eligible products.

A green loan may be secured or unsecured, meaning you may or may not need to offer collateral to qualify. They are offered by a variety of online banks and credit unions.

Can I use a personal loan for green home improvements?

Yes. You could use a personal loan for many types of eco-friendly home improvement projects. And you could use it to add eco-friendly features to a larger project, such as adding solar panels when you replace your roof.

In fact, you could use the funds from a personal loan for any home renovations, including energy efficient upgrades. For example, if you want to remodel your kitchen, you may be able to finance the project with a personal loan that could also cover your energy-efficient upgrades. Green loans that require the proceeds to be used for environmental improvements may cover ENERGY STAR® appliances, but not your new countertops. A personal loan could be used for both.

A few examples of green home improvements include:

Major renewable energy projects:

- Solar panels on your roof

- Geothermal heat pumps, which use ground temperature to heat and/or cool your home

- Energy-efficient windows, storm windows, and/or window coverings

- Kitchen and bathroom renovations using energy-efficient appliances

- New insulation in the attic and/or the walls

Water-saving projects:

- A drip irrigation system, which drips water into the soil

- Repair leaking faucets and pipes, to save water and prevent damage

- Energy-efficient landscaping, to help you make the most of available sun and shade

- Low-flow showers and toilets, to control water waste

Whether you use a green loan or a personal loan for home improvement, you may see two benefits. First, you could start your project just as soon as your loan is funded. And second, the interest rate on a traditional green loan or a personal loan you use for green projects might be lower than what you’d pay on a higher-rate credit card, potentially saving you hundreds or even thousands of dollars over time.

No matter how you fund your project, remodeling your home to fit your eco-friendly lifestyle can be a great way to reduce your impact on the environment. As a bonus, green renovation projects may also help you cut your energy bills.

While Discover® Personal Loans doesn’t offer green loans, if you’re looking into how to pay for solar panels or ENERGY STAR® appliances, a personal loan might help.