4. Apply for a personal loan

A personal loan is a fixed-rate loan that is unsecured, meaning you don’t need to put up collateral to get one. With a Discover® personal loan, you can borrow from $2,500 to $40,000. When you need quick access to funds to cover a large unplanned expense, a personal loan could be a good solution. With some lenders, such as Discover Personal Loans, money can be sent as soon as the next business day once you’re approved and accept the loan. And a personal loan offers flexibility: You choose where the money goes. You can send money straight to many creditors or to your bank account.

Another benefit of a personal loan with a fixed rate is that the interest rate and your monthly payment never change. There’s typically a set payoff date, and you know the total amount owed from the beginning of the loan. Your interest rate on a personal loan could also be lower than what you’d pay with a high-interest credit card, making it a potentially better option to pay for emergency expenses.

Additionally, it might be helpful to use some of the funds you get from a personal loan to consolidate higher-rate debt you already carry. This means you would take out a loan amount that covers both the emergency expenses and any outstanding bills and balances that have a higher interest rate. A personal loan can help you pay off debt sooner and save on interest when consolidating higher-rate debt. In fact, 93% of debt consolidators said they saved money or time by taking out a Discover personal loan.*

If you go the personal loan route, consider key factors before choosing a lender. Make sure you understand the total cost of the loan, including all fees. Your best option is to find a lender, like Discover Personal Loans, that doesn’t charge application fees, origination fees, or prepayment penalties.

5. Sell high-value items and cut expenses

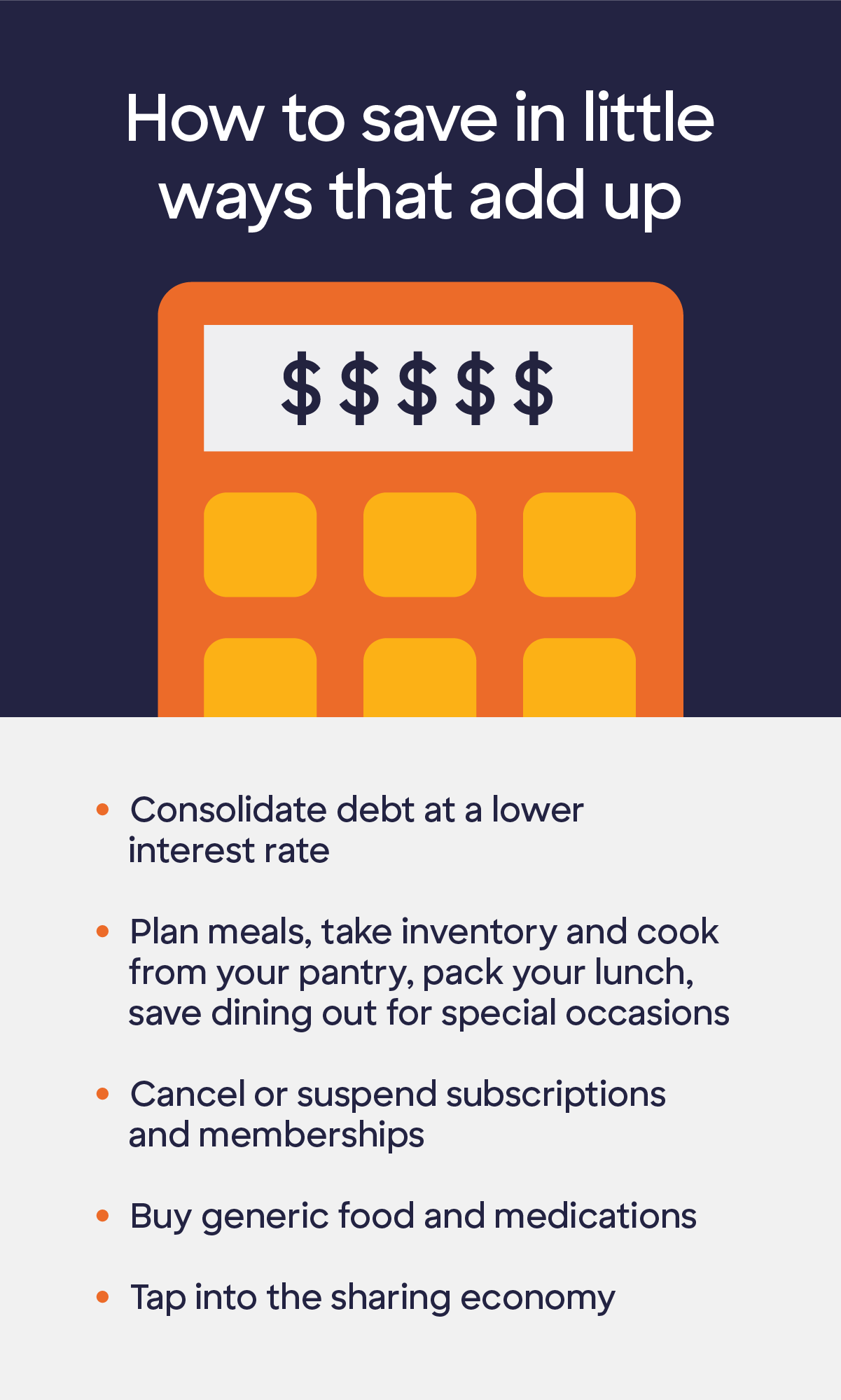

It might also help to look closely at your monthly spending habits: Start by prioritizing the bills that are non-negotiable, and then consider other spending to determine where you can cut back. Maybe you can suspend gym memberships or other subscriptions or decide to eat more meals at home until your unexpected expense is paid off.

When you look around your home, do you see items of value you can live without? Clothing, jewelry, handbags, antiques, electronics, or even unused gift cards can all be sold to generate cash quickly. Look for reputable online marketplaces or roll up your sleeves and have an old-fashioned garage sale.

What about your car? If walking, ride sharing, or public transit are viable options where you live, you might explore selling your vehicle, if you own it. It may seem like a big move, but this short-term sacrifice could bring a check that’s big enough to pay for that major expense, and you’ll learn whether you really need the vehicle. If you can eliminate a car, you you'll also avoid paying operating costs and insurance premiums; that money can go toward your big emergency expense.

6. Increase your income

When confronted with a serious gap in your finances, it’s time to get resourceful. You may be able to pick up an extra shift at your current job or land a second job to bring in additional income.

For example, seasonal work over the holidays or during a busy tourist season doesn’t require advanced qualifications, and employers don’t expect a long-term commitment. While working two jobs can be demanding, it may help you see light at the end of your financial tunnel.

Another option is to start a side hustle. Maybe you have a creative passion outside of your day job, like photography, art, or other “maker” pursuits, and you could sell your creations online or at local events.

Other popular opportunities for additional income include driving for a ride-share company or becoming a vacation rental host. Or you could keep it simple: cut grass, walk dogs, or take care of pets and homes for people when they’re out of town.

7. Prepare for the unexpected with an emergency fund

Expensive emergencies can deal a serious blow to your finances. Although you can’t anticipate the details of such an event, you can take steps to be better prepared if one does arise. To ensure that an emergency expense is a setback and not a full-blown financial crisis, start by creating an emergency fund if you don’t already have one.

Most financial experts recommend a target of 3-6 months of living expenses to ride out a financial emergency, but you can start with a smaller goal: Even $1,000 can make a dent in a big bill.

Next, create a budget that factors in your emergency fund, as well as periodic, expected maintenance for your car and home. List annual bills, like property taxes, and other known expenses, such as car insurance. Use a budget strategy that fits your personal circumstances. One that’s helpful to many people is the 50-30-20 rule.—that is, divide up your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings.

And finally, continue to live within a budget, even as your income increases. This sets the groundwork to grow savings and prepares you to make necessary changes if you’re hit with a financial emergency.