What is a recession?

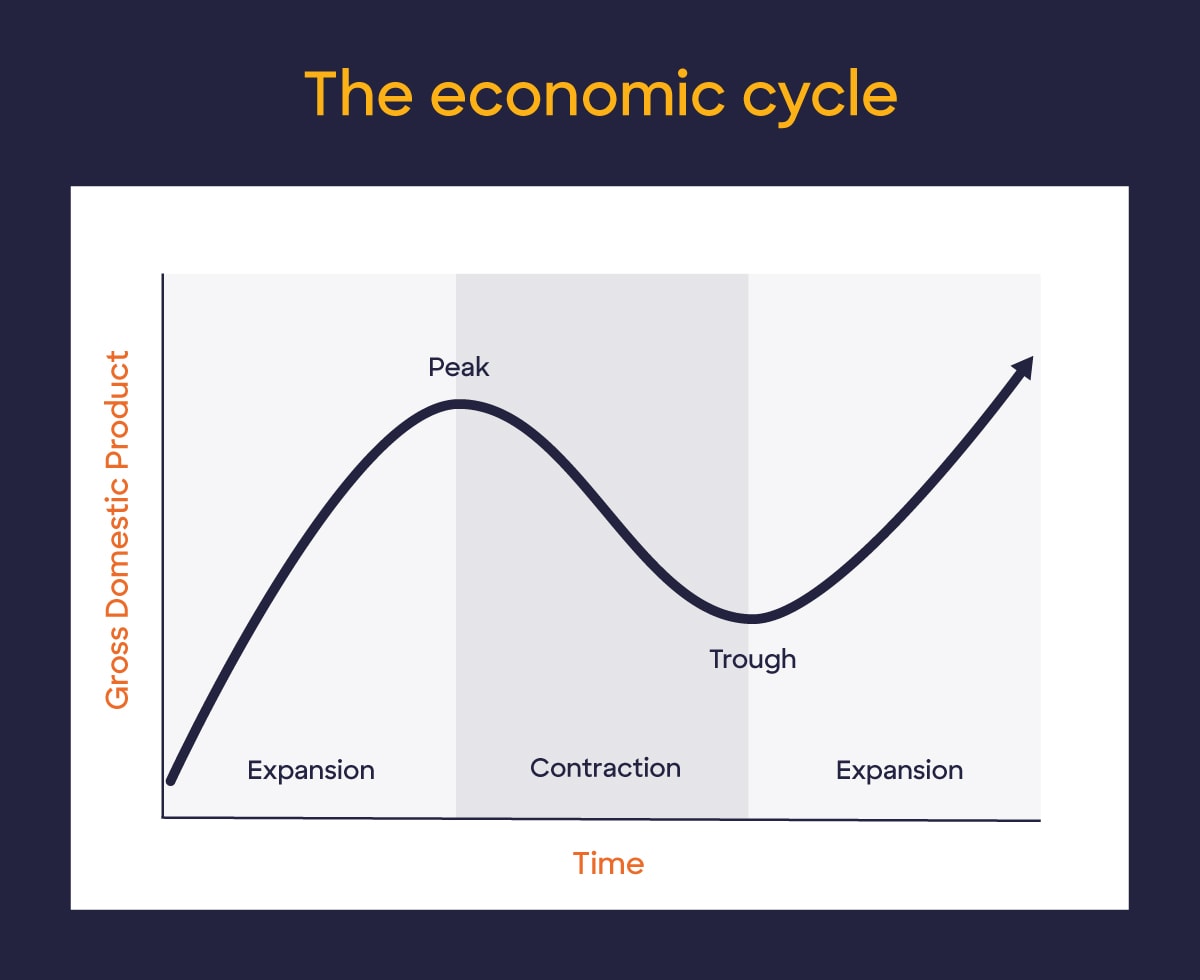

A common way to define a recession is when the gross domestic product (GDP) falls for two quarters in a row. (GDP is the total economic output of the country.) But that is not an official definition.2

A committee of economists at the National Bureau of Economic Research decides when a recession starts and stops.3 According to this group, a recession is “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

The good news is that the economy is usually in expansion mode.1 But recessions do happen. Significant events like a banking crisis or a stock market plunge can set them off.

There are different kinds of recessions

While recessions have many similarities, they are by no means all the same. Some recessions are deep and short. Economists call these “V-shaped recessions.”

Others are less severe, but last longer and are called “U-shaped” recessions.

Some recessions are shaped like a “W,” also known as a double-dip recession. That’s when economic activity falls, then rebounds, falls again, and rebounds for good.

How might what happens in a recession affect me?

They say that when your neighbor loses their job, it’s a recession. But when you lose your job, it’s a depression. People feel recessions differently depending on what happens to them.

Recessions can impact the average person in a number of ways. The biggest is through layoffs and difficult job markets.

A recession might make it hard to land a new job, and wages are likely to be lower during or after a recession than before. It could be hard for recent college graduates to find their first jobs. During the 2007-09 recession, for example, the unemployment rate reached 9.5% in June 2009,4 almost three times the June 2023 rate of 3.6%.5

The stock market also usually falls during a recession. That can cause your retirement savings and other investments to fall in value.

Lastly, it’s harder to borrow money during a recession. Lenders may want to lend to only the most creditworthy borrowers because they worry about getting paid back.

Even if your job is secure and you don’t have an investment portfolio, you might still feel uneasy during a recession. It’s unsettling to see those close to you struggling.