NEXTQUARTER FIRSTMONTH. - NEXTQUARTER LASTMONTH. QUARTER YEAR

Discover it® Student Cash Back

Earn rewards and build a credit history3

No annual fee. No credit score required to apply*

Where can you get 5% cash back today?

CURRENTQUARTER FIRSTMONTH. - CURRENTQUARTER LASTMONTH. CURRENTQUARTER YEAR

QUARTER TITLE

QUARTER DESC10 QUARTER EXCLUSION CRITERIA

CURRENTQUARTER FIRSTMONTH. - CURRENTQUARTER LASTMONTH. CURRENTQUARTER YEAR

99% nationwide acceptance: Discover is accepted nationwide by 99% of places that take credit cards.2

Which Discover it® Card design fits your style?

Choose from several colorful card designs when you apply to become a cardmember. Go ahead – express yourself.

Designed just for students

x% Intro APR† for x months on purchases. Then x% to x% Standard Variable Purchase APR will apply.

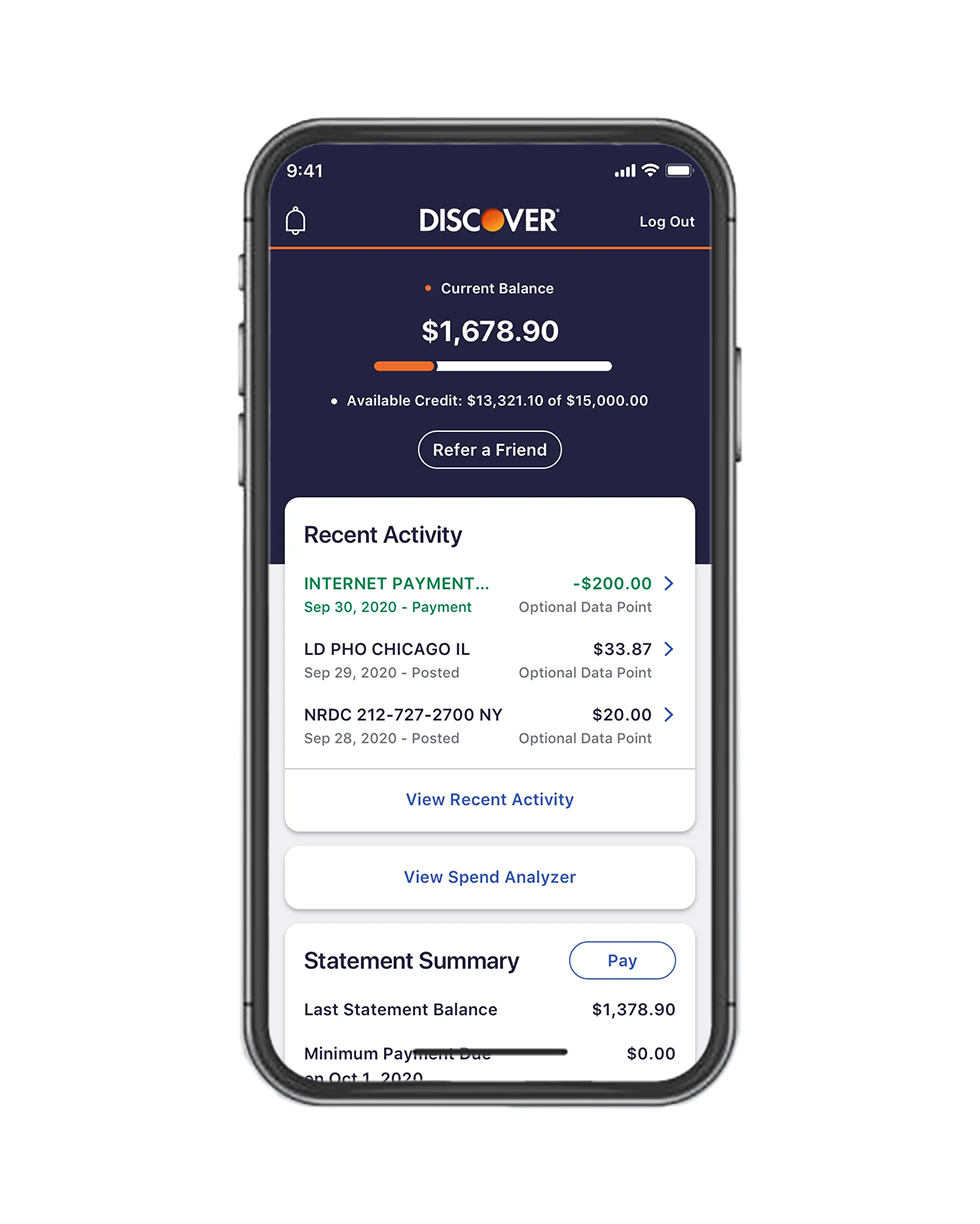

Bring your Discover account with you on-the-go

Use your Discover student login to set alerts, viewing your Credit Scorecard will never impact your FICO® Score4 and more, all from your smartphone or tablet.

Track and redeem cashback reward

Easily message us for customer service right from our app

Free Social Security number alerts: Get an alert if we find your Social Security Number on any of thousands of Dark Web sites. 5 Activate for free.

Freeze it® - If you misplace your card, you can prevent new purchases, cash advances, and balance transfers in seconds with the Freeze it® on/off switch on our mobile app and website.6

Over 500,000 new student cardmembers referred by their friends since 2020

Refer a friend and get a statement credit for each friend who becomes a cardmember. Eligibility requirements apply. See terms and conditions.7

Looking to get started with a student cash back card?

See how the Discover it® Student Cash Back Card is a great place to start.

Credit card, secured or student credit card - what’s best for your teen? What they need to know before getting their first credit card.

Learn whether you’re ready for your first credit card, how to choose a starter credit card, and the best ways to build your credit history.3

From payments to rewards, ensure you start your credit history off right with these 7 tips for applying for your first credit card.