There's no annual fee to use your NHL® credit card. Not now. And not hiding a year from now.

Action required: Update your browser

We noticed that you're using an old version of your internet browser to access this page. To protect your account security, you must update your browser as soon as possible. You'll be unable to log in to Discover.com in the future if your browser has not been updated. Learn more in the Discover Help Center

-

Credit Card Products

-

![Discover it Cash Card Art]()

- Discover it® Cash Back Earn cash back rewards

-

![Discover it Student Cash Card Art]()

- Discover it® Student Cash Back Start building credit in college

-

![Discover it Student Chrome Card Art]()

- Discover it® Student Chrome Earn restaurant & gas rewards as a student

-

![Discover it Secured Card Art]()

- Discover it® Secured Build or rebuild your credit

-

![Discover it Miles Card Art]()

- Discover it® Miles Explore with the travel rewards credit card

-

![Discover it Chrome Card Art]()

- Discover it® Chrome Earn restaurant & gas rewards

-

![Discover it NHL Card Art]()

- NHL Credit Card Represent your team & earn cash back

-

NHL® Discover it® Credit Card

Show your loyalty with every purchase

Support the team you love while earning top-tier rewards with the official credit card of the NHL®.

No annual fee

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

32 teams in the league - but only one matters to you.

Which NHL® team logo is worthy of your

Discover® Credit card?

Earn great rewards with the Discover it NHL® card

Earn 5% cash back on everyday purchases at different places you shop each quarter like grocery stores, restaurants, gas stations, and more, up to the quarterly maximum when you activate. Plus, earn 1% cash back on all other purchases.

Earn unlimited 1% cash back on all other purchases.

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we’ll match.1

Where can you get 5% cash back today?

CURRENTQUARTER FIRSTMONTH. - CURRENTQUARTER LASTMONTH. CURRENTQUARTER YEAR

QUARTER TITLE

QUARTER DESC7 QUARTER EXCLUSION CRITERIA

CURRENTQUARTER FIRSTMONTH. - CURRENTQUARTER LASTMONTH. CURRENTQUARTER YEAR

99% nationwide acceptance: Discover is accepted nationwide by 99% of places that take credit cards.5

Low intro APR

x% Intro APR† for x months on purchases and balance transfers and x% Intro Balance Transfer Fee until x. Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Every NHL® team credit card - all beauties with no annual fee

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Carolina Hurricanes®

Columbus Blue Jackets®

New Jersey Devils®

New York Islanders®

New York Rangers®

Philadelphia Flyers®

Pittsburgh Penguins®

Washington Capitals®

© NHL

Boston Bruins ®

Buffalo Sabres ®

Detroit Red Wings®

Florida Panthers®

Montreal Canadiens®

Ottawa Senators®

Tampa Bay Lightning®

Toronto Maple Leafs®

© NHL

Chicago Blackhawks®

Colorado Avalanche®

Dallas Stars™

Minnesota Wild®

Nashville Predators®

St. Louis Blues®

Utah Hockey Club®

Winnipeg Jets™

© NHL

Anaheim Ducks®

Calgary Flames®

Edmonton Oilers®

Los Angeles Kings®

San Jose Sharks®

Seattle Kraken®

Vancouver Canucks®

Vegas Golden Knights®

© NHL

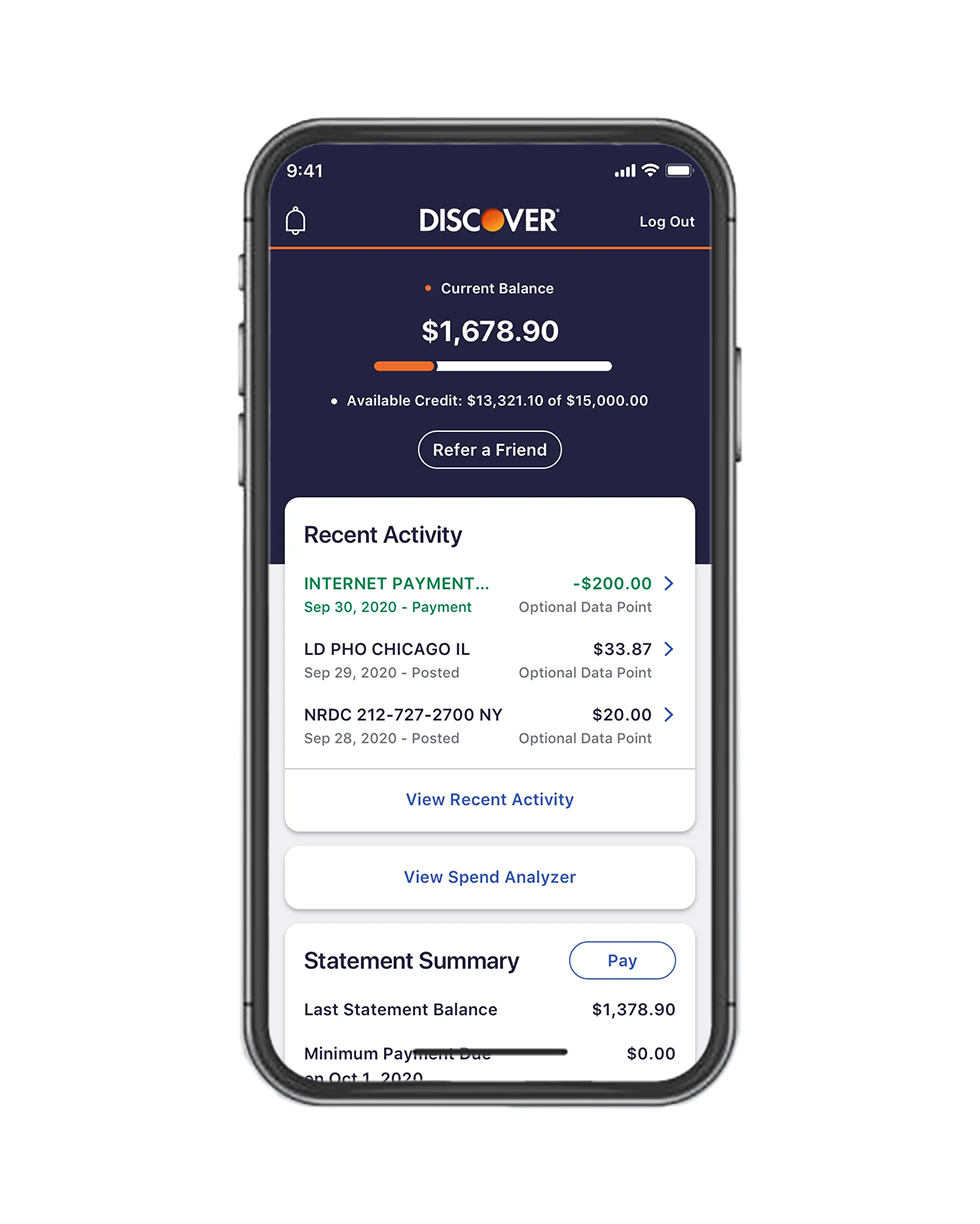

The Discover mobile app plays well at home or on the road

Track and redeem cash back rewards

Easily message us for customer service right from our app

Viewing your Credit Scorecard will never impact your FICO® Score.2

The security you expect from Discover

Get an alert if we find your Social Security Number on any of thousands of Dark Web sites. 3 Activate for free.

You're never responsible for unauthorized purchases on your Discover Card.6

The hockey credit card for true NHL® fans

Want to support the team you love while also enjoying top-shelf cash back rewards with no annual fee?

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

NHL® Discover it® Credit Card Frequently Asked Questions

The NHL® Discover it® credit card is generally available to people with good to excellent credit. Discover considers information on your credit report along with other factors when determining if you qualify for an account. If you do not qualify for the NHL® Discover it® credit card, you may qualify for another card, like the Discover it® Secured credit card designed for people looking to build their credit history.

The NHL® Discover it® credit card offers the same rewards on purchases as the Discover it® Cash Back credit card as well as the same match of the all the cash back you’ve earned at the end Fof your first year.1 You also enjoy great Discover benefits like real human customer service 24/7 and more. But the NHL® Discover it® Card is the best credit card for hockey fans because all 32 NHL® teams are available as card designs. So you can show off your loyalty to your favorite NHL® team whenever you shop.

A credit card balance transfer allows you to use some portion of your available credit line to transfer outstanding debt from another credit card account at a different bank or credit card company. Consider a credit card balance transfer if your NHL® Discover it® credit card has a low balance transfer APR or promotional APR that can help you save money on interest when you transfer higher interest debt.

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.