OR

Earn rewards on every purchase

On everyday purchases at different places you shop each quarter – like grocery stores, restaurants, gas stations, and more – up to the quarterly maximum when you activate.

Plus, your cash back won't expire for the life of the account 3

99% nationwide acceptance — Discover is accepted nationwide by 99% of places that take credit cards.2

Join those in the know

“My favorite card!

Great everyday card. Easy to earn rewards and simple redemption. Fantastic customer service.

One of the 28,000 5-star reviews as of 03/259

Excellent card

The rewards are great, I love being able to shop at my

favorite stores and get rewards back.

One of the 28,000+ 5-star reviews as of 11/249

Very Great features

I'm just thrilled with my card [and] use it all the time for everything.

One of the 28,000+ 5-star reviews as of 11/249

Security features that matter

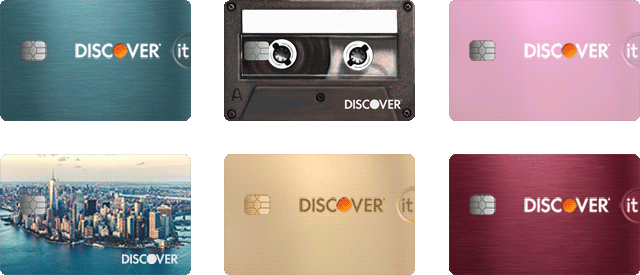

A look that's all

yours

Choose from a gallery of colorful card designs when you apply to become a Discover it® cardmember.

Start out right with our low intro APR

x% intro APR† for x months on purchases and balance transfers and x% intro Balance Transfer Fee until x. Then x% to x% Standard Variable Purchase APR and up to x% fee for future balance transfers will apply.

Cash back credit card FAQs

Discover will automatically match all the cash back you earn at the end of your first year after you open your new Discover it® cash back card.1 So if you earn $50 cash back, we'll give you another $50.

No, there's no limit to how much we'll match.

Yes, you can redeem cash back any time after you earn it and still receive the full match amount at the end of your first year.

You don’t have to sign up, just use your Discover card for purchases to earn cash back. We'll automatically match all the cash back you earn at the end of your first year.1

No, there is no annual fee for the Discover it® Card. Experience the rewards of our cash back credit card without an annual fee.

No annual fee

†See rates, fees and other info

While cards with no annual fee can lower the cost of using your card, these credit cards will charge interest and could have other types of fees. When you pay your balance on time and in full at each billing statement, you may be able to avoid paying interest on purchases and reduce the cost of using credit.

So while there’s no extra charge each year with a no annual fee credit card, any interest charges on your account are a cost of using credit.

Learn more about cash back rewards credit cards from Discover

The Discover Cashback Bonus program allows you to earn cashback rewards on every purchase.

Find out which credit cards you may qualify for with our online credit card-pre-approval tool - checking doesn't impact your credit score and can personalize your offer.

With a 99 percent acceptance rate at merchants that accept credit cards, it’s likely that Discover is accepted at your retailer of choice.2