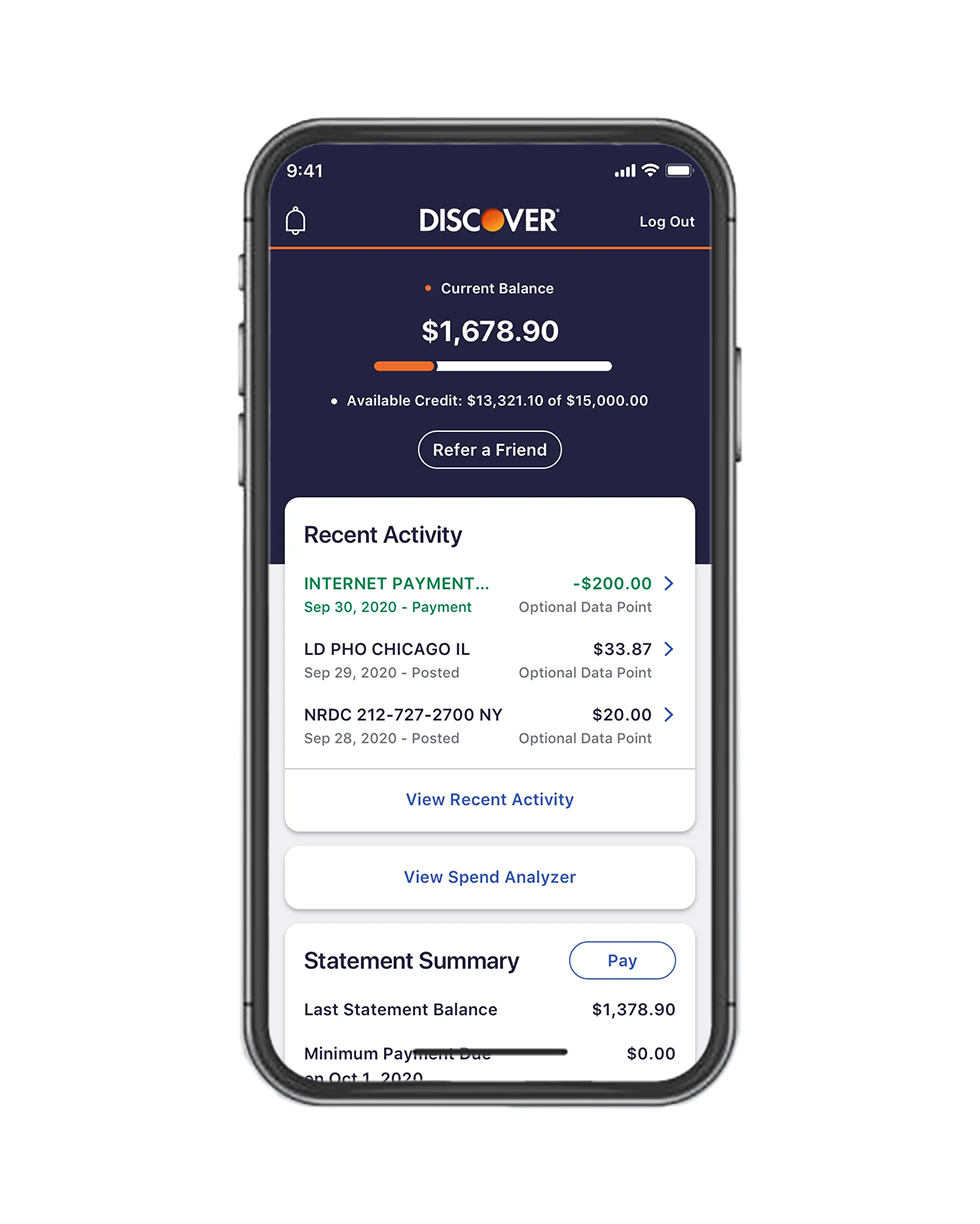

You can use the Discover mobile app to set alerts, get your FICO® Credit Score, plus see important details that help make up your score for free4 and more, all from your smartphone or tablet.

Track and redeem cashback rewards

Easily message us for customer service right from our app

Free Social Security number alerts: Get an alert if we find your Social Security number on the dark web.5 Sign up to activate this free benefit.

Freeze your account: If you misplace your card, you can prevent new purchases and cash advances in seconds with the on/off switch on our mobile app and website.6