Students earn 5% cash back on everyday purchases at different places you shop each quarter, such as

Grocery stores

Restaurants

Gas stations

up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

Students earn 5% cash back on everyday purchases at different places you shop each quarter, such as

Grocery stores

Restaurants

Gas stations

up to the quarterly maximum when you activate.

Plus, earn 1% cash back on all other purchases.

Earn 2% cash back at

Gas Stations

Restaurants (including cafes and fast-food)

on up to $1,000 in combined purchases each quarter, automatically.2

Plus, earn unlimited 1% cash back on all other purchases.

As a college student, you may have little or no credit history, so the best credit cards for you will be geared toward students in your situation. A rewards student credit card, such as Discover it® Student Cash Back Card or Discover it® Chrome for Students, can help you earn cash back on everyday purchases.

You don't need a job to apply for a student credit card, but you must show income. For students under 21, there are different rules for what counts as income than for those 21 and older.

Discover reports your credit card account activity to the three major credit bureaus, so you start to develop a record of your financial activity. That’s why Discover student credit cards can help you build your credit with responsible use.5 (Plus, you earn cash back rewards on every purchase.)

It can be a simple process to start building credit. To build your credit responsibly with a student credit card:

• Make all payments on time.

• Pay your balance in full each month (or, if you can’t, at least pay more than your minimum due each month).

• Avoid carrying a balance: you’ll have to pay interest on any purchases or amounts you don’t pay off each month.

Things like late payments, failing to pay at all, or other negative activity with your student credit card or other loans in your name could hurt your ability to build credit.

When you apply online, here are some of the things you will need when applying online.

You need to be at least 18 to apply for a student credit card and meet the income requirements for your age, but there's no credit score required to apply for a Discover student credit card.*

Discover student credit cards can help you build your credit history5 and earn cash back rewards on every purchase.

Regular credit cards are typically designed for people with an established credit history. These differ from student credit cards, which are designed with students in mind who may have little to no credit and are enrolled in school. It’s common for student credit cards to have a lower credit limit, so students can get started using credit and build credit with responsible use.5

Feel like you're ready to take on more credit? You can apply by requesting an increase online or you can call us at 1-800-DISCOVER.

When you graduate, call us to update your personal information, such as your income, housing, e-mail, and address. Updating this information may make you eligible for credit line increases.

No credit score is required to apply for a Discover it® Student credit card.* The Discover it® Student credit card can help you build credit with responsible use.5

Although you might need a new student credit card for a number of reasons, simply replacing your credit card if it is lost or stolen won’t affect your credit score. Also, you’re never held responsible for unauthorized purchases on your Discover Card account.11

Different student credit cards offer different initial credit limits, which depend on factors like:

Your income

Your credit score

How much credit you’re already using (known as “credit utilization”), if applicable

There is no set credit limit as everyone's situation is different. The minimum credit line for Discover student cards is $500.

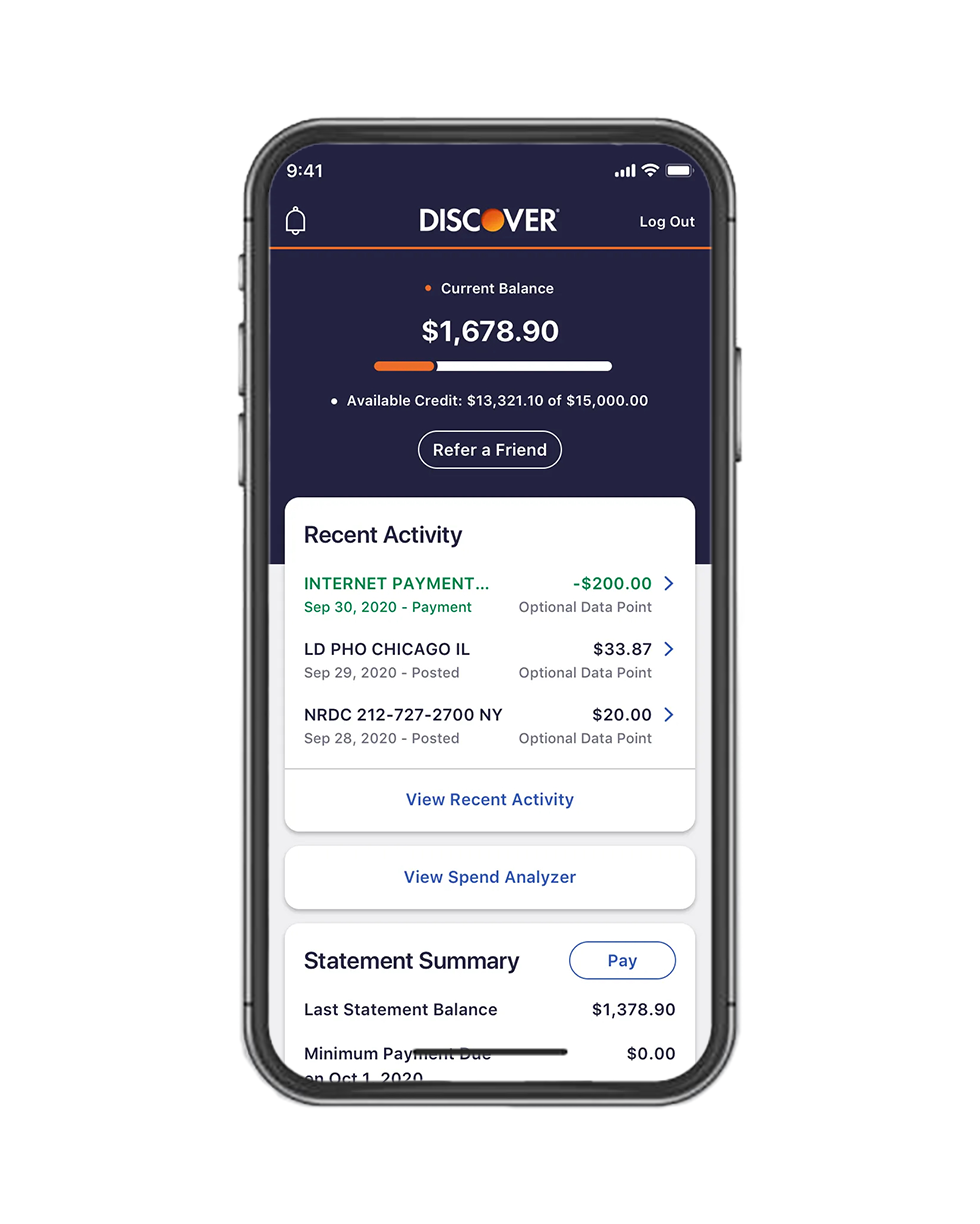

We’ll help you regularly remove your personal info from select people-search websites that could sell your data. It’s free, activate with the Discover app.10

Get an unlimited dollar-for-dollar match of all the cash back you earn at the end of your first year, automatically. There is no limit to how much we’ll match.3

Refer a friend and get a statement credit for each friend who becomes a cardmember.4

Viewing your Credit Scorecard will never impact your FICO® Score.1

Discover is accepted nationwide by 99% of the places that take credit cards.6

x% Intro APR† for x months on purchases. Then x% - x% Standard Variable Purchase APR will apply.

Whether you're brand new or already have some credit history, a student Discover Card lets you earn great rewards while you build credit with responsible use5. This includes making all of your payments on time to your Discover account or any other bills and loans.

Use your Discover student login to set alerts, get your free Credit Scorecard with your FICO® Credit Score and more1 all from your smartphone or tablet.

As a college student, you may have little or no credit history, so the best credit cards for you will be geared toward students in your situation. A rewards student credit card, such as Discover it® Student Cash Back Card or Discover it® Chrome for Students, can help you earn cash back on everyday purchases.

You don't need a job to apply for a student credit card, but you must show income. For students under 21, there are different rules for what counts as income than for those 21 and older.

Discover reports your credit card account activity to the three major credit bureaus, so you start to develop a record of your financial activity. That’s why Discover student credit cards can help you build your credit with responsible use.5 (Plus, you earn cash back rewards on every purchase.)

It can be a simple process to start building credit. To build your credit responsibly with a student credit card:

• Make all payments on time.

• Pay your balance in full each month (or, if you can’t, at least pay more than your minimum due each month).

• Avoid carrying a balance: you’ll have to pay interest on any purchases or amounts you don’t pay off each month.

Things like late payments, failing to pay at all, or other negative activity with your student credit card or other loans in your name could hurt your ability to build credit.

When you apply online, here are some of the things you will need when applying online.

You need to be at least 18 to apply for a student credit card and meet the income requirements for your age, but there's no credit score required to apply for a Discover student credit card.*

Discover student credit cards can help you build your credit history5 and earn cash back rewards on every purchase.

Regular credit cards are typically designed for people with an established credit history. These differ from student credit cards, which are designed with students in mind who may have little to no credit and are enrolled in school. It’s common for student credit cards to have a lower credit limit, so students can get started using credit and build credit with responsible use.5

Feel like you're ready to take on more credit? You can apply by requesting an increase online or you can call us at 1-800-DISCOVER.

When you graduate, call us to update your personal information, such as your income, housing, e-mail, and address. Updating this information may make you eligible for credit line increases.

No credit score is required to apply for a Discover it® Student credit card.* The Discover it® Student credit card can help you build credit with responsible use.5

Although you might need a new student credit card for a number of reasons, simply replacing your credit card if it is lost or stolen won’t affect your credit score. Also, you’re never held responsible for unauthorized purchases on your Discover Card account.11

See if you’re pre-approved with no harm to your credit score.12