Updated: Oct 20, 2023

Article highlights

- Fill out the FAFSA promptly and accurately to make sure you have the best chance of receiving financial aid.

- Double-check that you input all your information correctly. Mistakes can result in your FAFSA being rejected.

- The FAFSA must be completed every year you’re in school.

The first step to applying for financial aid is completing the FAFSA (Free Application for Federal Student Aid). This form is required to be considered for federal student aid, such as grants, student loans, and work-study. Many states and schools also use the information you provide to determine eligibility for state and institutional aid. The FAFSA becomes available every year on October 1 and should be filled out each year you are in school. You should submit it as soon as you can, since some forms of aid are “first come, first served.”

The process of applying for financial aid can feel overwhelming to students and parents, particularly when it comes to completing and submitting the FAFSA. The good news is that it typically takes less than an hour to complete. As you prepare for the application, familiarize yourself with these common FAFSA mistakes so you don’t miss out on financial aid. Plus, most students qualify for some aid.

1. Deciding not to fill out the FAFSA at all

Many families assume they won’t be able to receive aid based on income or financial circumstances, but there is no income cap to be eligible for federal student aid. It’s a good idea to fill out the FAFSA even if you don’t think you will qualify since many schools and states also use it to award scholarships, grants, and other forms of aid.

2. Waiting until you start the form to get an FSA ID and other documents

Before you begin, you and your parent(s) will each need to obtain an FSA ID. This is a username and password that lets you sign your FAFSA electronically. You should also have all the documents and information you’ll need to fill out the form, such as your Social Security number (SSN), asset records, and tax returns from two years prior. The FAFSA assistant is a free tool that can help you get ready to complete the application.

Keep copies of these records, FSA IDs, and log-in credentials in a safe place so you can refer to them later. You will need your FSA IDs each year you complete the FAFSA.

3. Procrastinating—and possibly missing deadlines

File the FAFSA as soon as it becomes available on October 1 to give yourself the best shot at getting the most aid. If you wait to file, then be aware of the deadlines for each school you are applying to, and make a plan to meet them.

4. Paying a fee to complete the FAFSA

Be wary of websites that offer assistance to fill out the FAFSA for a fee. These are not affiliated with the official US Department of Education site, which never charges a fee. Instead, fill it out for free at StudentAid.gov.

5. Making errors when inputting your information

The FAFSA asks for a lot of information. To respond to questions accurately, be sure to:

- Double-check your name, date of birth, and SSN. This seems like a no-brainer, but mistakes with this type of information can cause your FAFSA to be rejected.

- Input the correct tax information. To make this easier, your Federal Tax Information (FTI) can be retrieved and transferred directly into your FAFSA via a direct data exchange with the IRS. This system replaces the IRS Data Retrieval Tool (DRT).

- Count all sources of income. You'll need to include income and assets, such as investments and savings, as well as earnings from any jobs for both the student and parents.

- Provide the correct parent information (if yours are divorced). There are guidelines about how to report parent information on the FAFSA if they are divorced or separated. For instance, you would report the parent who provides you with the most financial assistance. You will also need to report a stepparent's financial information if the parent you report is remarried.

6. Only listing schools you’re definitely applying to

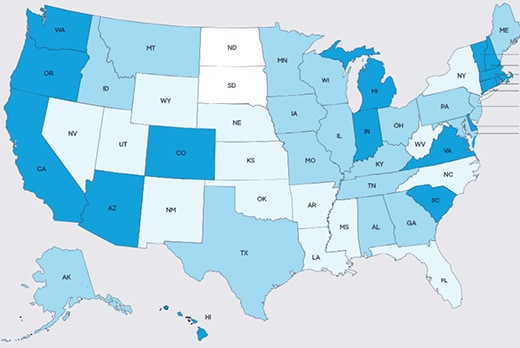

You can list up to 20 schools in the online FAFSA (and you can add more later). You don’t need to have applied yet to include a school, so if you’re still finalizing your list, you can put down any schools you're considering. The order of schools doesn't matter for federal aid, but it could make a difference on a state level. Some states require that you list an eligible state college in a certain position to receive aid from the state.

7. Not signing the FAFSA

You and your parents will each use your FSA ID to sign your form electronically. Once you’ve signed, make sure you hit Submit. If you skip this step, your form is considered incomplete.

8. Forgetting how often you need to fill out the FAFSA

The FAFSA needs to be completed each year you’re in school. The process gets easier and shorter after the first year. Family financials can fluctuate year to year, so the aid you received one year may not be the same in the future. Even if you haven’t received need-based financial aid in the past, you should still resubmit the FAFSA each year as your eligibility can change.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.