Updated: Nov 23, 2022

Article highlights

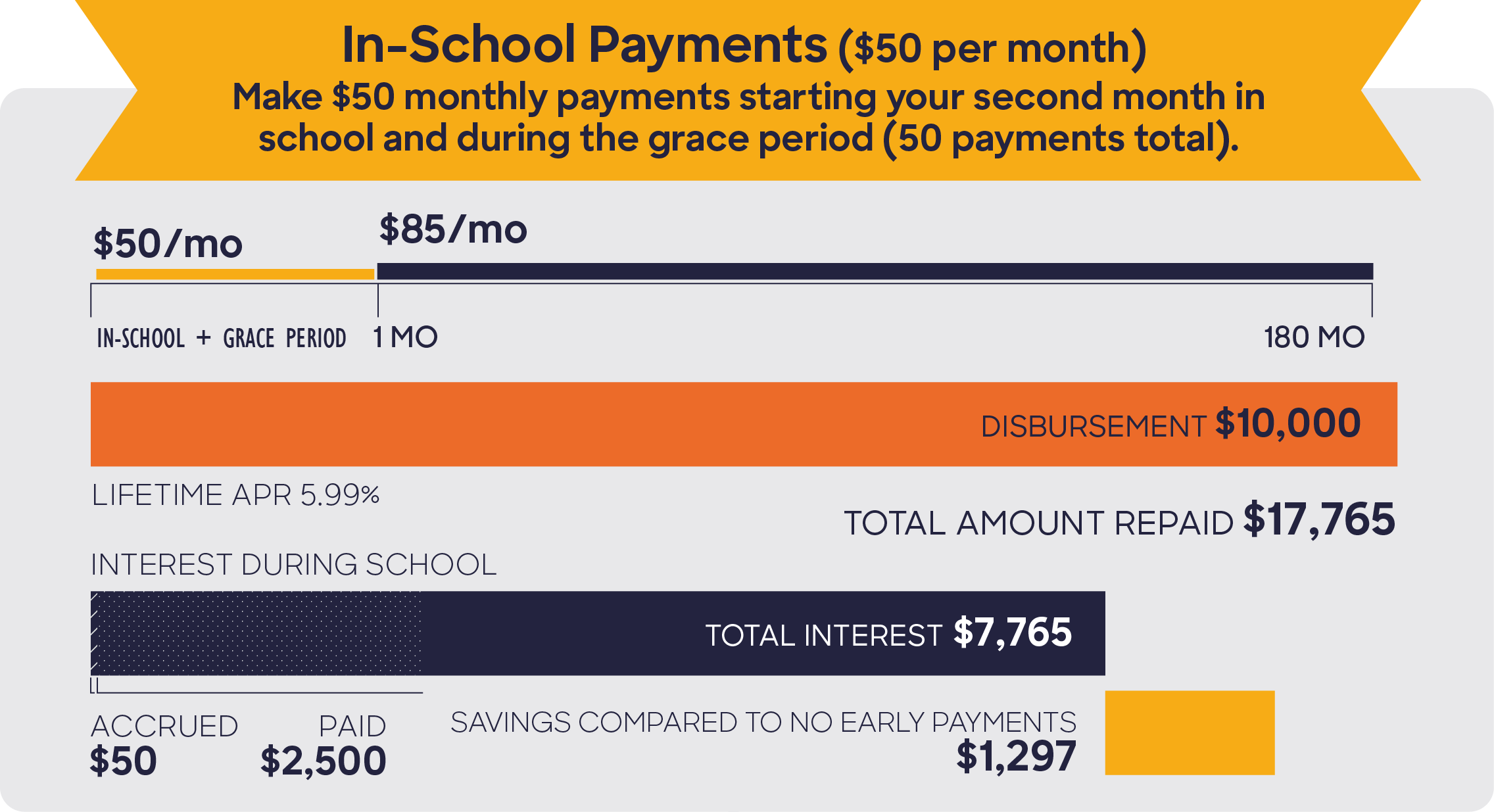

- Paying student loans while in school can help reduce the total cost of your loan.

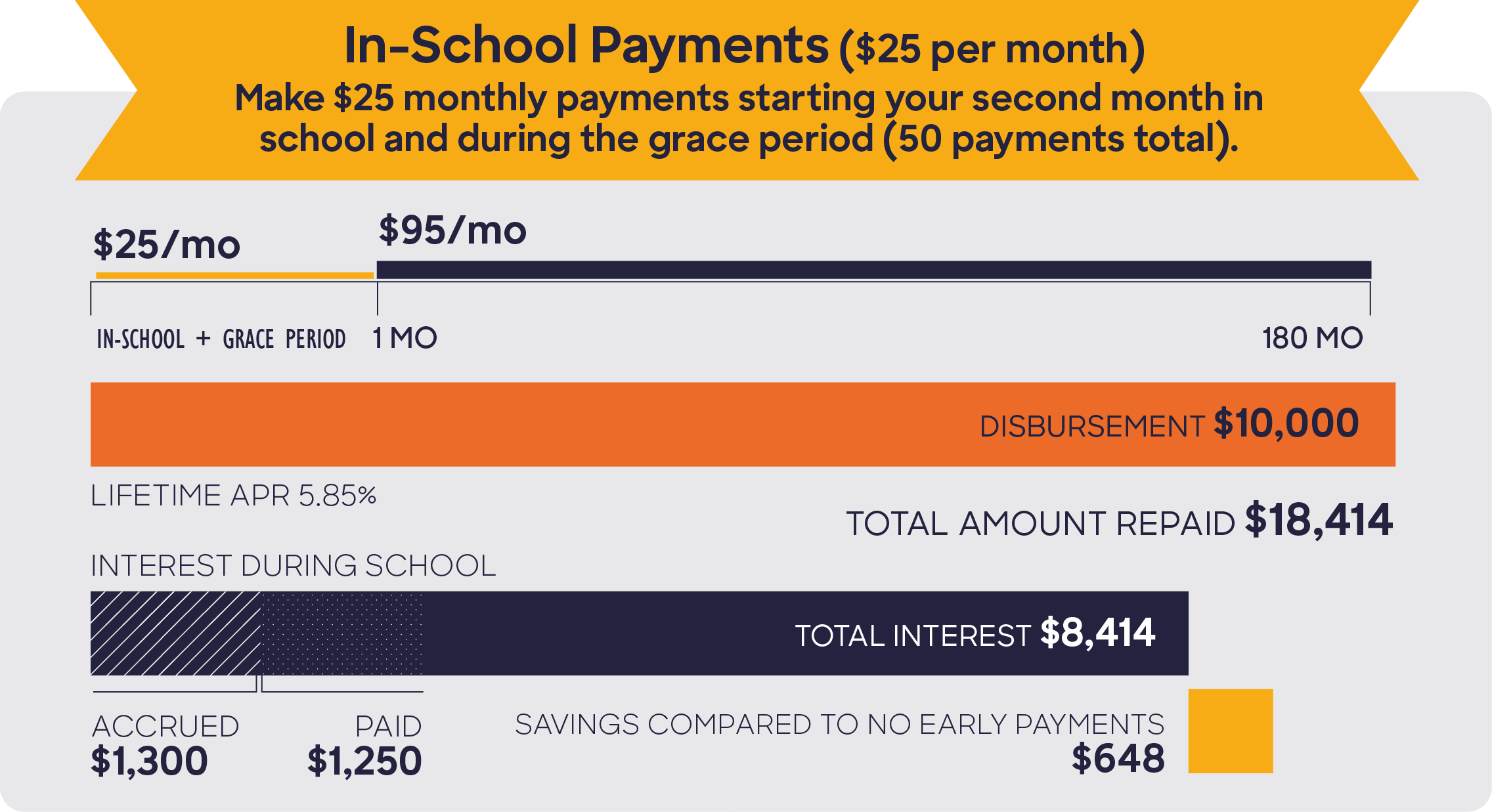

- Even a small payment of $25 per month can save you hundreds of dollars in interest.

- You can make early payments at any time without prepayment fees.

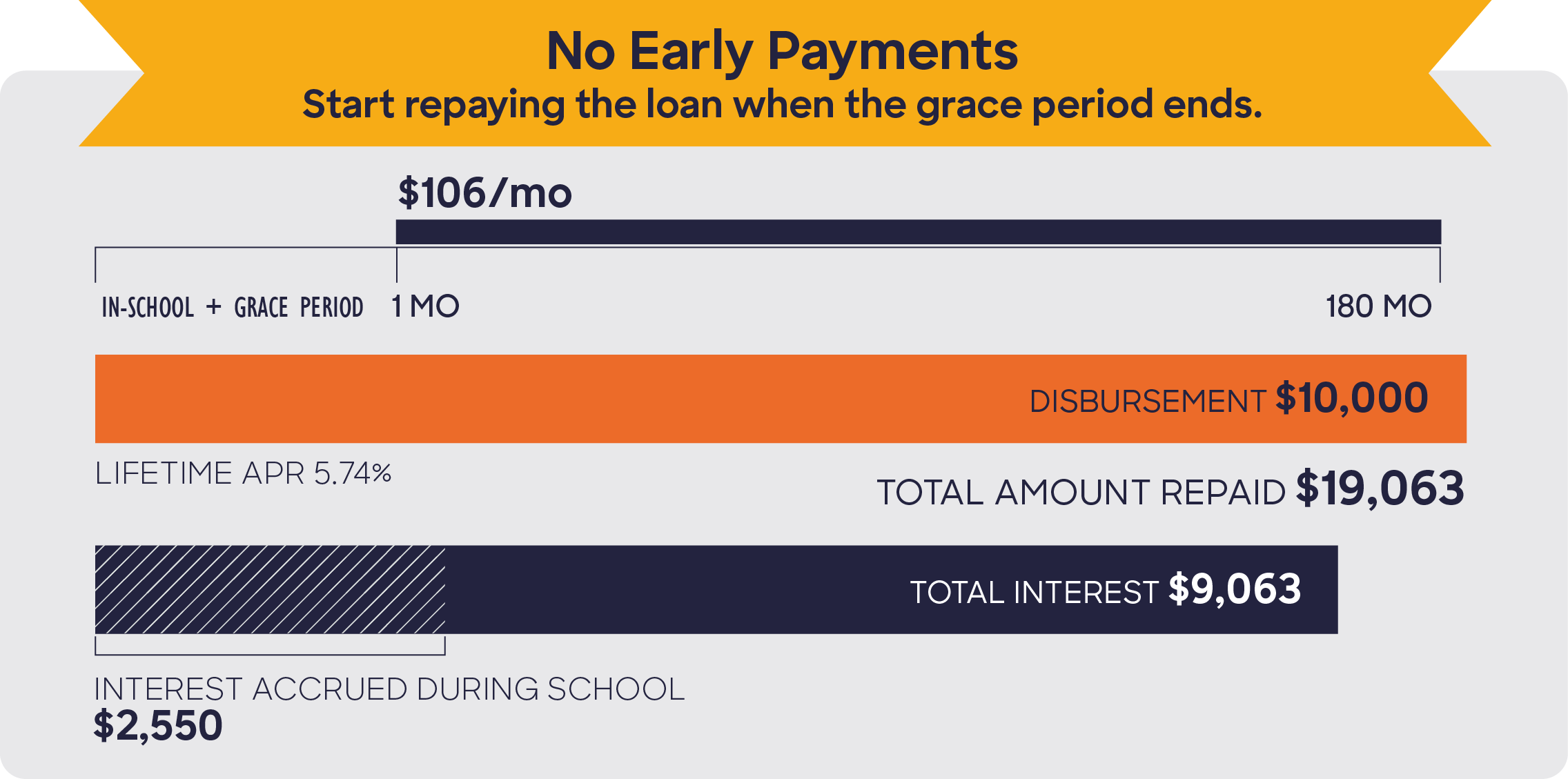

Most student loans have the option to defer repayments until after graduation. This can be a tempting choice for a student on a tight budget, but making even small monthly payments while in school can make a difference because it helps offset the interest that accrues.

Here's how making payments while enrolled in college and during the grace period can reduce your monthly payments and the total cost of your loan.

Imagine you take out a $10,000 undergraduate loan with the following terms:

- The private student loan has a fixed 6% interest rate.

- You graduate after 4 years, and the loan is deferred during your 45 months at school and for 6 months after graduation (your grace period). You don’t need to make payments during deferment, but interest still accrues.

- Once the grace period ends, a 180-month (15-year) repayment period begins.

Looking for ways to make extra money?

Check with your school’s career center for work opportunities and advice.

Consider a flexible part-time job while you’re studying. Join the gig economy by signing up with an on-demand service provider, work at a local restaurant, or tutor high school students.

If you’re offered a work-study award, check with your college for a list of participating employers and potential openings.

You could also work during the summer and use the savings to make early loan payments.

Use gift money, perhaps from your birthday or the holidays, to make early payments.

There is never a penalty for prepaying.

Examples do not include an interest rate reduction, such as a 0.25% reduction for automatic payments. Examples also assume that during the life of the loan, the account remains in good standing and does not have an additional deferment or a forbearance.