Updated: Oct 12, 2023

Article highlights

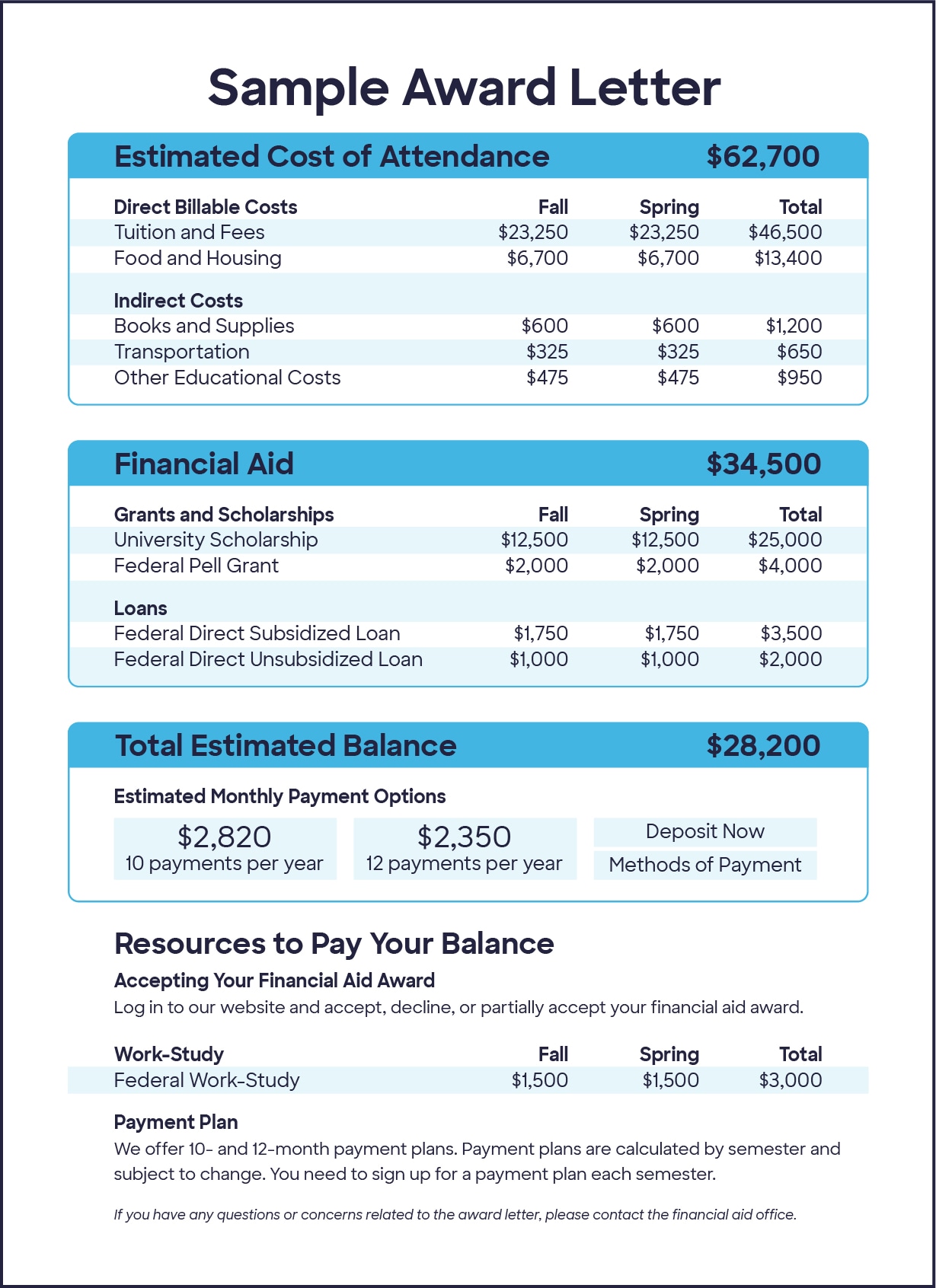

- Financial aid award letters can include grants and scholarships, Work-Study, and federal loans.

- Since different schools use different templates, it takes a little bit of work to compare financial aid award letters to figure out what’s best for you.

- Using the College Cost Comparison tool from Discover® Student Loans can help you compare financial aid packages.

College acceptance season is an exciting time. High school seniors across the country find out which colleges and universities are offering them a spot—and they start making decisions about where to attend. A big part of that decision-making is based on the financial aid award letters that students receive. These can sometimes bring stress and confusion since award letters can be difficult to decipher and vary from one school to another.

Financial aid award letters generally include grants, scholarships, Work-Study programs, federal student loans, and your Student Aid Index (SAI). Beginning with the 2024-25 academic year, the SAI will replace the Expected Family Contribution (EFC), but it serves the same purpose and reveals how much financial aid you’re eligible for. Because each school uses its own template for award letters, it can be challenging to compare them. But evaluating them doesn’t have to be complicated. Just follow these five steps.

Step 1: Understand the different types of financial aid

Your financial aid offer may contain a mix of different types of aid. It’s important to know the differences between these, since some will have to be paid back, while others will not.

Grants and scholarships

Financial aid that does not have to be repaid (also known as gift aid). Learn more.

Federal Work-Study

A part-time employment program funded by the government that allows students to earn money that can then be used to help pay for college. The wages are paid directly to the student and then used to pay for books and living expenses. Learn more.

Federal loans

These are loans that must be paid back. They’re designed to cover the gap between cost of attendance (COA) and other financial aid. Federal student loans are made by the federal government. If these aren’t enough to cover your costs, you may want to consider private student loans. These are made by banks and financial institutions and are not included in your award letter. (You’ll have to apply for them separately.)

Step 2: Carefully review each award letter

Here's what to do when you're ready to review financial aid award letters:

- Print all of your award letters and grab a highlighter or two.

- Carefully read each letter, highlighting each type of aid and the amount offered. You may want to use two different colors to highlight—one for loans that will need to be repaid and another color for scholarships and grants that do not need to be repaid.

Step 3: Compare financial aid award letters

Now that you have all the information in front of you, it’s time to compare your offers. There are tools, such as the College Cost Comparison Tool from Discover Student Loans, that can help guide you through this process. It’s important to understand and compare the costs of attending each school, the various types of aid you are being offered (free money versus money you have to pay back), and how much money each school expects you and your family to contribute toward your education. Consider the following:

Total college costs

When comparing the COA, take note of these numbers. They may not all be listed on every award letter, but it’s important to know the full cost associated with attending each school—so do a little digging if you have to for the following:

- Tuition and fees

- Room and board

- Travel/transportation

- Books and other expenses

Available financial aid

The next step is comparing the various types of financial aid being offered, such as:

- Grants

- Scholarships

- Work-Study

- Federal loans

Out-of-pocket costs

Your last step is to determine your net cost, which is the amount you’ll pay to attend one year at each school. The calculation for this is simple: it’s the cost of attendance minus the total amount of free money awarded to you in grants and scholarships. The difference shows you the amount you personally need to cover through savings, job earnings, or student loans.

Step 4: Find out how long the financial aid will last

Financial aid offers typically cover one year in school, so families must complete the FAFSA® (Free Application for Federal Student Aid) every year. Some forms of aid, like scholarships or grants, may be guaranteed for four years, though most are guaranteed for only one year at a time. Families should ask the college’s financial aid office about the likelihood of aid being extended and get the answers to their questions in writing.

Step 5: Research other funding sources

Students can and should continue applying for outside private scholarships throughout their time in college, since that is free money that doesn't have to be paid back. Leverage free online scholarship search tools to help you find them.

Keep in mind that when you compare financial aid award letters, costs aren't the only factor. You should also consider each school's location, academic rigor, graduation rate, employment rate, and campus culture. (A college campus visit can be really helpful.) The right school for you is the one that will give you the best combination of education and experience, while leaving you with a manageable amount of debt.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.