Managing the high cost of owning a dog

Here's how to handle many of the possible expenses your dog could incur.

When Craig Hynd and his fiancée brought home their new Lhasa Apso puppy Chewie, they knew the addition to their family would be worth it—but they didn’t quite understand the true cost of owning a dog. As new homeowners, “we didn’t have a lot of money to spare on a month-to-month basis,” Hynd says, “but we also love dogs and felt that we could afford to bring one into our home.”

To make sure they were financially on the mark, Hynd, a marketing executive, decided to do some research on how to afford a dog on a budget, shortly after Chewie settled in. He was glad he did: He found that the costs of dog ownership added up to much more than he originally anticipated. Fortunately, there was still time for him to adjust.

But Hynd’s foresight is not always top of mind for new dog owners. Getting a dog can be an emotional, knee-jerk decision, and you may not think about the expenses that go along with it or how to budget for a dog. The cost of owning a dog over the average lifespan of 12 years ranges from $20,000 to $55,000.1 The majority of dog owners underestimate this figure. That’s the kind of misunderstanding that can leave you short on funds for things such as vaccinations and preventative care—even food and toys.

So when asking yourself the question, “How much money should I budget for a dog?”, you’ll be glad to know that a little financial preparation can go a long way toward making sure you’re ready for the responsibilities that come with pet ownership. The information that follows can help you and your new pooch share a happy, healthy friendship for years to come.

Welcome home: First-year costs for your pup

“Before getting my dog, I made sure to save as much money as possible,” says Danielle Mühlenberg, a professional dog trainer and blogger. Mühlenberg paid $1,300 for her 115-pound rottweiler Amalia. A safe approach when thinking about how to budget for a dog is to “always put away more money than you’ve calculated in your budget, so you won’t be overwhelmed by any surprise costs,” she adds.

Mühlenberg outlines the first-year expenses new dog owners should expect as they resolve how to afford a dog on a budget and some suggestions on managing costs:

Purchase/adoption fees and dog license

The adoption of a puppy can cost anywhere from $0 to $700 depending on the breed. You will also need a dog license to bring home your pup, which costs about $151 (and needs to be renewed annually).

- Pro Tip: Once you bring your tail-wagger home from the shelter or breeder, research local vets. Offices in one neighborhood or town can be much pricier than what you’d find if you’re open to a commute.

Upfront medical costs

It can cost between $200 and $800 to spay or neuter a dog at a veterinary clinic.1 You can typically pay less at a shelter or humane society, where such procedures are often subsidized by donations. In other costs, puppies need an initial exam and special vaccinations that typically run between $70 and $3001 (rabies is the only shot required by law, however). Microchipping, while not mandatory, is recommended to help identify your pet if it’s lost or stolen. This procedure costs around $20.1

- Pro Tip: Plan to have your dog spayed or neutered. Otherwise, you may pay higher boarding fees and license fees, as well as release fees if your pup is taken in by animal control.

Comfort, training, and grooming supplies

Expect to spend another few hundred dollars for a collar and leash ($15 to $170), food bowls ($5 to $75), waste bags ($10 to $45), a crate and bed ($45 to $950), doggie shampoo and brushes ($15 to $40), training pads ($20 to $80), toys ($5 to $80), and the first month’s supply of food ($25 to $325).2

- Pro Tip: Supplies like a dog crate or bowl can be found secondhand for a lower cost, sometimes for free. Check online listings for yard sales and giveaway events, where used or unwanted items are given away instead of being sold or thrown away.

Lost time at work

A new puppy needs a lot of attention, which can add to the cost of owning a dog. Dog owners may need to take time off from work to care for a new puppy. Some puppies have a harder time on their own and can chew up your home and belongings, so it’s worth knowing this upfront in case your pup needs a sitter.

- Pro Tip: Prepare for “puppydom” ahead of time by banking extra personal days or asking about short-term, work-from-home opportunities.

Ongoing expenses for your furry companion

Annual, ongoing costs of owning a dog can vary widely depending on your situation. Why the disparity? It’s due mainly to dog size. For instance, larger dogs eat more food, and if you’re the type of owner that chooses premium kibble over a lower-cost option, that can really add up. Groomers also charge more for larger dogs because of the extra time and care needed to handle them.

Mühlenberg spends about $1,200 per year on her Rottweiler’s high-end food and another $600 annually for twice-weekly social training sessions. A pricey diet and puppy play camp may fall in the “nice to have” category of dog ownership for some. Dog owners worried about how to afford a dog on a budget can minimize these costs by choosing less expensive canned food and kibble or by making their own dog food. To save on other expenses, Müehlenberg grooms her dog at home, makes her own toys and treats and buys pet supplies in bulk.

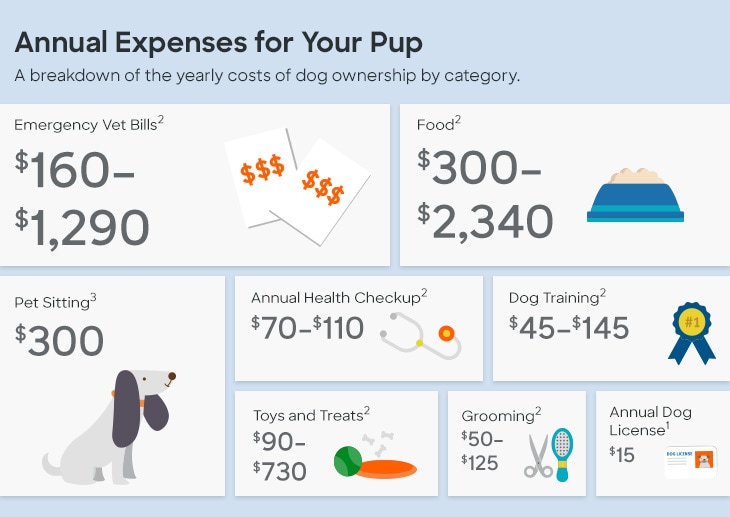

To get a handle on how to budget for a dog, here are some of the biggest costs annually that dog owners need to plan for:

To help relieve the financial burden of how to afford a dog on a budget, you may want to open a savings account for emergencies. Mühlenberg puts a few hundred dollars aside each month, which can be tapped for unplanned household repairs due to any damage the dog may cause, dog sitting for unexpected travel or illness or other pup-related surprises. A high-yield savings account is one place to hold cash for a dog-only emergency fund and grow your savings.

Invest in keeping your pooch healthy

As you can see, there are a lot of annual costs to consider when determining how to afford a dog on a budget—and they can really add up, particularly when a pooch gets sick or is involved in an accident. Preventative care such as flea, tick, and heartworm medication, which can cost a total of $64 to $320 monthly, and regular vet visits can decrease the risk of an expensive health condition.3

For larger or recurring costs, consider pet insurance (an annual policy costs about $360 to $720).2 Some unexpected expenses can be offset by a pet insurance policy, which “is kind of like a forced savings account,” says Sara Ochoa, DVM and veterinary consultant for a dog product review site. “You pay the insurance company, and they will pay for most of your pet’s medical bills.” This might go a long way in resolving how to budget for a dog.

For example, a typical pet insurance policy may cover accidents, illness, and conditions that are genetic, congenital, and chronic, as long as these conditions were not present at the time the policy was purchased.4

“Always put away more money than you’ve calculated in your budget, so you won’t be overwhelmed by any surprise costs.”

Ochoa is often able to witness the financial benefits of pet insurance firsthand. She cites one example of a client whose dog had emergency surgery and spent a few nights in the hospital. According to Ochoa, the bill would have cost the owner around $7,000. With their pet insurance, they paid somewhere around $1,000.

Create a happy home for your four-legged friend

In the end, how to budget for a dog just takes some advance planning and preparation, which can help manage the upfront costs and monthly cash cushion required to ensure a happy and healthy dog. By understanding the cost of owning a dog as much as possible, you’ll have less financial stress and more time to focus on play time with your pup.

“Even with the associated costs,” Hynd says, “I don’t for one moment regret our decision [to bring Chewie home].” Mühlenberg agrees: “Bringing a dog into my life has always been a goal and dream of mine. The love and affection you receive back from a dog are priceless.”

Sources:

1“The True Cost of Owning a Dog or Cat,” Credit.com

2“The Cost of Dog Parenthood in 2023,” Rover.com

3“The True Cost of Getting a Puppy,” Rover.com

4“Pet Insurance Coverage: What You Need to Know,” ConsumersAdvocate.org

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.

The information provided herein is for informational purposes only and is not intended to be construed as professional advice. Nothing contained in this article shall give rise to, or be construed to give rise to, any obligation or liability whatsoever on the part of Discover, a division of Capital One, N.A., or its affiliates.