There's no annual fee for any Discover Card.

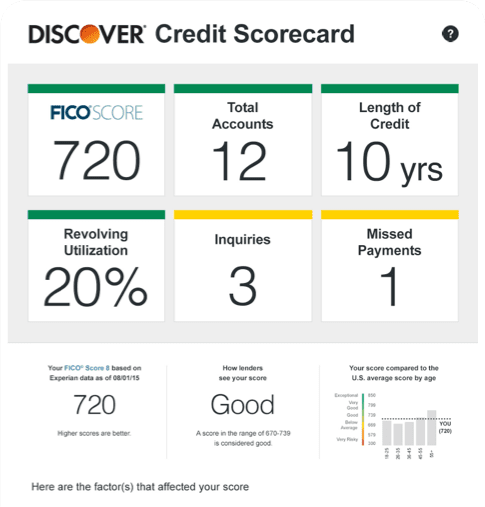

Free Credit Score with a Discover® Card

See if you're pre-approved for a Discover Card

It's fast, easy, and doesn't harm your credit score to check if you’re pre-approved. If you accept a pre-approval offer, we'll help you apply.9

You earn rewards, we match it all at the end of your first year

We automatically match all of the cash back or Miles that you've earned at the end of your first year. There is no limit to how much we'll match.2

If you earn $150 cash back, we’ll give you another $150.

If you earn 35,000 Miles, we’ll give you another 35,000 Miles.

Plus, you'll earn rewards on every purchase and your rewards never expire.3

Which Discover Card design fits your style?

Choose from colorful card designs when you apply to become a card member. Go ahead, express yourself.

Frequently asked questions

While cards with no annual fee can lower the cost of using your card, these credit cards will charge interest and could have other types of fees. When you pay your balance on time and in full at each billing statement, you may be able to avoid paying interest on purchases and reduce the cost of using credit.

So while there’s no extra charge each year with a no annual fee credit card, any interest charges on your account are a cost of using credit.

No, there's no limit to how much we'll Match.

FICO® scores are three-digit numbers that are calculated based on the information from your credit report. Lenders use FICO scores to assess how risky you are as a borrower, and your score can influence whether you're approved for credit such as credit cards, mortgages and car loans. Your FICO score also affects what interest rate you'll be offered.

No. The FICO® Score and other credit information we provide will never hurt your credit score. In fact, you can check as often as you like – it will never affect your score. Check back every 30 days to see a refreshed score.

Using credit responsibly can improve your FICO score. When you want to raise your credit score, it helps to make payments on time, pay your balance in full, and to use a small percentage of your available credit.

We want you to check your Credit Scorecard without worry, which is why we offer it for free.

Nearly all lenders in the US, including Discover, use a FICO® Score among other information when they make their credit decisions, and they have for more than 20 years. We think that everyone should be informed about their credit so that they can avoid surprises.

We monitor thousands of sites on the Dark Web–a hidden area of the Internet where stolen Social Security numbers can be traded or sold for the purposes of identity theft and fraud. If we find your Social Security number, we’ll send you an alert so you can take action.

We also monitor your Experian credit report and notify you whenever any new credit inquiry or new account is reported. In most cases, you will probably recognize it as an account you opened. However, if you don’t recognize the account, you can contact Experian for assistance.

Learn more about credit scores and credit cards

Learn about credit score ranges from our credit score chart, and what you could do to help you move to a better credit score range.

Learn what a credit score is, factors that determine your credit score, and how your credit score rating affects your interest rate and other credit terms.

Learn how to use credit cards responsibly, and how using your credit card properly can help you build your credit history and earn rewards.

Cash Back Credit Cards: Discover it® Cash Back, Gas &Restaurant Card, NHL® Discover it®

Travel Credit Card: Discover it® Miles

Student Credit Cards: Discover it Student® Cash Back, Student Chrome Card

Secured Credit Card: Discover it® Secured credit card

Cash Back Credit Cards

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Travel Credit Card

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% variable to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Student Credit Cards

Intro purchase APR is x% for x months from date of account opening then the standard purchase APR applies. Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Standard purchase APR: x% to x% variable, based on your creditworthiness. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50. Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

Secured Credit Card

x% standard variable purchase APR . Intro Balance Transfer APR is x% for x months from date of first transfer, for transfers under this offer that post to your account by x then the standard purchase APR applies. Cash APR: x% variable. Variable APRs will vary with the market based on the Prime Rate. Minimum interest charge: If you are charged interest, the charge will be no less than $.50 . Cash advance fee: Either $10 or 5% of the amount of each cash advance, whichever is greater. Balance transfer fee: x% Intro fee on balances transferred by x and up to x% fee for future balance transfers will apply. Annual Fee: None. Rates as of . We will apply payments at our discretion, including in a manner most favorable or convenient for us. Each billing period, we will generally apply amounts you pay that exceed the Minimum Payment Due to balances with higher APRs before balances with lower APRs as of the date we credit your payment.

NHL and the NHL Shield are registered trademarks of the National Hockey League. NHL and NHL team marks are the property of the NHL and its teams. © NHL 2024. All Rights Reserved.

-

FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com and cardmembers are also provided a score on statements. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

If you prefer not to receive your FICO® Credit Score just call us at 1-800-DISCOVER (1-800-347-2683). Please give us two billing cycles to process your request.

-

Cashback Match: We’ll match all the cash back you’ve earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You earn cash back only when they’re processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; or rewards transfers from Discover checking or other deposit accounts. Your account must be open and in good standing to receive your Cashback Match. This offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

Discover Match®: We’ll match all the Miles you’ve earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You earn Miles only when they’re processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; or rewards transfers from Discover checking or other deposit accounts. Your account must be open and in good standing to receive your Discover Match®. This offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

-

Rewards Redemption: Rewards never expire. We reserve the right to determine the method to disburse your rewards balance. We will credit your Account or send you a check with your rewards balance if your Account is closed. You may be unable to redeem rewards in some limited situations such as when you choose to use an electronic funds transfer to redeem rewards to a new (unverified) deposit account. Any gift card must have a minimum value of at least $5.00 to be redeemed.

-

Discover® Identity Alerts (Alerts) are offered by Discover, a division of Capital One, N.A., at no cost, are available only online, and do not impact your credit score. The Alerts currently provide: (a) daily monitoring of your Experian® credit report and an alert when a new inquiry or account is listed on your report; (b) daily monitoring of thousands of Dark Web sites known for revealing personal information and an alert if your Social Security Number is found on such a website. Alerts are only provided to Primary cardmembers who agree to receive them online and whose accounts are open, in good standing, have a Social Security Number, and an email address on file. This benefit may change or end in the future. Discover is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. To see a list of Frequently Asked Questions, visit discover.com/freealerts.

-

Freeze it®: When you freeze your account, Discover will not authorize new purchases, cash advances or balance transfers (including checks). However, some activity will continue including charges from merchants where your card is stored or billed regularly, as well as returns, credits, dispute adjustments, delayed authorizations (such as some transit purchases), payments, Discover protection product fees, other account fees, interest, rewards redemptions and certain other exempted transactions.

-

$0 Fraud Liability: An “unauthorized purchase” is a purchase where you have not given access to your card information to another person or a merchant for one-time or repeated charges. Please use reasonable care to protect your card and do not share it with employees, relatives, or friends. Learn more at Discover.com/fraudFAQ.

-

Free Overnight Card Replacement: Free overnight shipping is not available to P.O. boxes or addresses outside the U.S. Carrier overnight shipping limitations apply that may impact the exact delivery date.

-

Real human customer service 24/7: You can reach a live agent any time by calling 1-800-Discover (1-800-347-2683). Certain specialized customer service agents may not be available 24/7.

-

There is no hard inquiry to your credit report to check if you’re pre-approved. If you’re pre-approved, and you move forward with submitting an application for the credit card, it will result in a hard inquiry which may impact your credit score. Receiving a pre-approval offer does not guarantee approval. Applicants applying without a social security number are not eligible to receive pre-approval offers. Card applicants cannot be pre-approved for the NHL Discover Card.