When you apply for credit, whether for credit cards, an auto loan, or even a home mortgage, one factor may come up again and again—your credit score. This three-digit figure can have a significant impact on your financial life. High scores may help you qualify for lower interest rates, better loan terms, and more credit options, while low scores can prevent you from obtaining credit at all.

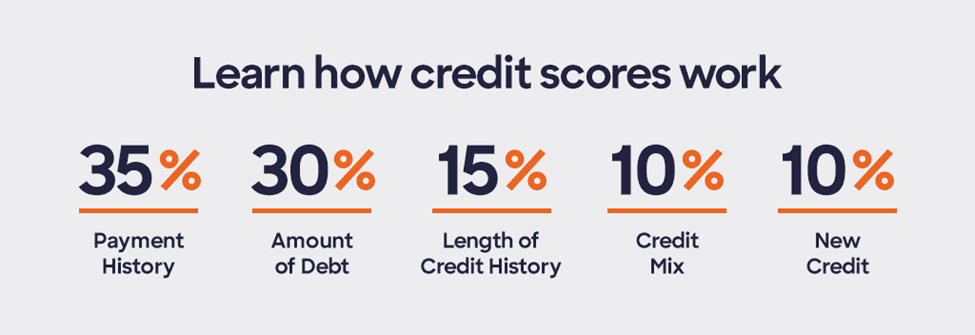

By understanding how your credit score is calculated, you can take actions that may help your score and avoid the missteps that can hurt it.