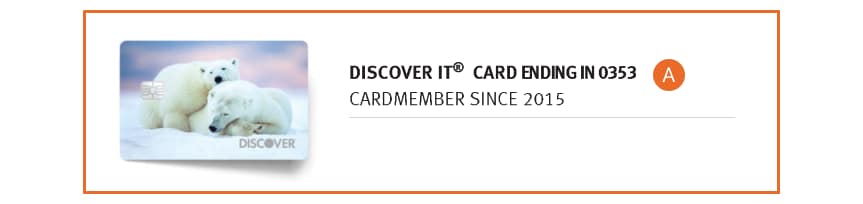

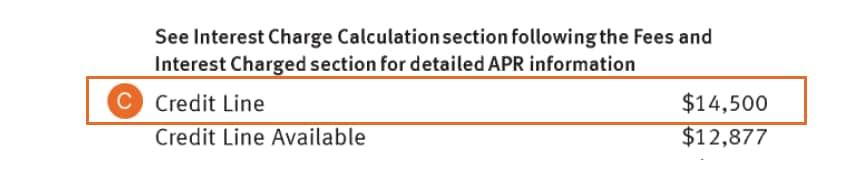

Every month, your credit card statement arrives in the mail or email. You might think the only thing you need it for is to find the minimum amount you owe to keep your account up to date. But there’s a lot you can learn from the different sections of your statement.

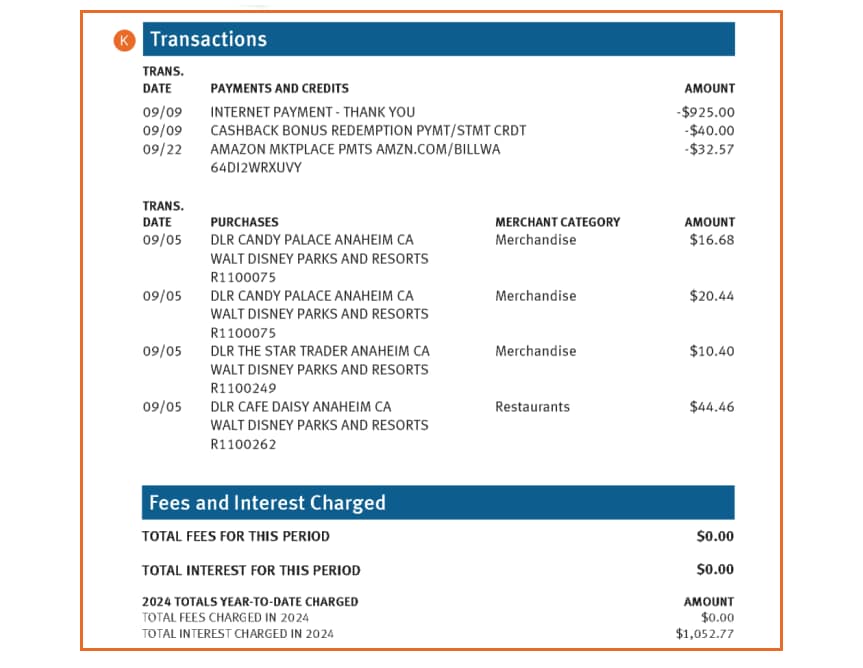

Your monthly statement isn’t just about paying your bills. It can help you balance your budget and ensure there are no errors or fraudulent charges.

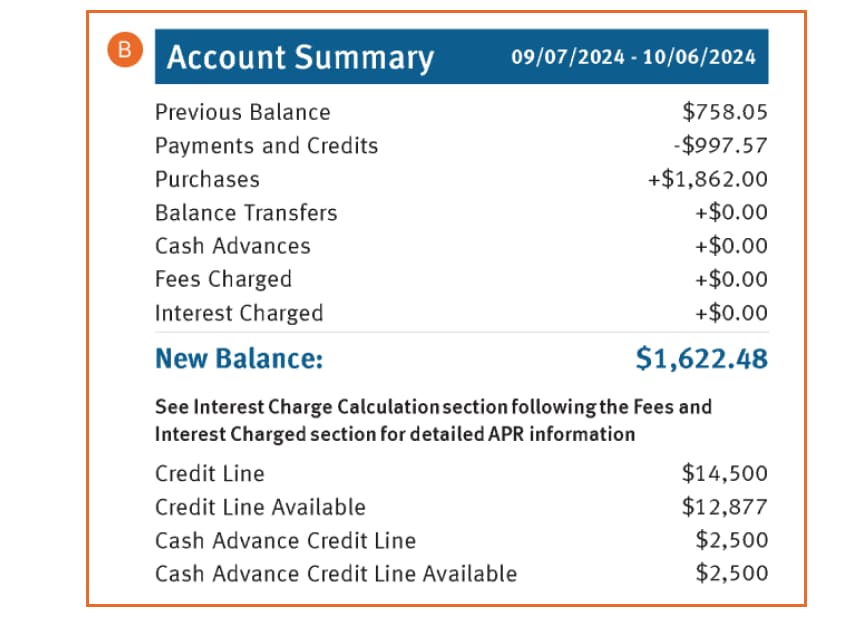

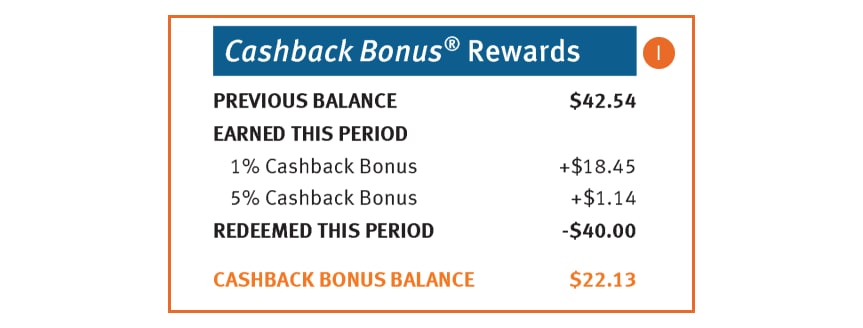

When you review each section of your monthly credit card statement, you can understand where you spend the most money (groceries, eating out, clothing, impulse buys) and better manage your account and spending.

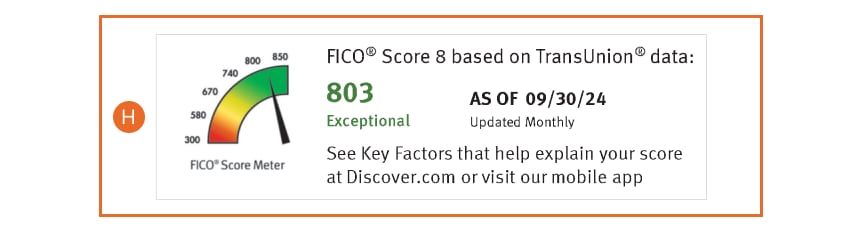

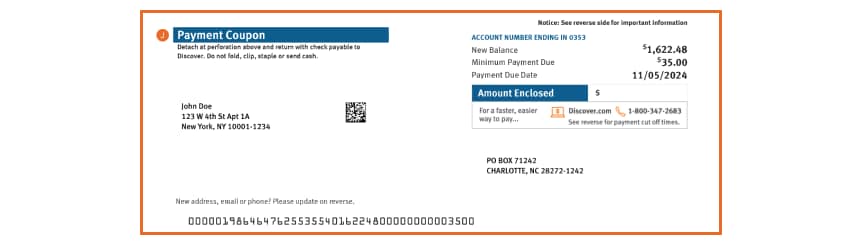

But how do you navigate a credit card statement? Our easy-to-read guide has key points about reading your credit card statement. You can learn how to locate transactions, payments, your credit score, and more.

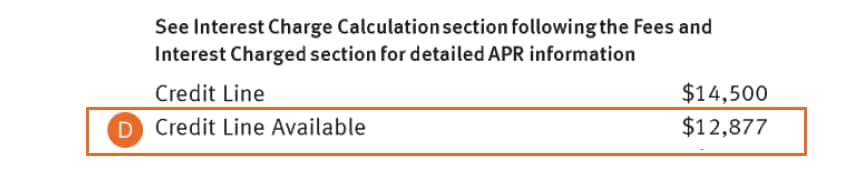

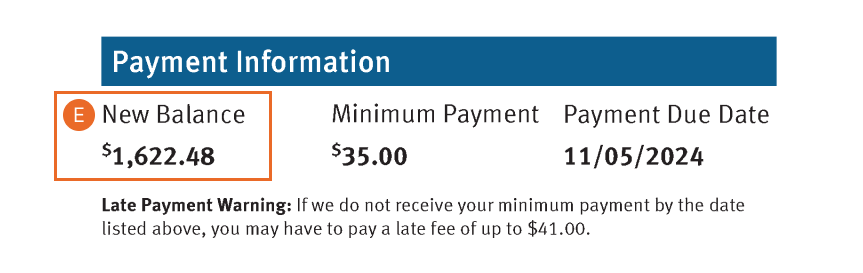

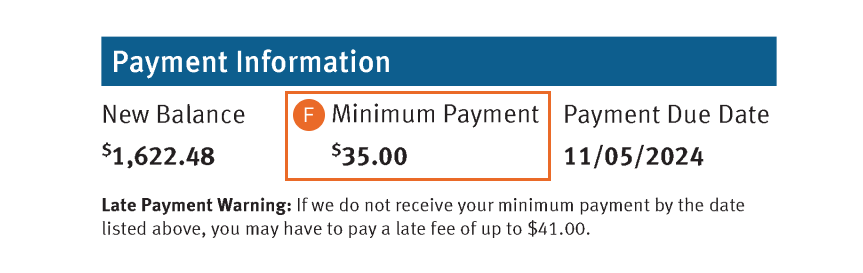

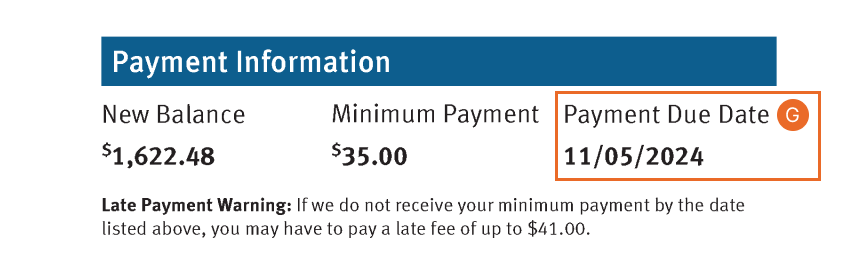

Using a Discover® credit card statement, we’ll also help you decode the terminology, numbers, and interest rates that make up your statement. While not all statements look the same, most include basics like account information, payment due date, transaction history, and credit limit information.