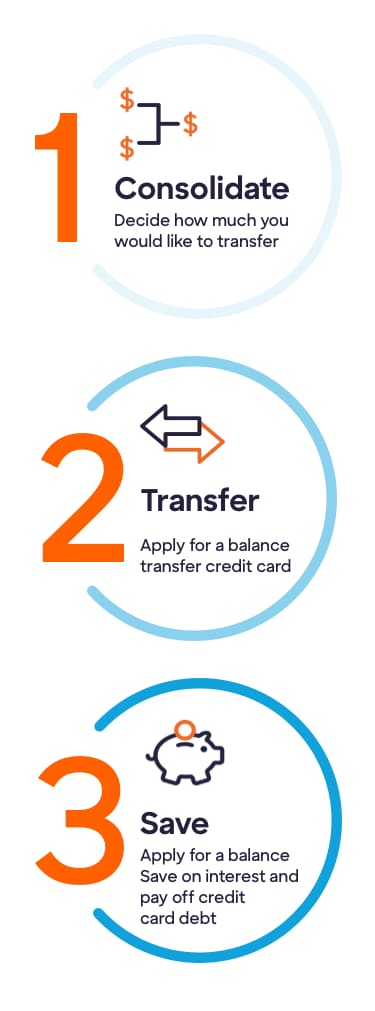

Tackling high-interest credit card balances may feel like an uphill battle. As interest piles up, keeping up with payments can become more difficult, and the amount you owe can grow by the day. Juggling balances across several cards may be even more difficult to manage. A credit card balance transfer is one strategy for achieving some relief. This approach involves moving your existing debt to a new credit card that offers a lower interest rate, potentially saving you money and simplifying your payments. We’ll discuss the ins and outs of credit card balance transfers and guide you through selecting the best credit card for your balance transfer needs.