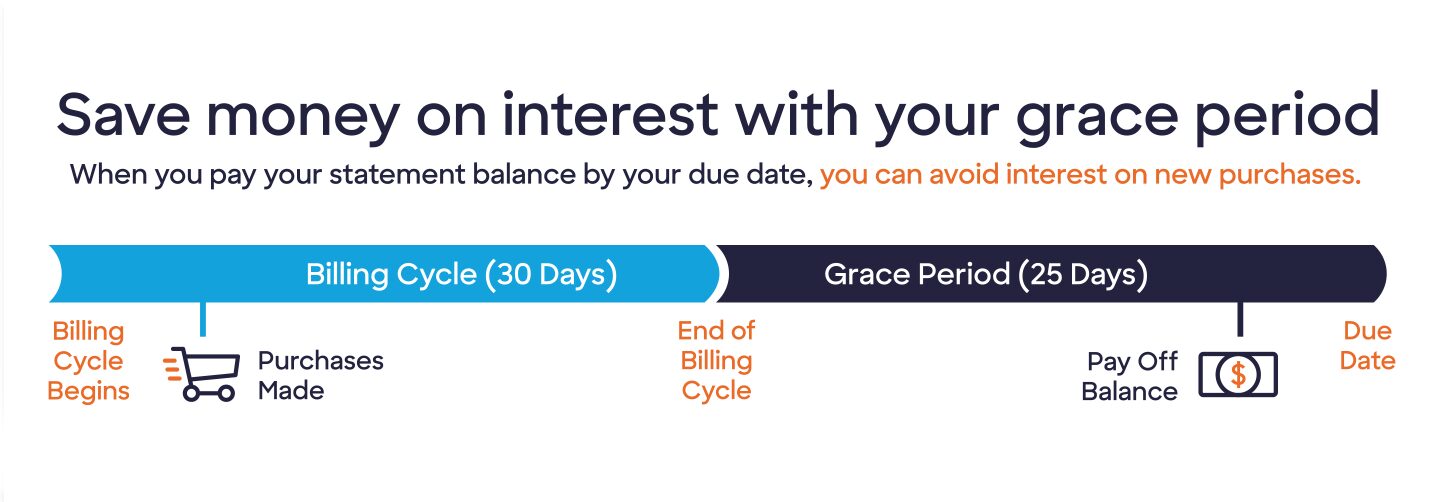

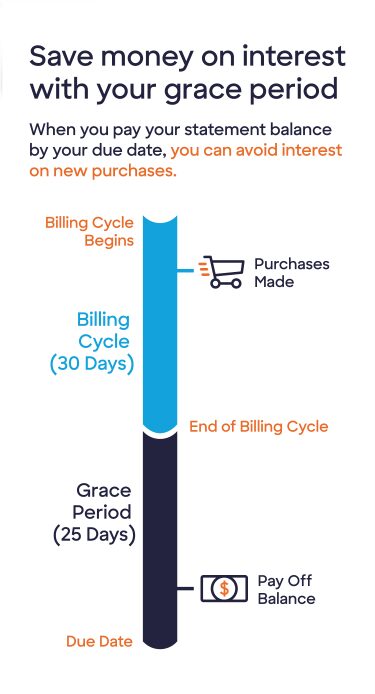

You may more easily manage major purchases, like last-minute airline tickets or new appliances, when you break them down into multiple monthly payments with your credit card. But credit card debt might cost you in the long run, as credit card issuers typically charge interest on any balance you carry from month to month. If you’re not careful, interest charges may pile up quickly and drastically increase the amount you owe. However, with the right strategies, you may manage interest effectively and avoid excess credit card debt.

How to Avoid Interest on a Credit Card

7 min read

Last Updated: November 6, 2025

Next steps

See if you're pre-approved

Learn about Discover It® Cash Back Credit Card

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?