How to prepare for the end of unemployment benefits

If you’re nearing the end of unemployment benefits, don’t worry. Here are your options for what to do when your unemployment runs out.

When you lose a job, finding yourself suddenly out of work can be disconcerting. After all, your bills and expenses don’t stop just because your work does. Unemployment benefits can offer an essential lifeline that can help you to stay financially afloat.

But if you’ve never accessed these benefits before, you may have questions about how they work. You might also be asking: What do I do when my unemployment benefits run out and I’m still unemployed?

This article1 offers tips about what you need to know about filing an unemployment claim. It also addresses the following questions:

- How do you prepare for the end of unemployment benefits?

- Can my unemployment benefits be extended?

- What can you do when unemployment runs out?

- Can you refile for unemployment after it runs out?

If you’re just getting ready to file or need a refresher on the basics of unemployment benefits, read on to have your questions answered.

If you’re already collecting benefits and want to know what happens once you reach the end of the benefit period, skip ahead to “Steps to take before your unemployment benefits run out.”

Common questions about unemployment benefits

Experiencing a job loss is challenging no matter what. Keep in mind that you’re not alone, and remember that unemployment benefits were created to help you.

While they’re designed to provide financial relief, unemployment benefits are not always easy to navigate. Here’s what you need to know to understand how unemployment benefits work:

What are unemployment benefits?

Unemployment insurance provides people who have lost their job with temporary income while they find another job. The amount provided and time period the benefits last may vary by state. States have their own way of coming up with the amount they will extend to those who are unemployed, but all look at your previous wages to determine the benefit amount—and most offer the benefits for 26 weeks or until you land another full-time job, whichever comes first. Requirements and eligibility may vary, so be sure to check your state’s unemployment agency for guidance.

How do you apply for unemployment benefits?

Depending on where you live, claims may be filed in person, by phone, or online. Check your state government’s website for details.

Who can file an unemployment claim?

This also may vary from state to state, but eligibility typically requires that you lost your job or were furloughed through no fault of your own, in addition to meeting work and wage requirements.

When should you apply for unemployment benefits?

Short answer: As soon as possible after you lose your job. “If you are someone who has had steady W2 work, it’s important that you file for unemployment the moment you lose work,” says Julia Simon-Mishel, an unemployment compensation attorney. The longer you wait to file, the longer you’re likely to wait to get paid.

When do you receive unemployment benefits?

Generally, if you are eligible, you can expect to receive your first benefit check two to three weeks after you file your claim. Of course, this may differ based on your state or if there’s a surge of people filing claims.

Steps to take before your unemployment benefits run out

In a perfect world, your job leads would become offers long before you reached the end of your unemployment benefits. But in reality, that’s not always the case.

If you’re still unemployed but haven’t yet exhausted your benefits and extensions, you may want to prepare for the end of your unemployment benefits as early as possible so you don’t become overly stressed about money. Here are four tips to help you get through this time:

“It’s really important to keep on top of all the information out there right now and be aware of what benefits are available to you.”

Talk to service providers

Reaching out to your utility service providers like your gas, electric, or water company is one of the first steps John Schmoll, creator of a personal finance blog, suggests taking if you’re preparing for the end of unemployment benefits.

“A lot of times, either out of shame or just not knowing, people don’t contact service providers and let them know what their situation is,” Schmoll says. “[Contact them to] see what programs they have in place to help you reduce your spending, and basically save as much of that as possible to help stretch your budget even further.”

Save what you can

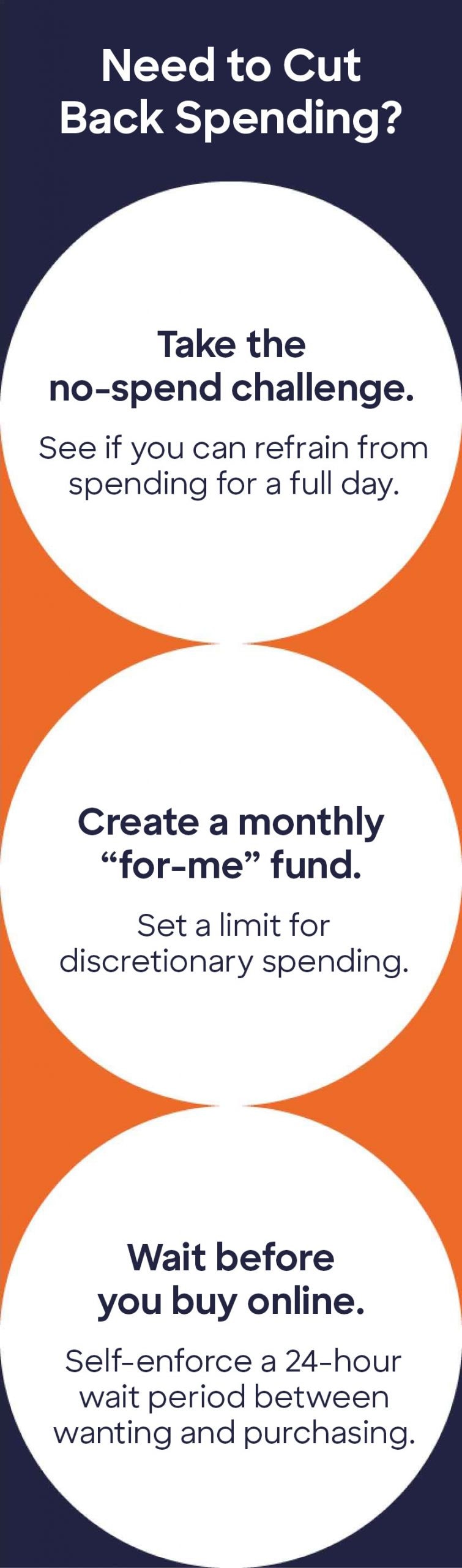

To help prepare for the end of your unemployment benefits, a few months before your benefits end, Schmoll suggests cutting back spending as much as possible, focusing only on necessities.

“If you can try and save something out of the benefits that you’re receiving while you’re receiving them—it doesn’t matter if it’s $10 or $20—that’s going to help provide some cushion,” Schmoll says. Having multiple savings accounts, and keeping those funds separate if you can, might help you avoid the temptation to spend them. That way you’re more prepared in case of an emergency.

If you hunkered down during your period of unemployment and were able to save, try to resist the urge to splurge on things that aren’t necessary.

“There might be temptation to overspend, but curtail that and focus on true necessities,” Schmoll says. “That way when [or if] you receive an extension on your benefits, you now have that extra money saved.”

Seek additional financial aid

If you find that your savings and benefits aren’t covering your expenses, and you’re reaching a point where you no longer qualify for benefits, look into other new benefit programs or features designed to help during times of crisis.

For example, there are programs across the country to assist people with rent or mortgages, Simon-Mishel says. Those programs are generally designed to keep those facing financial hardship from losing their home or apartment. You may need to show that you are within the programs’ income limits to qualify or demonstrate that your rent is more than 30 percent of your income. These programs vary widely at the state and even city level, so check your local government website to see what might be available to you.

As you prepare for the end of your unemployment benefits, explore which government benefits or government agency may be best suited for your needs.

Keep up with the news

During economic downturns, government programs and funds often change to keep up with evolving demand.

“It’s really important to keep on top of all the information out there right now and be aware of what benefits are available to you,” says Simon-Mishel. “You should closely pay attention to the social media of your state unemployment agency and local news about other extension programs that might be added and that you might be eligible for.”

Options for extending your unemployment benefits

If you’re currently receiving benefits, but they’ll be ending soon, you’re likely wondering what to do when your unemployment runs out and asking if your unemployment benefits can be extended. Start by confirming when you first filed your claim because that will determine your benefit end date.

If you’re wondering, “Can you refile for unemployment after it runs out?” the answer is yes, but most states make claimants wait until the current benefit year expires. Note that a benefit year is 12 months from when you file a claim. If you filed at the beginning of June, for example, you generally can’t file again until the beginning of the following June.

You may get up to 26 weeks of unemployment benefits, depending on your state’s rules at the time. Check your state’s website for the particulars on what to do when your unemployment runs out.

If your claim is still active but you’ll be in need of additional financial relief after your unemployment benefits run out, here are your options:

File for an unemployment extension

During extraordinary economic times, the federal government may pass legislation giving citizens additional economic aid, which might include extended unemployment benefits. Think: the CARES Act during the coronavirus pandemic.

For example, in 2020, for most workers who exhausted, or received all their unemployment benefits, a 13-week extension should’ve automatically kicked in, Simon-Mishel says. This would’ve given people up to 39 weeks total of unemployment benefits. However, if more than a year has passed since you originally filed and you need the extension, you will likely need to file a short application provided by the government. Details vary by state.

As you’re determining what to do when your unemployment runs out, reach out to your unemployment office. It’s important to do this before your benefits expire so you can avoid a missed payment. You can also confirm you’re eligible and that you can refile for unemployment after it runs out.

Ask about the Extended Benefits program in your state

Can unemployment benefits be extended beyond that? In periods of high unemployment, you may qualify for a second extension, depending on your state.

“After those [first] 13 weeks, many states have added a new program called Extended Benefits that can provide another 13 to 20 weeks of unemployment when a state is experiencing high unemployment,” Simon-Mishel adds. This means you may be able to receive a total of up to 59 weeks of unemployment benefits, including extensions. The total number of weeks of unemployment you may receive varies based on your state and the economic climate.

It’s hard enough keeping up with everything as you prepare for the end of unemployment benefits, so don’t worry if you don’t have your state’s benefits program memorized. Visit your state’s unemployment insurance program page to learn more about what benefits are available to you.

Beyond unemployment benefits

While life and your finances may seem rocky now, know that you’re not alone. Remember that there are resources available to help support you, and try to take things one day at a time, Schmoll says.

“Realize that at some point your current situation will improve,” he says.

If you find that your benefits aren’t covering all of your expenses, now may be the time to dip into your cash reserve. Explore these tips to determine when to use your emergency fund.

If you know a job loss is coming, there are things you can do to stay proactive. Here’s how to prepare your budget for a layoff.

1 This article is not legal advice and should not be construed as such. Eligibility for unemployment benefits may be impacted by variations in state programs, changes in programs, and your circumstances. If you have questions, you should consider consulting with your legal counsel, at your expense, or seek free assistance from your local legal aid organization.

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.