How much should I save each month?

10 tips to determine how much to put in savings each month—and how to make the most of your hard-earned money.

We all want to save money—or save more than we already do. But knowing exactly how much money you need to stash away for rainy days and retirement can be hard, as is figuring out how to go about it. Determining the right amount to save can also be challenging when you’re juggling multiple financial goals, like building an emergency fund, maxing out retirement accounts, or saving for a child’s education.

Nearly 9 in 10 Americans save regularly, and those who do typically set aside an average of $985 monthly, according to NerdWallet. What are their top savings motivations? More than half of Americans (53%) regularly save for emergencies, while 43% save for retirement, and 42% for vacations. While this sounds promising, the Federal Reserve’s 2022 Survey of Consumer Finances found that nearly half of all American households had no savings in retirement accounts.

If you have a monthly budget, chances are you wondered while creating it, “How much should I save each month?” The trick to calculating the right amount to save each month is understanding key factors about your finances, like how much money is regularly coming in and going out. To make meeting your savings goals easier, Erika Kullberg, founder of a personal finance website, shares insights into how much money you should save each month.

Determining how much to save each month

If you struggle with the question, “How much money should I save each month?” it’s time to do a financial analysis. When deciding how much to save, you should consider your income—your salary plus any other household earnings—as well as all fixed and variable expenses. Financial goals like building an emergency fund, saving for retirement, or planning for large purchases also play a vital role. If you have debt, you should also factor in those repayment obligations.

It can be challenging to balance these financial needs, especially with inflation and rising costs causing so much financial stress. But if putting money in a savings account regularly is a goal, the first step is to increase your awareness of your spending habits.

These 10 tips will help you be more mindful about how you save money and figure out a monthly savings amount that works for you.

1: Set specific financial goals

According to Kullberg, there’s no exact formula for saving enough to feel secure. But a good rule of thumb is to think about your financial goals and future needs, then work backward to set aside the money needed to support them.

“Having specific goals in mind is a great place to start when creating your savings plan,” she says. “Figuring out exactly what goes into your savings plan is the first step in saving the right amount. Whether you want to save for an emergency fund, retirement fund, or new house, nailing down the specifics—from what you’d like to save for to how long you expect it to take—comes first.”

Creating a simple budget designed to target financial goals is key.

2: Use a savings calculator

Kullberg also recommends turning to a savings calculator for help. “Savings calculators help you estimate how much you’ll need to put away each month to meet your savings targets,” she says.

3: Use the 50-20-30 rule

There’s no one right way to create a budget. But the 50-20-30 rule is a popular option: 50% of your income goes toward needs, 20% toward savings and investments, and 30% toward wants.

“It’s a useful budgeting rule of thumb to help you sustain saving money as a habit,” Kullberg explains. This method helps you create a sustainable budget—and one that isn’t so strict that you’ll get off course when spending temptations arise.

4: Calculate your ideal savings rate

If you’re struggling to meet your savings goals, create a goal-savings schedule. “Aim to save at least 15% to 20% of your gross income if possible,” Kullberg says. “And if it’s not, adjust this figure based on your financial needs and goals.”

5: Prioritize your debts

Having debt can really slow your savings progress. If you have debts to repay—particularly ones with high interest—prioritize reducing or paying those off before accelerating your savings routine. Every month you carry a debt balance is a month your hard-earned cash is going toward interest payments instead of your savings goals. “If you have high-interest debt you’re trying to pay off, it’s generally better to put more energy into paying down that debt,” Kullberg says. “High-interest charges could quickly counteract all your savings success.”

6: Figure out your emergency fund

“Once high-interest debt is paid off, you can concentrate more on savings—especially for your emergency fund, which should provide you with three to six months of living expenses in case the unexpected happens,” Kullberg says.

Build an emergency fund in a place where it can grow. A high interest rate savings account is a great spot to keep your money safe and accessible while taking advantage of the power of compound interest, which is when your money earns interest on both the original amount and the interest already earned.

“Figuring out exactly what goes into your savings plan is the first step in saving the right amount.”

7: Factor in retirement savings

When asking yourself, “How much should I put in savings each month?” don’t forget about your retirement plans. Although it’s tempting to push retirement savings to the back of your mind—you may have years to save, after all—doing so can be detrimental to your future financial health. “It’s important to start saving for retirement early because typically, the longer you save, the more compound interest will significantly amplify your retirement savings,” Kullberg shares.

Having a retirement budget in mind can help you determine how much money to set aside so you can enjoy your well-earned retirement. Putting your savings in a certificate of deposit (CD) can be a great way to grow your cash, as can investing it in a 401(k) or individual retirement account (IRA).

8: Set up savings accounts for your goals

If you don’t already have a savings account, open one now so you have somewhere safe to keep your funds. Even better—turn to a high interest rate savings account to earn as much interest as possible. And while having one savings account is a great start, feel free to open more if it helps you to stay organized while working toward different financial goals.

9: Let tech help with your financial plan

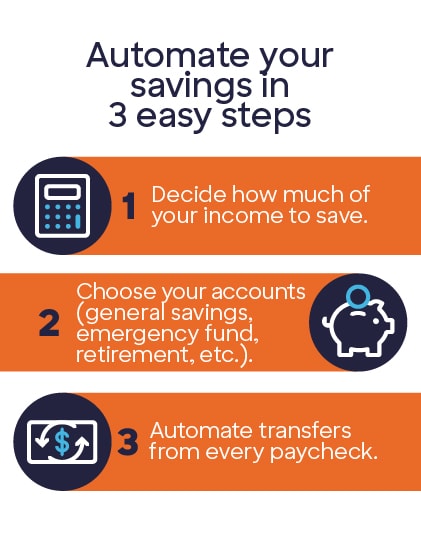

When using the strategies above to build a financial plan, consider letting technology do some of the heavy lifting. Saving money takes discipline, but you can make the task easier by automating your savings to ensure you’re setting aside a certain percentage of each paycheck or deposit.

“Automating transfers to separate savings accounts for your goals—such as home improvements, holidays, and emergencies—will help you to be disciplined and consistent,” Kullberg notes.

10: Review and adjust regularly

Creating financial goals and a corresponding budget, getting out of debt, and prioritizing your financial needs is hard work. Don’t let that effort go to waste by just setting and forgetting your plan. “Periodically reviewing and adjusting your budget is important,” Kullberg says. “Doing this helps you make sure your savings goals are realistic and in line with changing income or priorities.”

Finding the right amount to save each month doesn’t need to be a guessing game. By setting clear goals, following these strategies, and revisiting your financial plan regularly, you can strike the perfect balance between enjoying today and saving for tomorrow.

Articles may contain information from third parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third party or information.

The information provided herein is for informational purposes only and is not intended to be construed as professional advice. Nothing contained in this article shall give rise to, or be construed to give rise to, any obligation or liability whatsoever on the part of Discover, a division of Capital One, N.A., or its affiliates.