Key Takeaways

-

You can submit a credit limit increase online or over the phone.

-

An increased credit limit might increase your credit score and give you more flexibility in spending.

-

Responsible use of your existing credit may increase your odds of getting a higher limit.

Your credit limit is an important part of your financial history. If you want to expand your purchasing power or get a better credit score, a higher credit card limit could help you achieve your goals.

Before learning how to increase your credit limit, it’s important to understand what a credit limit is and how it’s determined.

Your credit limit is the maximum amount you can borrow on your credit card. Credit card issuers set the amount based on a few factors. This includes your credit history, credit score, income, housing expenses, and other personal information. If you have a good credit score and have used your credit responsibly, you may be eligible for a higher credit limit.

You may have lower credit limits if you have a limited credit history or lower credit. If that’s the case, you may want to consider a secured credit card. For example, the Discover it® Secured Credit Card helps you rebuild your credit history with responsible use.1

Reasons you might want a higher credit limit

There are a few reasons you may want to raise your credit limit:

- If you plan on using your credit cards to fund a large purchase

- If you anticipate making more purchases than usual within a certain period, such as a vacation

- If you want to reduce your credit utilization ratio

Your credit utilization ratio plays a significant role in determining your credit score. Because of this, if you can increase your total credit limit it might help reduce your credit utilization rate and raise your credit score.

A higher credit limit could pay off in other ways. If you use your increased credit line responsibly, you could:

- Increase your purchasing power

- Get better credit card offers

- Receive lower interest rates

- Have new financial opportunities like a personal loan or mortgage

- Increase the amount of rewards you can earn through your credit card reward program

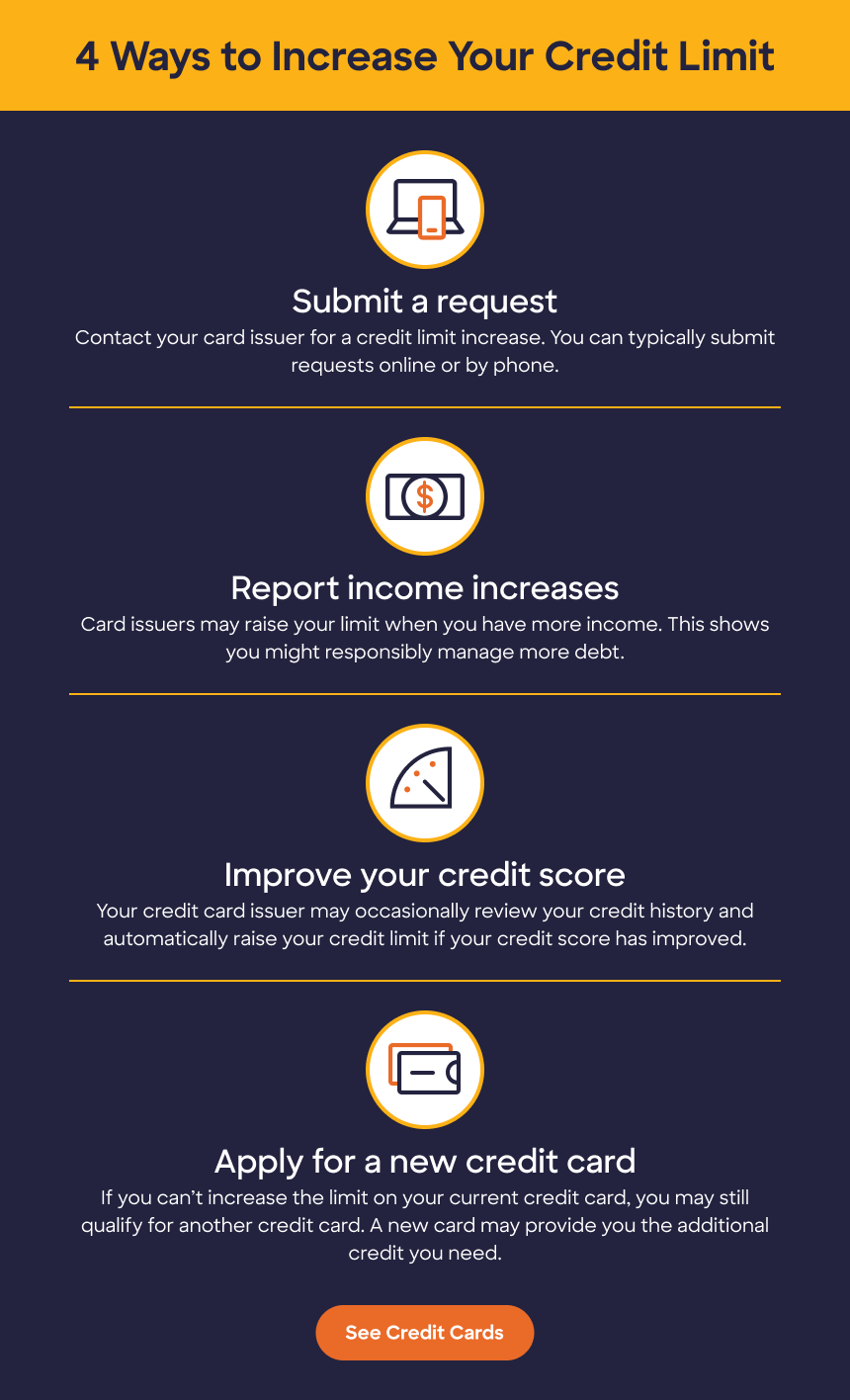

4 ways to increase your credit limit

Submit a credit limit increase request to your credit card company

Contact your credit card issuer and ask them for a limit increase. You might call the customer service line, log into your online account, or use a mobile app to make the request.

Did you know?

It’s simple to ask for a credit line increase on your Discover credit card. You can quickly log into the Discover mobile app and select “services”. Or you can call the number on the back of your card and talk to a customer service representative.

Report increases in your income

If your card issuer sees that you’re earning more money, you may get a higher credit limit. So keep your personal information up to date. Reporting other information, like a lower housing payment, might also help.

Improve your credit score

Your card issuer may also occasionally look at your credit report and credit score. If you have a longer history of on-time payments or a lower credit utilization ratio than you did when you got your card, your card issuer may offer a credit limit increase.

Apply for a new credit card

Instead of requesting a higher credit limit on an existing card, you could apply for a new credit card with a rewards program or better features that make the card more valuable to you than your current card. For example, a Discover balance transfer low intro APR offer could be a good option if you have high-interest rates on your existing credit cards and may help you save money on interest payments.

What to do before a credit limit increase request

Before requesting a credit limit increase, you may want to review some aspects of your credit history. These steps may improve the chances that your credit request gets approved.

Check your credit report regularly. Dispute any mistakes you find. For example, if a lender reports your payment as late when you made it on time, fixing the error could help improve your credit. Just make sure your lender reports the update to a credit bureau.

Understand your credit score

Aside from errors on your credit report, check for other elements that could hurt your credit score. Here are two important items to look out for:

- If your payment history includes late or missed payments

- If you have a high credit utilization ratio (the amount of money you owe compared to the amount of available credit you have)

Before asking for an increase, take time to help your score. Always pay your credit card bill on time. If you can, pay off the credit card balance on your credit card account to reduce your credit utilization ratio.

See if you’re pre-approved

With no harm to your credit score2

Drawbacks to requesting a credit limit increase

In some cases, having a higher credit limit could do more harm than good. For example:

- If an increased credit limit tempts you to overspend, you could end up with credit card debt.

- If you use your new credit limit to accrue high balances without paying them off, it could hurt your credit score.

The best credit card for you may not be the card with the highest credit limit but rather a card with features that match your lifestyle.

With the Discover it® Chrome Gas & Restaurant Credit Card, you earn 2% Cashback Bonus® at Gas Stations and Restaurants on up to $1,000 in combined purchases each quarter, automatically. Plus earn unlimited 1% cash back on all other purchases.3

Does requesting a credit limit increase impact your credit score?

Before you ask for a higher credit limit, check whether your credit card issuer conducts a hard credit inquiry as part of their review.

A hard credit inquiry has the potential to impact your credit score. Too many hard inquiries within a short time could make lenders think twice before issuing you more credit. You may want to wait to request a credit line increase on multiple credit cards at once.

What if you’re denied a credit limit increase?

If you’re denied a request for a credit line increase, here are some steps to consider.

One effective way to build credit history is to pay some or all your outstanding credit card debt. Not only can you help your credit score and increase your chances of getting a higher limit in the future, but you can also free up your existing credit so there’s more available credit on your credit cards. This gives you more purchasing power.

Keep using credit cards responsibly

Lenders may be more likely to give you additional credit if you show a history of responsible credit use. By practicing good credit habits, such as paying bills on time, you can show lenders that you’ll use a credit increase wisely.

Apply for a new credit card

If you’re able to get a new credit card, you’ll have more credit available to you. You might get a card with a higher limit or another card with the same limit—either way, you’ll be able to put more purchases on your card or cards.

Increasing the credit limit on your credit cards can increase your available credit, grant you more purchasing power, and help build your credit history. The key is to continue using your credit cards responsibly.