As you use a credit card, your financial institution, credit union, or credit card issuer typically reports your activity to one of the three major credit bureaus.

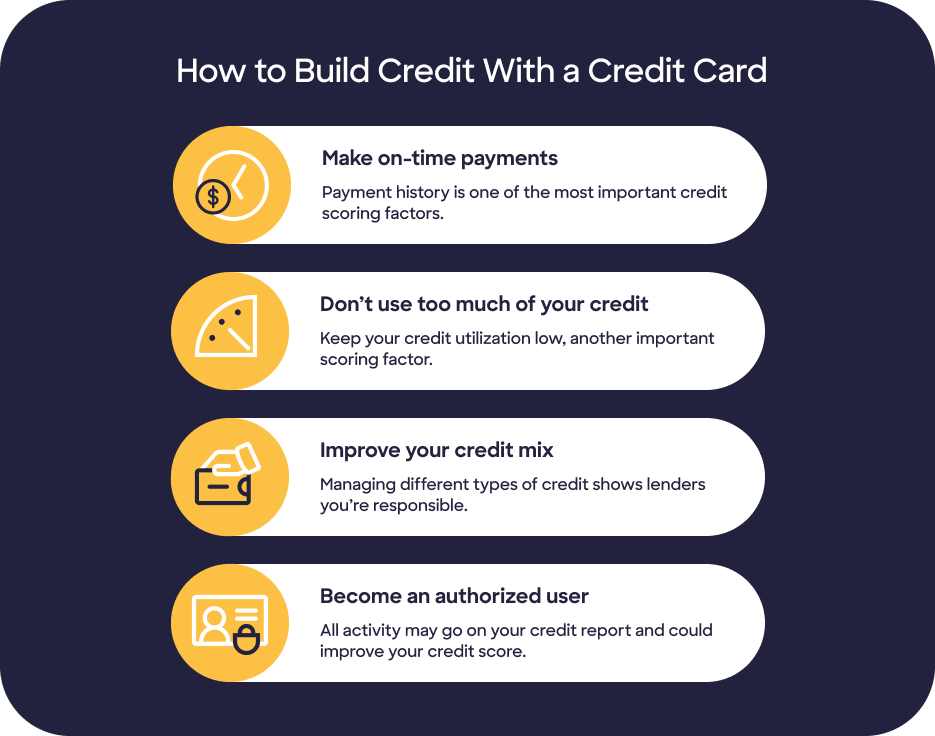

Each credit bureau or credit reporting agency collects and stores your payment history, amount of debt, length of credit, credit mix, and new credit within your credit report. Scoring agencies use your credit report to determine your credit score. Credit scores are three-digit numbers that show potential lenders your creditworthiness, or likelihood to repay debts, at a particular moment in time.

Every scoring agency is different, but credit scores generally range from 300 to 850. The higher your score, the better. A good credit score signals to lenders that you’re responsible with debt. A poor credit score, on the other hand, may indicate to lenders that you’re a risky borrower.

Generally, lenders review your credit score and credit report when determining how much money you can borrow and under what terms. A good credit history might make a big difference. With an excellent credit score, you may qualify for a higher credit limit, the best personal loan rates, or exclusive rewards credit cards, depending on other personal finance factors. With a poor credit score, you might not qualify for the best rewards credit cards or loan rates.