For a balanced financial life, it’s vital to build credit history. With a strong credit history, you may qualify for the best personal loan and credit card options, low interest rates, and higher credit limits. But where do you start, and how do you find the best credit card for the job?

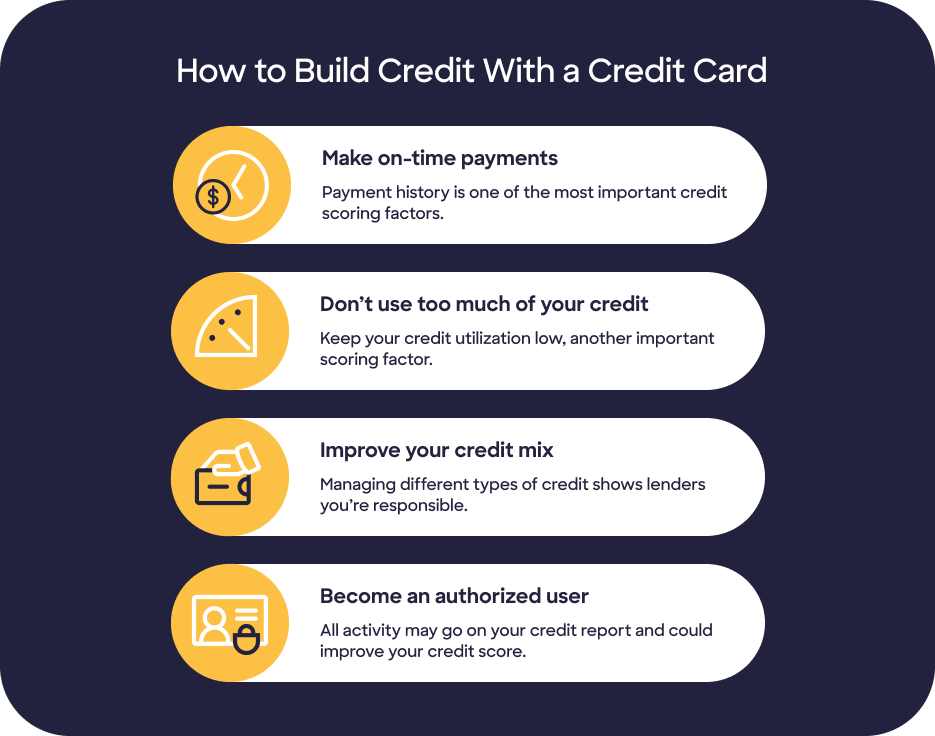

How to Start Building Credit with a Credit Card

7 min read

Last Updated: November 7, 2024

Next steps

See if you're pre-approved

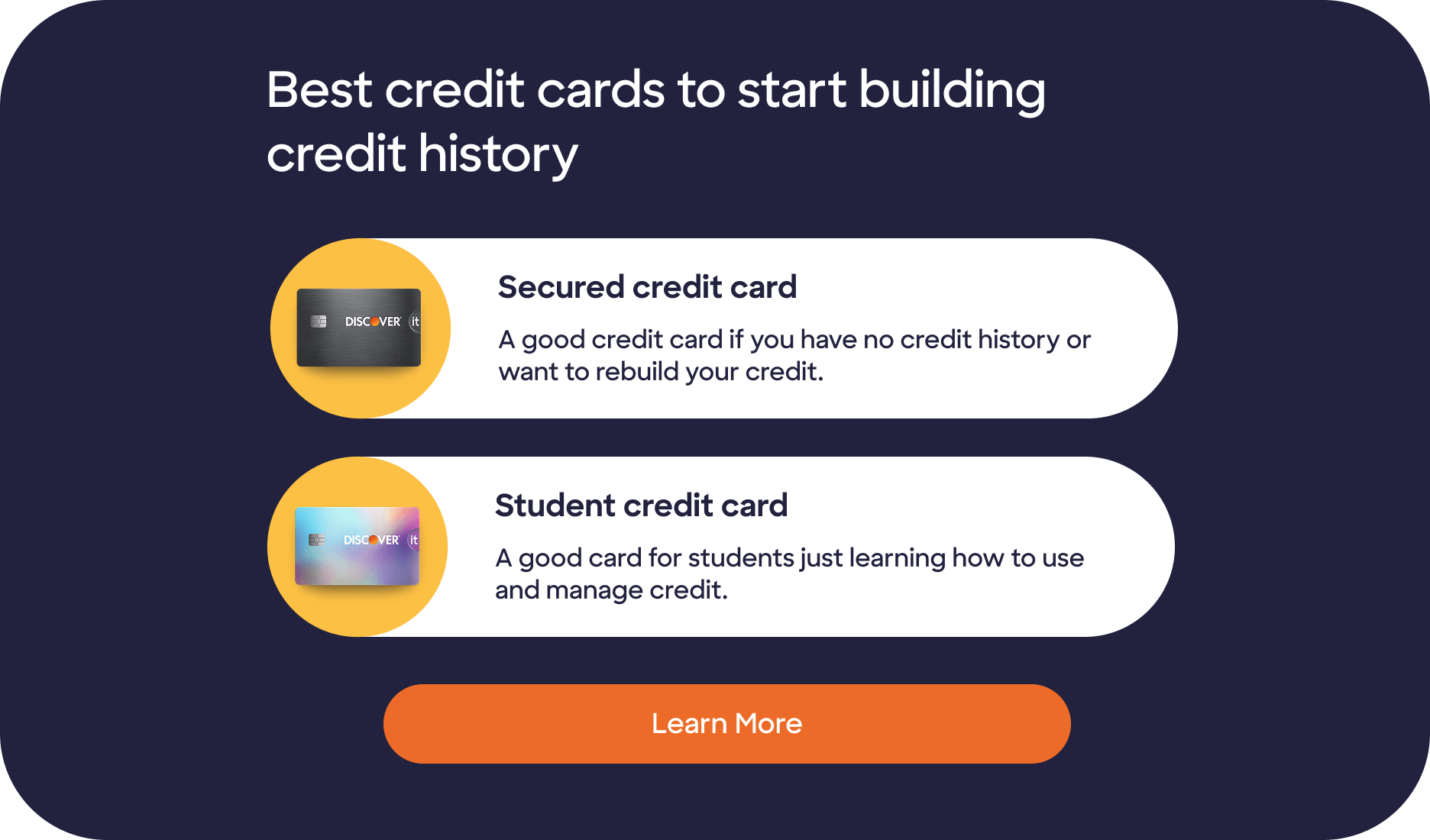

Learn about Discover It® Secured Credit Card

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?