Welcome to Discover®

Discover is now part of Capital One.

Discover Products

Products Designed with You in Mind

We provide banking and credit products that help people achieve their goals–from establishing good credit, to consolidating debt. In payments, our networks connect banks, cardmembers and merchants around the world with innovative commerce solutions.

Our Commitment

Mission, Vision & Values

At Discover our vision is to be the leading digital bank and payments partner.

Our mission is to help people spend smarter, manage debt better and save more so they achieve a brighter financial future.

Doing the right thing Innovation Simplicity Collaboration Openness Volunteerism Enthusiasm Respect

Resource Center

Financial Tools and Resources

We’re committed to providing our customers with simple, easy-to-understand information and tools to help make more informed financial decisions.

Customer Service

We Treat You Like You’d Treat You.

Discover has 100% U.S.-based customer service. We provide competitive paying jobs to customer service representatives who have a stake in the success of our business and the care of our customers.

Discover believes in being a good corporate citizen, particularly in communities where our employees live and work. We’re your neighbors. Being here with you makes a difference.

Meet our employees:

Our History

Test marketing begins

The first purchase with a Discover card is made for $26.77 on Sept. 17, 1985, by a Sears employee from the Chicago area at a Sears store in Atlanta. Test marketing continues in Atlanta and San Diego prior to the national rollout.

Discover Card launches nationally

Dean Witter Financial Services Group, Inc., a subsidiary of Sears, Roebuck and Co., launches the Discover Card in a national campaign highlighted by the “Dawn of Discover” television commercial during Super Bowl XX.

Discover Network signs its 1 millionth merchant

Vincente’s Restaurant in Wilmington, Delaware begins accepting Discover cards.

Dean Witter, Discover & Co. becomes a new publicly traded company

Dean Witter Financial Services Group, Inc., spins off from Sears on March 1, 1993, into an independent publicly traded company known as Dean Witter, Discover & Co. with the stock ticker symbol DWD.

DiscoverCard.com launches

DiscoverCard.com offers card applications and provides options to pay bills, redeem rewards, receive email reminders and earn extra rewards through our online retail partners.

Novus is born

Discover Card Services, Inc. changes its name to NOVUS Services, Inc., distinguishing the company’s network functions from the Discover Card. NOVUS Services, Inc. eventually is renamed Discover Financial Services, Inc., on Feb. 1, 1999.

Dean Witter, Discover & Co. merges with Morgan Stanley Group, Inc.

The merged company is initially referred to as Morgan Stanley Dean Witter, Discover & Co.

Discover Platinum Card is announced

On Dec. 22 the company introduces Discover Platinum, a premium card featuring new ways to increase rewards, low balance transfer and annual percentage rates, no annual fee, expanded credit lines and enhanced services.

The Card product described above is no longer available. Go to Discover.com for information on our currently available products.

Greenwood Trust Company becomes Discover Bank

Greenwood Trust Company, incorporated in 1911, is acquired by Discover in 1985. The Greenwood Trust Company name changes to Discover Bank on Aug. 1, 2000 and represents the company’s only banking branch.

Discover Card launches the industry’s first keychain credit card

The Discover 2GO Card was recognized as one of the “Best Products of 2002” by editors and reporters from Business Week and USA Today.

Discover introduces gas and miles rewards cards

The Gasoline Card (renamed Open Road in 2007) awards 5% Cashback Bonus® on gas purchases.

The Miles Card by Discover card allows redemption with as little as 2,500 miles for non-flight reward options.

The Card product described above is no longer available. Go to Discover.com for information on our currently available products.

Paperless statements introduced

Discover offers the option for paperless statements to minimize the impact on the environment and reduce clutter for customers.

Landmark U.S. Department of Justice antitrust lawsuit resolved

The resolution of the U.S. Department of Justice lawsuit against Visa and MasterCard for anticompetitive practices clears the way for financial institutions to issue cards on competing networks.

DFS acquires PULSE payments network

This acquisition enables PULSE and its more than 4,000 member banks, credit unions and savings institutions to join with the Discover Network and its 4 million merchant and cash access locations.

First China UnionPay card transaction in the U.S.

On Dec. 5, 2005, executives from the People’s Bank of China purchase a necktie in New York with a card issued in China, marking the first use of a China UnionPay bankcard in the United States. This transaction marks the beginning of a strategic alliance between China UnionPay and Discover Financial Services for reciprocal card acceptance.

Discover Debit launches

On Feb. 13, 2006, Discover Financial Services becomes the first credit card services company to compete directly with Visa and MasterCard in the rapidly growing signature debit market.

Discover and largest card issuer in Japan sign reciprocal card acceptance agreement

Discover Financial Services announces on Aug. 23, 2006, its reciprocal card acceptance agreement with JCB, the largest card issuer and acquirer in Japan, which will help lead to increased card acceptance for both companies.

Discover joins industry effort to form security standards

Discover Network unites with Visa, MasterCard, American Express and JCB to form the Payment Card Industry (PCI) Security Standards Council, which helps to manage the ongoing payment account security throughout the transaction process.

Discover Business Card launches

The Discover Business Card offers a single payment solution for small business owners.

The Card product described above is no longer available. Go to Discover.com for information on our currently available products.

Discover signs its first merchant acquiring agreement

On July 14, 2006, Discover Financial Services and First Data Corp., a global leader in electronic commerce and payment services, announce that First Data, the first of many industry-leading acquirers, will offer Discover Network card services to small- and mid-sized merchants.

Morgan Stanley announces Discover spin-off

During a fourth quarter earnings report on Dec. 19, 2006, Morgan Stanley CEO John J. Mack announces that Morgan Stanley would spin off Discover Financial Services into an independent publicly traded company in the third quarter of 2007.

First Discover network card transaction in China

David Nelms, Discover CEO, purchases a bronze horse with his Discover Card on Nov. 8, 2006, marking the first transaction using a Discover Network card in China.

New Discover Motiva card is industry’s first credit card to give cash rewards for good credit management

On March 13, 2007, Discover announces the launch of the Discover Motiva card, the credit card that gives cardmembers cash rewards for making six on-time monthly payments in a row.

The Card product described above is no longer available. Go to Discover.com for information on our currently available products.

Discover More Card replaces Discover Platinum Card

The Discover More Card is designed for consumers who use credit in many different categories and provides them with more ways to earn cash back on their purchases.

The Card product described above is no longer available. Go to Discover.com for information on our currently available products.

Discover Financial Services begins trading on the NYSE as DFS

Discover Financial Services becomes an independent public company on June 30, 2007, and begins trading on the NYSE for the first time on July 2.

Discover acquires Diners Club International

The acquisition of Diners Club International in July 2008 puts Discover on the path to global acceptance. The integration of networks allows Discover cardholders to use their cards globally on the Diners Club network. Established in 1950, Diners Club International is credited with creating the first multipurpose charge card in the world.

Discover wins $2.75 billion in damages to settle antitrust lawsuit against Visa and MasterCard

Discover sought damages for imposing rules that prohibited member banks from issuing credit and debit cards over Discover Network. Discover receives $2.75 billion in the October 2008 settlement, the third largest settlement at the time, in U.S. history.

Discover introduces the Spend Analyzer tool

Discover introduces Spend Analyzer, an innovative, easy-to-use online tool that provides cardmembers with a visual representation of their Discover card purchases for the past 24 months.

iPhone app is available to Discover cardmembers

Discover introduces its Discover app for iPhone and iPod Touch users, which allows cardmembers to manage their accounts on the go.

Alliance with Korea’s BCcard adds network volume

Discover announces a network-to-network acceptance alliance with BCcard, a leading Korean payments network.

Discover to Acquire Private Student Loans And The Ongoing Business Of The Student Loan Corporation

Discover acquires The Student Loan Corporation expanding Discover’s market presence and origination capabilities in private student loans.

Discover signs strategic partnership with Softcard to build nationwide mobile payment network

Discover and Softcard announce a strategic partnership to build a mobile payment network that utilizes mobile phones to make point-of-sale purchases.

Discover begins its sponsorship of college football’s Orange Bowl

Discover is the sponsor of the Orange Bowl from 2011-2013 and the BCS National Championship in 2013.

Discover enters a float in the 2011 and 2012 Tournament of Roses Parade in Pasadena

Discover receives the Grand Marshal award for excellence in creative concept and design in 2011 and 2012.

Discover introduces Home Loans to its Direct Banking Portfolio

Discover completes the acquisition of the Home Loan Center and officially launches Discover Home Loans. The Home Loans business was later sold in 2015.

Discover supports financial education in high schools

Discover announces a five year, $10 million commitment called Pathway to Financial Success to help bring financial education curriculum to public high schools across the U.S.

Discover cards are issued internationally for the first time

Agreements are made with banks in Ecuador and Russia to issue the first Discover cards outside the U.S.

Paypal partners with Discover to bring services to millions of merchant locations

Starting in 2013, Discover will work with PayPal to enable participating merchants to accept PayPal easily through their existing relationship with Discover.

Discover Cashback Checking is offered

Discover extends its direct banking reach with the addition of Cashback Checking paying customers 10 cents for every debit card purchase, Online Bill Payment and check written. Exclusive for Discover customers.

Discover introduces the Discover it® card

Discover announces the new Discover it card. The card rewards cardmembers with 5% cash back in rotating categories each quarter like gas, restaurants and more - up to the quarterly maximum each time you activate. Plus, unlimited 1% cash back on all other purchases.

Discover debuts home equity loans

Discover Home Equity Loans offer homeowners the opportunity to simplify their finances. This can include supporting home improvement projects, paying for major expenses, or consolidating debt into a single, fixed monthly payment.

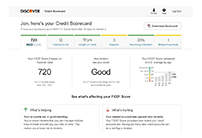

Discover becomes the first major credit card issuer to provide free access to FICO® Scores directly to its cardmembers on their monthly statements

Discover it® cardmembers will see their FICO® Score Meter, indicating the relative strength of their scores, as well as educational content to help them better understand them. In 2014, Discover expanded the rollout of free access to FICO® Scores to all consumer cardmembers.

*The FICO® Score we provide is FICO® Score 8 based on TransUnion data and may be different from other credit scores. FICO is a registered trademark of the Fair Isaac Corporation of the United States and other countries.

Discover Student Loans launches Rewards for Good Grades

When college and graduate students get at least a 3.0 GPA (or equivalent), they qualify for a one-time cash reward. The reward is equal to 1% of the loan amount on each new Discover student loan. Learn More

Discover launches Discover it® Chrome for Students

Students can establish credit while earning 2% at gas stations and restaurants on up to $1,000 in combined purchases each quarter.

Discover Launches Pride Card Design

Discover introduced a Pride card design available for all Discover it customers. The card was designed in partnership with the Discover Pride Employee Resource Group.

Discover launches new Discover it® Miles card

The Discover it® Miles credit card helps travelers get where they want while earning 1.5x Miles per dollar and with no blackout dates. Fly any airline, any time. Just purchase your ticket and use your Miles to credit your statement.

Discover announces strategic network service agreement with Brazilian domestic card network, Elo

Discover and Elo announce a strategic agreement that will allow acceptance of Elo Global Cards for international purchases and cash access outside of Brazil on the Discover Global Network.

Discover Student Loans introduces FAFSA assistant

Discover Student Loans helps students and their families get ready to complete the Free Application for Federal Student Aid (FAFSA®), which is an important step in the financial aid process. This interactive tool gives them tips and guidance to complete the FAFSA based on their personal situation.

FAFSA is a registered service mark of the U.S. Department of Education.

Discover introduces the Discover it® Secured Credit Card

Discover announces the launch of its Discover it® Secured Credit Card for consumers looking to build their credit.

Discover First to Offer FICO® Credit Scores for Free to Everyone as Part of New Credit Scorecard

In addition to providing the credit score that 90 percent of top lenders use, Credit Scorecard provides a summary of the data that helps determine an individual’s FICO® Score.

FICO® Credit Scores provided by Credit Scorecard are based on data from Experian and may be different from other credit scores. See discover.com/creditscorecard to learn more. FICO is a registered trademark of the Fair Isaac Corporation in the United States and other countries.

Discover Announces Free Service to Alert Cardmembers If Their Social Security Numbers Are Found on Risky Websites

Discover will alert cardmembers if any new credit cards, mortgages, car loans or other accounts are opened on their Experian® credit report. Cardmembers can sign up for these alerts at discover.com/freealerts

Discover® Identity Alerts are offered by Discover Bank at no cost, only available online, and currently include the following services: (a) daily monitoring of your Experian® credit report and an alert when a new account is listed on your report; (b) daily monitoring of thousands of risky websites known for revealing personal information and an alert if your Social Security Number on is found on such a website. This information is intended for, and only provided to, Primary credit cardmembers whose accounts are open, in good standing and have an email address on file. The Primary cardmember must agree online to receive identity alerts. Identity alert services are based on Experian information and data which may differ from information and data at other credit bureaus. Monitoring your credit report does not impact your credit score. This benefit may change or end in the future. Discover Bank is not a credit repair organization as defined under federal or state law, including the Credit Repair Organizations Act. To see a list of Frequently Asked Questions, visit discover.com/freealerts.

Discover is Named the Official Credit Card of the Big Ten Conference

As a part of the multi-year sponsorship, Discover will be the first ever presenting sponsor of the Big Ten Football Championship Game.

Discover Announces Industry-Leading Rewards for Checking

Discover Checking customers now earn 1 percent cash back on up to $3,000 in qualifying debit card purchases each month.1 Additionally, the Discover checking product is now available to everyone.

1 ATM transactions, the purchase of money orders or cash equivalents, cash-over portions of point-of-sale transactions, and Peer-to-Peer (P2P) payments are not eligible for cashback rewards. In addition, purchases made using third-party payment accounts (services such as Venmo® and PayPalTM, who also provide P2P payments) may not be eligible for cashback rewards.

Discover Bank, Member FDIC

Discover Introduces First Fee Forgiveness

The new program automatically waives the first eligible fee each calendar year for customers of Discover's Cashback Debit, Savings and Money Market Accounts.

Fees that are waived as part of the program include insufficient funds, stop payment, excessive withdrawal and Money Market minimum balance fees.*

*The first fee charged to any eligible customer account (which includes Cashback Debit, Money Market and Online Savings accounts) will be automatically waived and credited to your account. Eligible fees by product include: Cashback Debit (Insufficient Funds and Stop Payment fees); Money Market (Excessive Withdrawal, Insufficient Funds, Money Market Minimum Balance and Stop Payment fees); Online Savings (Excessive Withdrawal, Insufficient Funds and Stop Payment fees). Wire transfer fees are not eligible and will not be waived. Fees incurred prior to May 7, 2018 are not eligible for reimbursement.

Discover Bank, Member FDIC

Discover Offers Employees a Full-Ride Bachelor's Degree Program

The Discover College Commitment, covers tuition, required fees, books and supplies needed to complete select online degrees at one of three schools – the University of Florida (via UF Online), Wilmington University and Brandman University for US-based eligible employees. The benefit has no tenure requirement so employees can start participating as early as their first day of work. For more information, including eligibility requirements, please visit www.mydiscoverbenefits.com/keyword/education-assistance.

Discover launches Discover it® Business Card

On Sept. 12, the company introduces the Discover it® Business credit card, the latest addition to the Discover it family of credit cards. The card offers unlimited 1.5 percent cash back on all purchases, as well as free business and security features.

Discover Bank Ends Fees on All Deposit Products

Discover customers with a checking, savings, money market or CD account from Discover Bank will receive no fees, period*, on their accounts.

*Outgoing wire transfers are subject to a service charge. A fee may be charged by a non-Discover ATM if it is not part of the 60,000+ ATMs in our no-fee network.

Discover Home Equity Loans Achieves $1 Billion in Funded Loans

With a compounded annual growth rate (CAGR) of more than 80% over the last 3 years , Discover Home Equity loans has surpassed $1 Billion in funded dollars and has helped over 20,000 homeowners with their financial goals.

Discover Launches Contactless Cards

Adding to its long line of innovative, digital products and services, Discover begins issuing contactless-enabled credit cards, giving cardmembers more choices in how they pay.

Discover commits $5 Million to support Black-owned restaurants

In an effort to support the restaurant industry as it rebounds from the impact of COVID-19, Discover announces it would give 200 randomly selected Black-owned restaurants $25,000. Consumers can nominate their favorite black-owned restaurant via Discover's social media pages.

Discover Student Loan Launches Parent Loans

Discover Student Loans launches the Parent Loan which allows parents, or other creditworthy individuals, to take out a loan on behalf of their student to cover the student’s higher education costs. As with all Discover student loans, Parent Loans have no fees and U.S.-based loan specialists are available to help 24/7.

Discover Student Loans Expands on Cash for Good Grades

Discover Student Loans expands its existing Rewards for Good Grades benefit to incoming freshmen who now may qualify for an additional cash reward based on their high school grades. This benefit is incremental to the existing cash reward students are eligible for, by earning good grades while in college which is a 1% cash reward for a 3.0 GPA or higher.

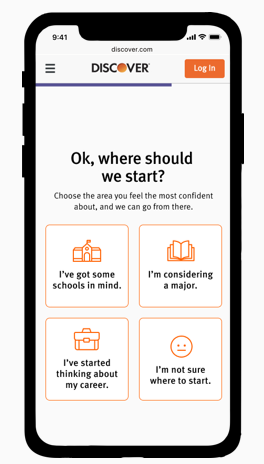

Discover Launches Personalized Tool for Students and Their Families Making Important College Decisions

Discover Student Loans launches My College Plan, an innovative tool to help students and their families navigate some of the complex decisions as they start to think about their college experience. The tool guides students as they select their institution type, and provides the skills needed to forecast how their college decisions will impact them while in college as well as after they graduate. My College Plan is available on https://www.discover.com/student-loans/calculators/college-plan and adds to the extensive suite of free resources designed to help families navigate the college decision-making process.

Discover Launches Click to Pay

Discover cardmembers and merchants can experience a more seamless and consistent checkout experience when shopping online or through a mobile app with the launch of Click to Pay. The digital payment solution, based on the EMV® Secure Remote Commerce (SRC) industry standard, replaces the need for cardmembers to manually enter personal and account information at checkout with participating merchants.

Discover Surpasses 20 Network Alliance Partnerships

Discover’s unique approach to partnership has produced rapid growth, and put Discover in the position to help businesses expand their customer base. Discover’s connected network of experts, technology and capabilities, has allowed continuous gains when it comes to reach, acceptance and cardholder base. These agreements open acceptance for Discover Global Network cardholders in the partner’s region and open global acceptance for cards the partner issues.

Discover Opens New Customer Care Center in Chicago's Chatham Neighborhood

The new customer care center seeks to positively effect change in the cornerstone south side community by bringing 1,000 full-time jobs to the area, prioritizing hiring local residents and providing them with Discover's full benefits package and renovating space to be used by local, community-based organizations.

Discover expands fully paid education benefit program through a partnership with Chicago State University (CSU)

Discover expands its fully paid education benefit program through a partnership with Chicago State University (CSU). The addition of CSU will be Discover’s first education partner to offer in-person learning. The partnership allows students to finance their education and will also provide career opportunities to help them advance their careers. For more information, please visit https://investorrelations.discover.com/newsroom/press-releases/press-release-details/2022/Discover-Chicago-State-University-Partner-to-Offer-Fully-Funded-Undergraduate-Degree-Program-to-Chicago-Employees/default.aspx

Discover Unveils New Cashback Debit Account

Discover launched its new, benefits-packed Cashback Debit account with user-friendly features, such as early access to paychecks up to two days in advance* and a mobile-first banking experience. Discover plans to continue enhancing the Cashback Debit product with additional eWallets, debit card enhancements and tools to help customers manage their credit score.

*With Early Pay, we may at our discretion make funds from eligible ACH direct deposits available to you up to 2 days early. This feature is dependent on the timing of our receipt of the direct deposit instructions. See terms and conditions.

Discover Launched the Discover Technology Experience

The Discover Technology Experience is a public-facing digital website that will help people build their technology craft and grow their careers through knowledge sharing. The site features expert blog posts, articles, videos, events, human-interest stories and more, and provides a glimpse into the people, processes, and tools that allow for Discover to build best-in-class products and be a leader in financial technology.

Discover Breaks Ground on New Customer Care Center in Whitehall, Ohio

Discover executives joined City of Whitehall leaders, local and state legislators, business owners, and non-profit organizations Tuesday afternoon to break ground on Discover's new customer care center in Whitehall, Ohio. A wall was demolished as part of a groundbreaking ceremony, signifying the start of construction. The new center is part of Discover's strategic site selection approach, which seeks to enhance high-quality employment opportunities and increase equity in the communities in which it operates.

Our Sponsorships

Offering More to Cardmembers

From extra savings to exclusive content, our partnerships with the NHL®, the Big Ten® Conference and Discover Bike San Diego – the local bike share program, allows us to celebrate moments that are important to our cardmembers.

NHL, the NHL Shield and the word mark and image of the Stanley Cup are registered trademarks of the National Hockey League. © NHL 2019. All Rights Reserved