Updated: May 21, 2020

Choosing a student loan repayment option is an important step in managing the total cost of your loan. There are four repayment options you can choose from:

- Defer Your Payments

- Make Interest-Only Payments

- Make Fixed Monthly Payments

- Make Full Monthly Payments

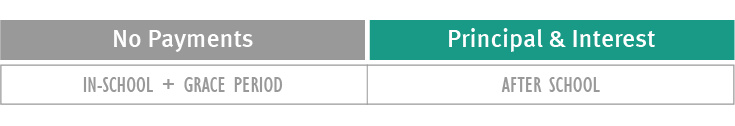

Defer Your Payments

What is it?

You won't have required payments during your automatic in-school deferment and grace period.

Interest will accrue on your loan and will be added to your principal balance when you enter repayment.

What does this mean?

No payments are required while you're in school at least half-time, but interest will continue to accrue and you'll end up paying more over the life of the loan.

You can make payments at any time with no pre-payment penalty.

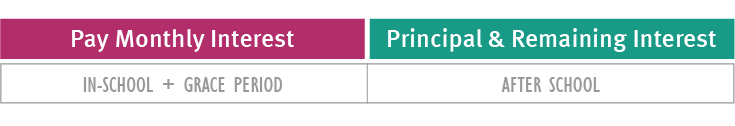

What is it?

You can elect to pay off the interest that accrues each month on your loan during your in-school and grace periods.

If you select this repayment option, you will receive an interest rate discount and you will lower the overall cost of your loan.

See our Terms & Conditions for more details.

What does this mean?

While you are making your interest-only payments, you will be eligible to receive a 0.35% interest rate reduction.

If all your interest is paid prior to entering repayment, you will retain the interest rate reduction for the life of the loan.

These monthly payments mean less interest accruing each month during your in-school and grace periods.

This means you will pay less interest over the life of your loan.

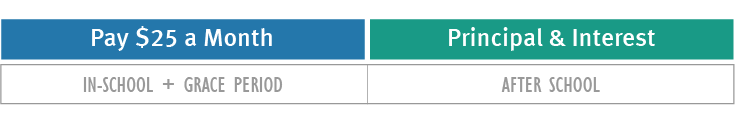

What is it?

You can elect to make a $25 fixed monthly payment on your loan during your in-school and grace periods.

Any unpaid interest will be added to your principal balance when you enter repayment.

What does this mean?

These monthly payments mean less interest will be added to your principal balance once your grace period has ended.

This means you will pay less interest over the life of your loan.

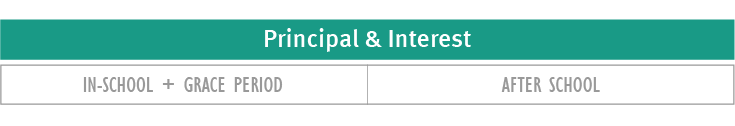

What is it?

Pay your principal and interest each month during your in-school and grace periods.

What does this mean?

These monthly payments would be the full principal and interest amounts due on your loan.

Making full interest and principal payments while you're in school will save you the most on the overall cost of your loan.