Updated: Sep 03, 2024

Article highlights

- While the FAFSA process has multiple steps, it's an important and necessary part of applying for financial aid.

- Financial aid can take many forms, from grants and scholarships to student loans.

- Follow these five simple steps to walk you through the financial aid process from start to finish.

Whether you’re applying for an undergraduate program or grad school, deciding which college you’ll attend is one major piece of the puzzle. The other is figuring out how to pay for it. That’s where the FAFSA (Free Application for Federal Student Aid) comes in. We’ve broken down each step of the FAFSA process to make things a little easier for students and parents to fill out this important form to apply for federal student aid.

Step 1: Complete the FAFSA

The FAFSA is a form required to be considered for state- and federal-funded student aid. States and colleges also use FAFSA information when doling out their own grants, scholarships, and loans. That’s why it’s wise to fill out the FAFSA each year you’re in school, even if you don’t think you’ll qualify.

To complete the application, you’ll first need to apply for an FSA ID. This is the username and password you’ll use to log in to the US Department of Education online systems and electronically sign your FAFSA. Parents and students each need their own IDs. Once you have your FSA ID, you can gather the documents and information you’ll need to complete your FAFSA. That includes:

- Your Social Security number (SSN)

- Tax returns for parents and students going back two years before the academic year for which you’re seeking aid

- Asset records like bank and investment statements

- Your driver’s license number

- A list of the schools you’re applying to

The application typically becomes available October 1 of each year. FAFSA deadlines vary by state and school, but it’s best to get it done as soon as you can because some funds are awarded on a first-come, first-served basis.

Some colleges and universities may also require you to complete a CSS Profile® in addition to the FAFSA. This is an online application used to determine your eligibility for aid from your school that is separate from federal student aid. You can check with your school or online to see if one is required.

Step 2: Review your FAFSA Submission Summary

Once you complete the FAFSA, the Department of Education will send you a FAFSA Submission Summary, previously known as the Student Aid Report (SAR). This summarizes the information you provided and includes your estimated Student Aid Index (SAI) (formerly EFC), which is the formula schools use to calculate financial aid.

It’s crucial that you check the FAFSA Submission Summary for accuracy. Make sure all the details match what was on your FAFSA application because schools use this information to determine your eligibility for aid. If you find any errors, correct them as soon as possible.

Step 3: Compare your financial aid packages

The next part of the financial aid process has to do with your financial aid packages. Each school listed on your FAFSA will receive a copy of your FAFSA Submission Summary and will use that information to prepare a financial aid package for you. This is also known as your award letter and it lists the grants, scholarships, and work-study funds the school is offering you. It will also include your eligibility for federal student loans.

If you’re accepted to multiple schools, you will receive more than one award letter. This college cost comparison tool can help you compare your award letters side by side and estimate your total out-of-pocket costs for each school. Keep in mind that you can also appeal a financial aid award letter if your family circumstances have changed since completing the FAFSA and you believe you may be eligible for more aid.

Step 4: Maximize grants and scholarships before applying for student loans

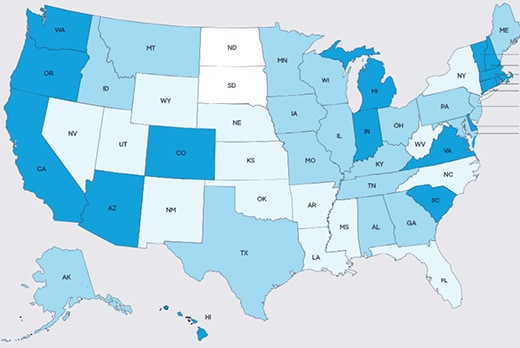

Grants and scholarships can also go a long way in paying for college. You may be eligible for ones that are available through the federal government, your state, the school you hope to attend, and private organizations—and unlike student loans, they don’t have to be paid back. Here are some resources you might find helpful:

- StudentAid.gov provides a wealth of information to guide you through the FAFSA process and financial aid process. You can also use it to find and apply for federal grants.

- Fastweb.com is a platform that matches you to grants and scholarships based on your skills, interests, strengths, and student activities.

- BigFuture.CollegeBoard.org has a free scholarship database with multiple filter options.

- Scholarships.com™ lets you customize your search results based on your profile.

Some scholarships are tied to financial need while others are based on academic achievements. You may also be eligible for scholarships based on your extracurricular activities, community service, athletic participation or achievements, skills or talents, identity or background, or your or your parents’ employers or military service.

Step 5: Consider federal and private student loans

After maximizing grants, scholarships, and other free financial aid, you may still have remaining costs to cover. That’s when you may want to consider loans. There are two main types of student loans:

- Federal student loans: Offered by the government and some are based on financial need

- Private student loans: Offered by private lenders, banks, and financial institutions and based on creditworthiness

When comparing student loans, consider fees, interest rates, monthly payment, repayment options, and the total cost of the loan.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.

CSS Profile® is a trademark registered by the College Board, which is not affiliated, and does not endorse this site.

Scholarships.com™ is a registered trademark of Scholarships.com, LLC and is not affiliated with Discover Student Loans.