Making on-time payments is important. Review the examples below to better understand how your payments are applied and how your payments may affect your overall cost of borrowing. To get more details about each example, click the "View example" link.

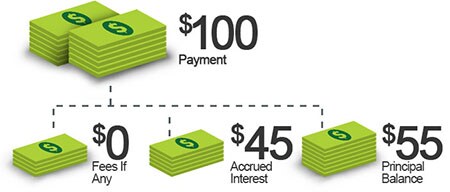

In general, payments are applied in order of fees (if applicable), accrued interest, and then principal (which includes capitalized interest). The examples provided here are meant only as a guide. We do not guarantee they will apply to your specific circumstances. If you have questions about your loan(s), please call us at 1-800-STUDENT anytime 24/7.

Single Loan Examples

These examples assume that you have one loan in normal repayment (e.g. the loan is not in deferment or forbearance), with payments that are current, and that there are no outstanding late fees or past due balances.

We apply payments in the following order:

- Fees, if applicable

- Accrued interest, due through the day before your payment is received

- Principal

If you are making your Minimum Payment Due, your payment will be applied according to the above order and your account will be current until your next payment due date.

The example provided here is meant only as a guide. We do not guarantee it will apply to your specific circumstances. If you have questions about your loan(s), please call us at 1-800-STUDENT anytime 24/7.

What if I pay less than the minimum payment?

If you pay less than the minimum for a single loan, your payment will be applied in the following order:

- Past due amounts

- Late fees

- Minimum Payment Due amount

Because you are paying less than your Minimum Payment Due:

- Your loan(s) may be reported as delinquent to credit reporting agencies.

- The amount left unpaid will be added to your next month's minimum payment

View Example

If you are having difficulty making your monthly payments, we have options to help temporarily manage your student loan payments. Please call us at 1-800-STUDENT to determine if you qualify.

What if I pay more than the minimum payment?

If you pay more than the minimum for a single loan, your payment will be applied differently if you chose to advance or not advance your payment due date.

If you don't choose to advance your payment due date, your payment is applied to:

- The Minimum Payment Due amount

- Remaining loan balance

If you choose to advance your payment due date by checking the box online or on the payment coupon, your payment is applied to:

- The Minimum Payment Due amount.

- Remaining loan balance(s). Interest will continue to accrue on the remaining balance(s).

- Payment due date will be advanced as many months as the payment fully covers. If the amount paid is not able to pay ahead the entire Minimum Payment Due for a loan, the remaining Minimum Payment Due on the next statement will be reduced accordingly.

If a loan is paid ahead for an extended period of time, the payment will be applied to fees, if applicable, accrued interest and principal loan balance. You can choose whether or not to advance your next payment due date.

View Example (payment due date is not advanced)

Multiple Loans Examples

These examples assume two loans in normal repayment (e.g. the loans are not in deferment or forbearance) with payments that are current, and no outstanding late fees or past due balances. These loans are based on the same product type with the same due date.

When you have multiple loans with the same due date, and you are making your full minimum monthly payment, your payment will be applied in the following order and your account will be current through your next payment due date:

- Fees, if applicable

- Accrued interest, due through the day before your payment is received

- Principal

What if I pay less than the minimum payment?

If you pay less than the minimum for multiple loans, payments will be applied in the following order:

- Past due amounts, starting with the most delinquent loan amount

- Late fees, based on the terms outlined in the promissory note(s) that authorize the collection of late fees

- Minimum Payment Due amount.

Because you are paying less than your Minimum Payment Due:

- Your loan(s) may be reported as delinquent to credit reporting agencies.

- The amount left unpaid will be added to your next month's minimum payment

View Example

If you are having difficulty making your monthly payments, we have options to help temporarily manage your student loan payments. Please call our Repayment Assistance Department at 1-800-STUDENT to determine if you qualify.

What if I pay more than the minimum payment?

If you are paying more than your minimum, your payment will be applied differently if you chose to advance or not advance your payment due date.

If you don't choose to advance your payment due date, your payment is applied to:

- The Minimum Payment Due amount

- Remaining loan balance on the highest interest rate loan in repayment on the statement. For loans with the same rate, overpayments will go toward the highest balance loan(s) in repayment.

If you choose to advance your payment due date by checking the box online or on the payment coupon, your payment will be applied to:

- The Minimum Payment Due amount

- Remaining loan balance(s). Interest will continue to accrue on the remaining balance(s).

- Payment due date will be advanced as many months as the payment fully covers. If the amount paid is not able to pay ahead the entire Minimum Payment Due for a loan, the remaining Minimum Payment Due on the next statement will be reduced accordingly.

If a loan is paid ahead for an extended period of time, the payment will be applied to fees, if applicable, accrued interest and principal loan balance. You can choose whether or not to advance your next payment due date.

View Example (payment due date is not advanced)

Recommended for you

See all >