Updated: Apr 13, 2022

For most students, help from mom and dad is the biggest financial contributor to the cost of their education. But what happens when your parents aren’t able to or are unwilling to pay? Some parents aren't in a position to afford the cost and others may feel it's their child's responsibility to finance their own education. Whatever the reason, needing to pay your way through college doesn't have to mean drowning in debt. There are, however, some things to consider. Here are six things to think about if you have to pay for college on your own.

1. Start the dialogue early

By your junior year, ask your parents if they are able or willing to contribute financially to your college education. If they say yes, ask how much they're willing to offer, either in a dollar amount or percentage of the total cost. This conversation may be uncomfortable—talking about finances can feel awkward to a lot of people—but it's important to know how much support they can provide. The earlier you have this conversation, the better, because if they say they won’t be able to contribute, or won’t be able to contribute much, it will give you more time to plan.

If your parents say that they will not help finance your college education, ask them what they will contribute (if anything). For example, can you continue to live at home rent-free while you attend college? Will they complete their portion of the Free Application for Federal Student Aid (FAFSA®)? This last question is especially important, because if you are a dependent student, you will need to include both you and your parent’s information with your application.

2. Consider the most affordable option for you

Without parental support, it will be especially important to get the best value for your tuition dollars. Students who spend their first two years at a community college—especially while living at home—and then transfer to a four-year program may save on tuition and fees.

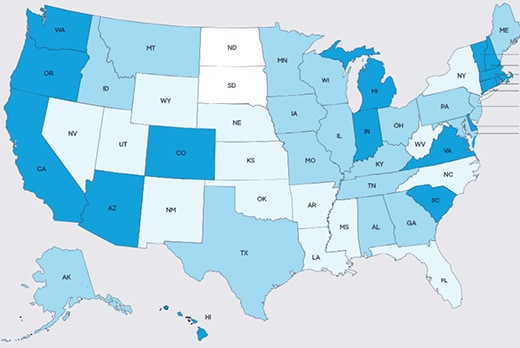

If you choose to go straight to a four-year school, the kind of university you attend can make a big difference for your bill. In-state colleges are typically cheaper than their private and out-of-state counterparts. According to the College Board®, the average cost of tuition at an in-state community college for the 2021-2022 academic year is $3,800 while tuition at public in-state four-year programs is $10,740 and tuition at a private four-year school is $38,070. Of course, that doesn’t take things like scholarships or grant aid into account; the most affordable option for you will depend on your individual circumstances.

3. Apply for as many scholarships as you can

Scholarship awards can be based on a variety of factors, including academic performance, special interests, unique backgrounds or particular skill sets. Sometimes the funds will cover the costs of your tuition bill, but may not be applied to books, supplies or living expenses. Other times you may get a one-time cash award to put toward any education expense.

The key is to keep applying for scholarships throughout your college career, not just as an incoming freshman. Check with local clubs and organizations in your community, look at your university's website, and use the Discover® Student Loans free scholarship search tool to find relevant scholarships.

4. Join the military

Most branches of the US military, including the Army, the Navy, the Air Force and the National Guard, offer education benefits, such as scholarships to cover tuition and living expenses. Some branches also offer help repaying qualified loans. The post 9/11 GI Bill covers tuition (up to a set limit), offers a housing stipend and up to $1,000 per year for books and supplies to those who have served at least 90 days active duty since September 11, 2001. If military service is of interest to you, it may be worthwhile to investigate this option further to help with college funding.

5. Work before and during college

Part-or full-time jobs can help you pay for your college expenses, potentially lowering the amount you need to take out in student loans. You could work and save up during high school, take a gap year before college to work and save, work part time while attending school, and/or work and save during the summer and school breaks.

6. Take Out Student Loans

If you still need more money for tuition and other expenses after all other options are explored, you may need to take out student loans. Before you do, make sure you do your research and compare loan types, such as federal and private, loan terms, features, interest rates and repayment options.

If you are still weighing your college options or need to compare college costs, you can test out various college planning scenarios with My College Plan.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.

College Board® is a trademark registered by the College Board, which is not affiliated with, and does not endorse, this site.