Jul 28, 2021

After a difficult year navigating remote learning and changing expectations of what college may look like amid the pandemic, a national survey from Discover® Student Loans revealed families’ feelings about the college experience are now returning to “normal.”

Sixty-three percent of parents surveyed agree their college plans have returned to what they were before the pandemic.

How did the pandemic affect students?

Of those who altered their college plans since the start of the pandemic, most say they will now attend a school closer to home (18%), an online university (10%) or go to a less expensive school then initially planned (10%).

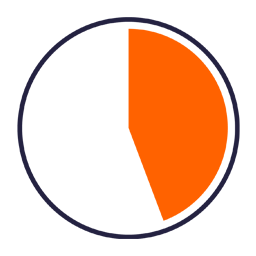

Parents’ ability to help their child pay for college has also started to rebound.

40%

of parents say their ability to help pay has improved since this time last year.

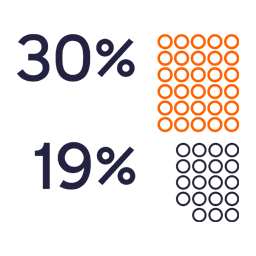

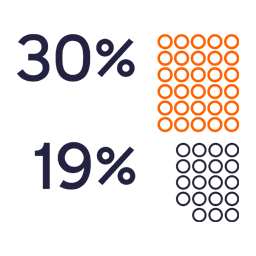

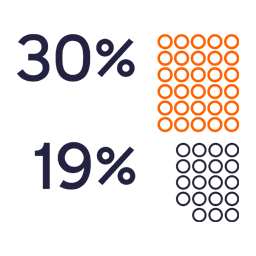

Of those parents who are worried about paying for college, just 19% say they lost money because of the COVID-19 pandemic in 2021—down from 30% who said they lost money in 2020.

Of those parents who are worried about paying for college, just 19% say they lost money because of the COVID-19 pandemic in 2021—down from 30% who said they lost money in 2020.

Parents plan to pay for more of their child’s college than they have in the past, but anxiety remains.

Nearly three-in-four parents (73%) say they will pay for half or more of their child’s education.

43%

of parents say they will not limit their child’s college choices based on price, up 10 percentage points from 2018.

63%

of parents say they are still worried about having enough money to help pay for their child’s education.

Most parents are worried their child is not receiving enough in financial aid (55%) or scholarships (49%).

38%

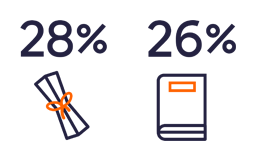

of parents say paying for college is the child’s top anxiety about attending college, followed by applying for scholarships and aid (30%).

These concerns with financing college outranked choosing a major (28%) and facing more difficult classes (26%).

Families are working together to find a plan to pay for college.

Over half (59%) of parents say the pandemic caused them and their student to have more candid conversations about how their family will pay for college.

While 41% of parents don’t feel like they started saving early enough, up from 37% in 2019, most are planning to leverage a mix of resources to finance college.

Scholarships/grants (47%), savings (45%) and student loans (37%) continue to be the most popular financing options among parents.

While families are returning to their pre-pandemic college plans, a large percentage of parents and students worry about having enough funds to pay for school and receiving enough in financial aid and scholarships. Discover Student Loans offers a free scholarship search tool as well as an assortment of student loan calculators and tools that can help you compare financial aid packages, prepare a budget, plan your college finances, and more.

© 2024 Discover Bank, Member FDIC

About the survey

All figures, unless otherwise stated, are from a Dynata (formerly Research Now/SSI) survey conducted on behalf of Discover Financial Services. The survey was conducted online; fielded from May 10–May 15, 2021 with a total sample size of 1,000 US parents of college bound students. The margin of sampling error was ±2.53 percentage points with a 95 percent level of confidence.