Depending on where you live, personal finance may or may not be a part of your high school learning curriculum. But even if you were one of the lucky ones to learn the basics in school, some teenagers in the U.S. and around the world may not understand the financial responsibilities that await them as college students and young adults.

A Guide to Personal Finance for Teens

Key points about: personal finance for teens

-

Starting early is the best way to get ahead of finances, which means getting a job and having easy access to funds earned is a must.

-

Learning budgeting tricks may help teens think about the importance of prioritization and fiscal responsibility.

-

Learning to save may help teens make and stick to goals and forecast their financial needs in the future.

To help you (or your teenager, if you’re a parent) navigate the financial universe of early adulthood, we’ve compiled a guide to personal finance for teens that covers everything from first jobs to saving money as a college student.

Tips for getting your first job

Working as a teenager is not just about earning money. It can be a character-building lesson in responsibility and independence. And while not every company may be willing to hire teens–whose resumes are usually light on experience–many summertime operations all but rely on them to fill seasonal posts. Think town recreation centers that need lifeguards and snack bar attendants, summer camps that need counselors, grocery stores that need cashiers and bagging attendants, and landscaping businesses that need mowers and planters.

Keep in mind that the road to employment for teenagers isn’t always easy, and you have to be persistent to navigate the ins and outs of applications, interviews, and rejection. But persevering will be well worth it when your paychecks start arriving, especially if you’re a teen getting ready to enter college.

Tip: Hold a mock interview with a parent, relative, or family friend who has experience hiring employees. Ask them to teach you how to properly answer questions that an interviewer might pose, and try asking questions at the end of the interview. This way, when your first job interview rolls around, you’ll feel more confident and prepared.

Deciding between an unpaid internship and a summer job

Though not for everyone, unpaid internships can be an attractive way to gain valuable experience that may not be attainable with a typical summer job. Unpaid internships may pay off in other ways, such as offering academic credit or job shadowing that provides insight into the day-to-day lives of professionals.

If you’re skeptical of unpaid work, consider that part-time jobscan reduce your financial aid award. Families sending kids to college fill out the Free Application for Federal Student Aid (FAFSA) to see how much money they’re expected to pay toward their children’s college costs—this is known as the Expected Family Contribution (EFC). One of the factors that goes into the EFC is the student’s own income. The EFC formula for 2023-2024 includes a $7,600 “income protection allowance” for students. That means students can earn $7,600 per year without affecting their eligibility for financial aid. For earnings above the threshold, however, half of every dollar gets added to the family EFC.

What teens should do with their money

If you have a paid job, you may have a few questions about what to do with all that money coming in, like where (and how) to deposit it so you can save or spend it.

There are two primary options to choose from when considering a checking account before turning 18. (Please note: Some financial institutions may not let students open a checking account if they’re under 18 years old. You must be at least 18 to open a Discover checking account.)

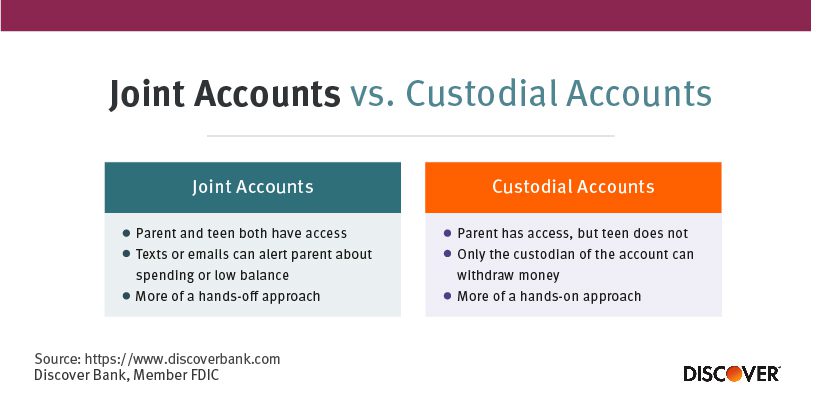

- Joint Accounts: Your bank may offer a student account that your parents or guardians can open in your name as a joint account. With a joint account, both you and your parent have access to the funds, as well as the details on how that money is spent. (Parents: Depending on the options your bank offers, you may even be able to set up text or email alerts to monitor the balance and spending on your teen’s account.)

- Custodial Accounts: Slightly different from joint accounts, you technically own the money in custodial accounts, but you won’t have direct access to the money. These types of accounts can be useful when parents want to take a more hands-on approach to monitoring their teen’s finances, but it may not be as beneficial as a joint account could be for learning independent financial management.

Tip: Parents, sit down with your teen and discuss how their new account will work, whether it’s a custodial or joint account.

Parents: Tips to help teens budget

Once teens start earning a regular income, they may want to start spending it too. Helping them develop a budget is a critical aspect of personal finance for teens as it can help them establish sound spending habits. To assist them, there are a couple of solutions.

- Download budgeting apps: If your teen spends a lot of time looking at their smartphone, you can use this to your advantage. Regularly using a simple expense app may help them stay on top of how much money they have. More sophisticated apps can help them monitor recurring bills and revolving accounts like credit cards in the future.

- Have them make financial contributions to household expenses: Whether it’s their first credit card or a car payment, the money they eventually earn shouldn’t just be for spending on the things they want—it will likely also be for spending on the things they need. Help kick-start this idea by creating a bill-type scenario where teens contribute to their expenses at home. It may be their portion of the cellphone plan or even the gas it takes to drive them to and from work, but either way, it can help prepare them for the future.

- Communicate about their spending: Regular budget meetings can be a good way to keep a teen’s spending front and center in his or her mind. Regularly reviewing their finances together is a great habit for the future. If they get used to doing it when they’re young, they’ll most likely continue to do it into adulthood, even when you’re not looking.

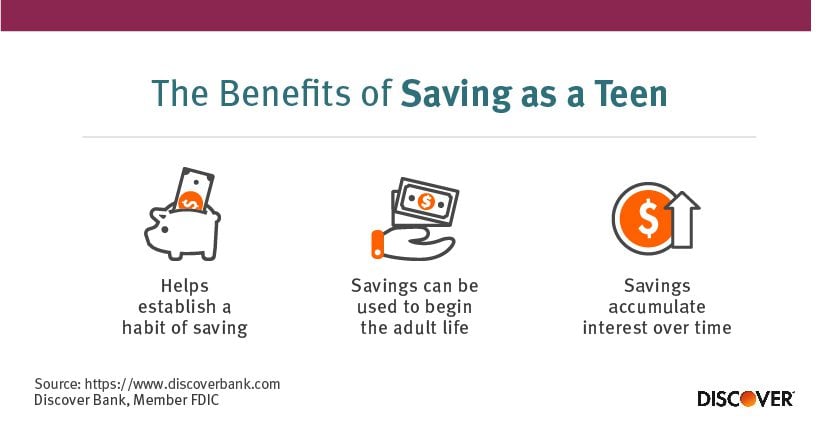

Parents: Teach your teen to save

Of course, you can’t have a conversation about personal finance for teens without talking to your teen about saving. The idea may not initially seem cool, but solid saving habits can make a world of difference in the future. Beyond opening a savings account, there are plenty of ways you can help your teen earn more interest and save more along the way.

- Funnel a set portion of their earnings into savings: Teach your teen to deposit a percentage of their money each week into a savings account when their allowance or paycheck first hits their checking account. This can help generate good saving habits for the years to come.

- Match the money they put aside: Matching the money your teen puts in savings can be a good way to encourage them to continue the practice. It may also be an opportunity to prime them for future jobs that offer 401(k) savings matches.

- Encourage them to think like entrepreneurs: While your teen may have landed their first job at a local restaurant or grocery store, encourage them to also think creatively about the ways they could earn and save additional money. If they’re crafty, they could set up a shop on platforms like Etsy. If they play an instrument or excel at a certain subject, they could offer to tutor other students for a small fee. If they like YouTube, they could start a channel and make money from ads.

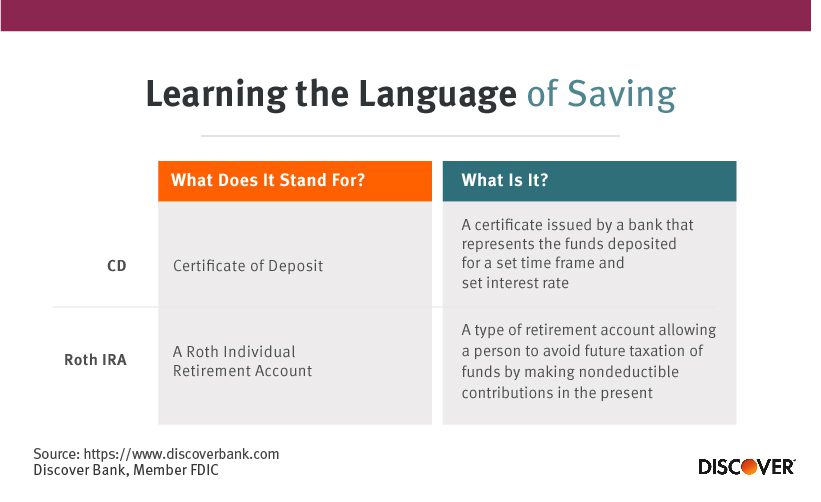

- Teach them to invest: Things like certificates of deposit and real estate may be foreign concepts to some teenagers today, but these types of investments can grow into serious opportunities for securing their financial future. Teaching a teenager about investing and showing them how investments can fluctuate over time may help them learn about the rewards and risks of this financial strategy.

Tip: Learn about savings accounts with competitive interest rates, and schedule regular check-ins with your teen to evaluate how much money is going into their savings account, and how much interest they're earning.

Did you know?

Teens who are 18 years or older can also use a credit card from Discover to help learn about responsible money management. Discover student credit cards let you earn cash back rewards and build a credit history1 while you're in college.

Start your financial journey sooner rather than later

Working, budgeting, investing, and spending wisely during your teenage and college years can help you lay the foundation for responsible financial management down the road. There are tons of resources online to help you make smart decisions along the way, from saving on college tuition to using your credit card responsibly. You’ll thank yourself later when life’s bigger expenses come knocking.

Next steps

No impact to your credit score

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?

- Builds credit with responsible use: Discover reports your credit history to the three major credit bureaus so it can help build your credit if used responsibly. Late payments, delinquencies or other derogatory activity with your other credit card accounts and loans may adversely impact your ability to build credit.

- Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.