When you apply for credit, whether for credit cards, an auto loan, or even home mortgages, one factor will come up again and again—your credit score. This three-digit figure can have a significant impact on your financial life. High scores may help give you access to lower interest rates, better loan terms, and more credit options, while low scores can prevent you from obtaining credit at all.

By understanding how your credit score is calculated, you can take actions that may help your score and avoid the missteps that can hurt it.

What Is a Credit Score?

Key points about: credit scores

-

Your credit score helps determine whether you qualify for credit cards, home loans, and other forms of credit.

-

FICO® Scores are calculated from the data on your credit reports at the three major credit bureaus using mathematical algorithms, which are called credit scoring models.

-

Most FICO® Credit Scores range from 300 to 850; the higher the score, the better.

Credit score basics

When a company decides to give you credit, they’re giving you money with conditions that determine how you’ll pay it back. They decide whether they’re able to give you money based on your credit score and credit history—because this is how they decide if you have the ability or likelihood of repaying their credit.

Lenders–and others, such as landlords–view your credit score as an assessment of your financial capability. A good credit score can enable you to obtain a credit card, take out a loan, or even rent an apartment. A good credit score may also help you get a lower interest rate on a credit card, allowing you to save money to put in your pocket or help you repay your balance.

If you have a lower credit score, on the other hand, lenders might be concerned about your financial reliability, and charge you more (in the form of a high interest rate) for the credit that they extend you. Different creditors have different thresholds for application approval, and sometimes a lower credit score might result in you being not approved for credit cards, bank loans, and home mortgages.

Let’s start with the different aspects that contribute to your credit score.

Sometimes credit bureaus don’t have any, or have limited, credit information about you and you won’t have a credit score. Not having a credit score isn’t necessarily a bad thing. It just means you’ll have to start accruing some debt, paying it off, and building your credit history.

If you’re new to credit, there are a few things you can do to get started. One thing you can do is apply for a credit card that’s aimed at new users, such as a secured card or student credit card.

Factors that affect your credit score

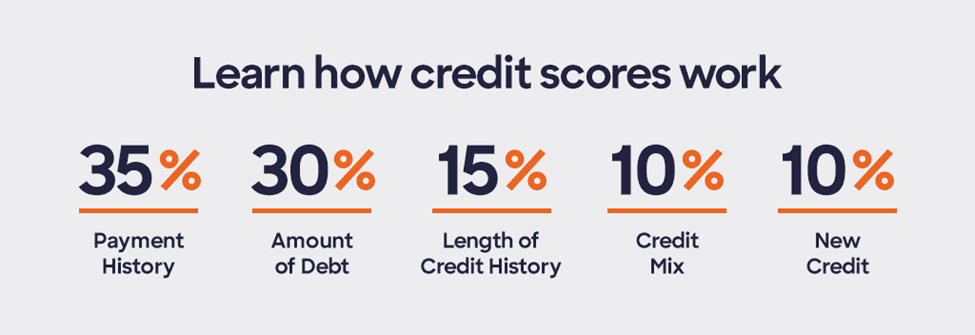

Your credit score is calculated at the credit bureaus using algorithms, or credit scoring models, and each model assesses risk differently. One example is the FICO® Score. (You’ve probably heard of it because 90% of top lenders use FICO® Credit Scores, including Discover.1) A FICO® Score is based on five categories, with some categories having more importance than others. According to myFICO, scores are calculated as shown below:

How do I build or establish credit?

Practicing good spending habits can help build your credit history. Begin by making smaller purchases and paying them off on time. Since payment history is a significant portion of your credit history, creditors pay close attention to whether you make your payments on time. If you have a credit limit on your card, keep your balances well under your credit limit.

Credit score ratings

Most FICO® Credit Scores range from 300 to 850, according to FICO—the higher your score, the better.

Did you know?

Discover was the first major credit card to give you your FICO® Credit Score for free on your monthly statement and online. You can get a free Credit Scorecard with your FICO® Credit Score and important information behind it, like credit utilization, number of missed payments, number of recent inquiries, length of credit history and total number of accounts.2

Here is how FICO® Credit Score ranges and ratings are considered, according to FICO:

Credit fact: You can’t have a credit score of 0. The lowest FICO® Score is 300.

Does a credit score mean the same thing as a credit report?

Your credit score and credit report are related, but not quite the same thing. Your score quantifies your credit risk into a three-digit number. Your report, meanwhile, provides the data that informs your score.

What’s in your credit report?

The data in your credit report is made up of your financial history. According to USA.gov, some of the personal information that will appear in your credit report is bill payment history, loans, current debt, bankruptcy history, and records of lawsuits.

According to the Consumer Financial Protection Bureau, you have access to one free credit report from each of the three major credit reporting agencies every year. Furthermore, each of the national credit reporting agencies allows consumers to check their credit report once per week for free, according to the FTC.

It’s a good idea to review your report at least annually. That way you can correct any errors that may be impacting your score.

Your credit score is an important indicator of your financial health and a tool that can help you access the credit you need. By understanding how it works and what you can do to impact it, you may put yourself on the path to better credit.

Next steps

No impact to your credit score

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?

-

FICO® Credit Score Terms: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Discover Financial Services and Fair Isaac are not credit repair organizations as defined under federal or state law, including the Credit Repair Organizations Act. Discover Financial Services and Fair Isaac do not provide “credit repair” services or assistance regarding “rebuilding” or “improving” your credit record, credit history or credit rating.

- FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

- Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.