If you’re a student considering a credit card for the first time, you probably have a lot of questions. Why is a credit card for students important? How can you use a credit card to build your credit history? What are the requirements for student credit cards? Well, you’ve come to the right place. Here, you’ll find information on how a student credit card, like Discover it® Student Cash Back or Discover it® Student Chrome, can help you build a brighter financial future. You’ll also learn more about student credit cards and building credit history like:

What Makes a Good Student Credit Card?

Key Points About: How Students Can Choose a Good Credit Card

-

You must be at least 18 years old to apply for a student credit card

-

Some student credit cards don’t require a credit history to apply. There is no credit score required to apply for Discover Student credit cards1

-

Students under 21 have different income requirements than those over 21

Guide to the benefits of a good student credit card

See additional details below for more information1.

A good student credit card can help you:

Establish and build your credit history

Why is a credit score important? Your credit report can be used by lenders, cell phone companies, and even landlords to determine your eligibility for their services or the interest rates on money you borrow. That means your credit report can impact where you live, your job opportunities and even your cell phone plan. So, it’s worth it to build a solid credit history.

But how do you build credit history as a college student? A student credit card is a great first step. It’s a credit card that’s tailored to first-time cardholders who don’t have a long (or any) credit history. Some student credit cards, like Discover it® Student Cash Back or Discover it® Student Chrome, offer spending and security alerts to help you manage your credit card account. Student credit cards can kick off your credit history and, if used responsibly, can help you get you on the right path.

Learn how to manage your finances

Student credit cards often have low credit limits, which can act as a guardrail as you learn how to manage credit as a student. Student cards are also frequently accompanied by tools and resources that can help you build good credit habits too. With the Discover it® Student Chrome credit card and accompanying mobile app for example, you can track spending and manage payments, mobile alerts, and rewards. With a student credit card, the goal is to build a foundation of borrowing and repaying in a responsible way, not overspend just because you can.

Low introductory interest rates

Student credit cards may come with low introductory APRs (or interest rates), which can help students save on interest during the introductory period.

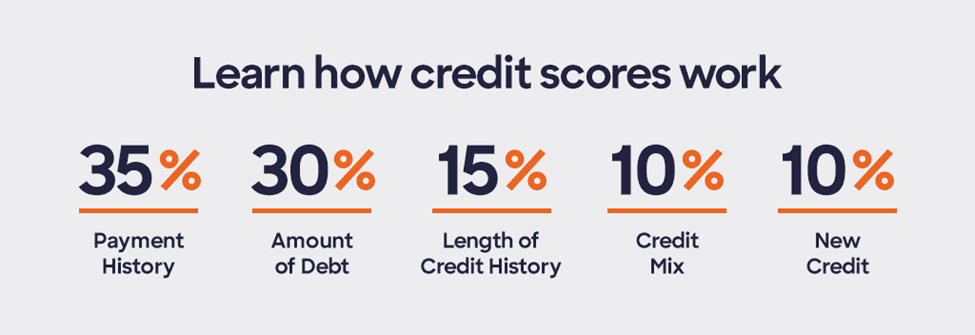

Learn how credit scores work

Let’s dig deeper into how credit scores work. According to Experian, FICO® Credit Scores generally range from 300 to 850. They’re calculated with algorithms created by the Fair Isaac Corp., which is why they’re called FICO® Credit Scores2. A FICOⓇ Score is the sum of several factors—below shows how each category impacts FICO® Scores for the general population:

- 35% is payment history (how many payments have you missed)

- 30% is amount owed (how much of your credit limit you’re using)

- 15% is length of credit history (how long have you had credit for)

- 10% is credit mix (how diversified your borrowing is)

- 10% is new credit (how many new accounts you’ve applied for and recently opened)

Regular, responsible use of a student credit card—as well as making on time payments on all your other loans—may help you earn a good credit score through improving your performance in all of the factors that contribute to your credit score.

Earn Cash Back for Your Expenses

Another benefit of some student credit cards is that you can actually earn cash back when you make purchases. Many credit cards for college students offer cash back rewards that are tailored to the student lifestyle. With Discover it® Student Cash Back, for instance, students earn 5% cash back on everyday purchases at different places each quarter, up to the quarterly maximum when you activate. Discover also offers Cashback Match, an unlimited dollar-for-dollar match of all the cash back you’ve earned at the end of your first year, automatically. There is no limit to how much we'll match. That means you could turn $50 cash back into $100. Or $100 cash back into $200.3 There is no limit to how much Discover will match. These are perks that plain old cash doesn’t have.

Student Credit Card Requirements for Age and Income

Now that you know how valuable student credit cards can be, you’re probably wondering how to get a student credit card. In other words, what are student credit card age limits and requirements?

Age Restrictions

If you’re a student, you’re eligible for a student credit card starting at age 18. Every credit card company has their own distinct set of qualifications for student card approval. When you apply, you need to provide your income to demonstrate your ability to make credit card payments. Discover factors the unique life stage of students into the card approval process and designs its student credit cards for those who are new to credit.

Income Requirements

While some student credit cards do have lower barriers to entry than other credit cards, the rules for what is considered income depend on the student’s age. If you are 21 or older, you may include another person's income that is available to you. If you are under 21, for example, you may be able to include income regularly deposited into your account, including a joint account You may be able to also include the income and assets of your spouse or domestic partner if you live in one of the following Community Property States: Arizona, California, Idaho, Louisiana, New Mexico, Nevada, Texas, Washington, or Wisconsin.

What are Some Alternatives to Student Credit Cards?

If you’re not able to obtain a student credit card because you are not a student or otherwise don’t qualify, you may want to consider a secured credit card like the Discover it® Secured Credit Card. With a secured card, you make a deposit to secure your line of credit. This refundable deposit protects the credit card issuer if you fail to repay your balance. Otherwise, the card functions very much like a traditional credit card. Your activity may be reported to credit bureaus and can impact your credit score. The Discover it® Secured Card can help you build credit with responsible use.4 You can get your deposit back after 6 consecutive on-time payments and maintaining good status on all your credit accounts.5

Comparing Student Credit Card Rewards

Rewards are one of the many benefits of a credit card. To maximize their value, you should look for a card that rewards the type of spending you do. For example, with the Discover it® Student Chrome card you can earn 2% Cashback Bonus® at gas stations and restaurants on up to $1,000 in combined purchases each quarter, automatically,6 making it perfect for students who drive frequently and eat out often. But, if you don’t have a car or like to cook all your meals, it might not be the best fit for you. A card like Discover it® Student Cash Back, which offers 5% cash back at different places each quarter, up to the quarterly maximum when you activate, could be a better match. Finding the right rewards and bonuses is all about assessing your spending habits and comparing card offers to see which best fits your lifestyle.

Apply for a Student Credit Card

Want to apply for a student credit card? Once you’ve done your research, found the right card for you, and double-checked that you understand all the terms and conditions, the hard work is over. A student credit card application is very simple and only takes a few minutes to complete. Note – you cannot apply for a credit card over the phone if you’re under 21, so you’ll need to apply online.

You’ll just need to provide information such as:

- Full name

- Date of Birth

- Email address

- College Information

- Annual income

- Housing Costs

Applying for a student credit card is a smart start to your financial future. Using your student card responsibly will set you up with a robust credit knowledge.

Next steps

No impact to your credit score

See rates, rewards and other info

You may also be interested in

Was this article helpful?

Was this article helpful?

- No credit score required to apply: Based on the preceding 12 months of Discover Student credit card application data. When we evaluate your creditworthiness, we consider all the information you provide on your application, your credit report, which includes your credit score if applicable, and other information.

- FICO® Credit Score Terms: Your FICO® Credit Score, key factors and other credit information are based on data from TransUnion® and may be different from other credit scores and other credit information provided by different bureaus. This information is intended for and only provided to Primary account holders who have an available score. See Discover.com/FICO about the availability of your score. Your score, key factors and other credit information are available on Discover.com and cardmembers are also provided a score on statements. Customers will see up to a year of recent scores online. Discover and other lenders may use different inputs, such as FICO® Credit Scores, other credit scores and more information in credit decisions. This benefit may change or end in the future. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

- Cashback Match: We’ll match all the cash back rewards you’ve earned on your credit card from the day your new account is approved through your first 12 consecutive billing periods or 365 days, whichever is longer, and add it to your rewards account within two billing periods. You’ve earned cash back rewards only when they’re processed, which may be after the transaction date. We will not match: rewards that are processed after your match period ends; statement credits; rewards transfers from Discover checking or other deposit accounts; or rewards for accounts that are closed. This promotional offer may not be available in the future and is exclusively for new cardmembers. No purchase minimums.

- Build/Rebuild Credit with responsible use: Discover reports your credit history to the three major credit bureaus so it can help build/rebuild your credit if used responsibly. Late payments, delinquencies or other derogatory activity with your credit card accounts and loans may adversely impact your ability to build/rebuild credit.

- Graduation Transparency (Secured Card): Monthly reviews start your seventh month as a customer. We will refund your security deposit if you have made all payments on time for the last six consecutive billing cycles on all your Discover accounts including any loans, and you've remained in “good status” on all credit accounts you are responsible for whether they are Discover accounts or not. “Good status” means: (1) your credit report shows no delinquencies, charge-offs, repossessions, or bankruptcies for the six months prior to our review; and (2) your Discover Secured Card is not in a prohibited status at the time of our review, including, but not limited to: closed, revoked, suspended, subject to tax levy, garnishment, deceased, lost/stolen, or fraud. Monthly reviews may be delayed if you change your payment due date. We typically process your refund in 2-3 business days based on your delivery preference. If you close your account and pay in full, we’ll return your deposit within two billing cycles plus ten days.

- You earn a full 2% Cashback Bonus® on your first $1000 in combined purchases at Gas Stations (stand-alone), and Restaurants each calendar quarter. Calendar quarters begin January 1, April 1, July 1, and October 1. Purchases at Gas Stations and Restaurants over the quarterly cap, and all other purchases, earn 1% cash back. Gas Station purchases include those made at merchants classified as places that sell automotive gasoline that can be bought at the pump or inside the station, and some public electric vehicle charging stations. Gas Stations affiliated with supermarkets, supercenters, and wholesale clubs may not be eligible. Restaurant purchases include those made at merchants classified as full-service restaurants, cafes, cafeterias, fast-food locations, and restaurant delivery services. Purchases must be made with merchants in the U.S. To qualify for 2%, the purchase transaction date must be before or on the last day of the offer or promotion. For online purchases, the transaction date from the merchant may be the date when the item ships. Rewards are added to your account within two billing periods. Even if a purchase appears to fit in a 2% category, the merchant may not have a merchant category code (MCC) in that category. Merchants and payment processors are assigned an MCC based on their typical products and services. Discover Card does not assign MCCs to merchants. Certain third-party payment accounts and digital wallet transactions may not earn 2% if the technology does not provide sufficient transaction details or a qualifying MCC. Learn more at Discover.com/digitalwallets. See Cashback Bonus Program Terms and Conditions for more information.

- Legal Disclaimer: This site is for educational purposes and is not a substitute for professional advice. The material on this site is not intended to provide legal, investment, or financial advice and does not indicate the availability of any Discover product or service. It does not guarantee that Discover offers or endorses a product or service. For specific advice about your unique circumstances, you may wish to consult a qualified professional.